Presto Labels Bitcoin’s Record Surge as an ‘Inflationary Illusion’

For a more accurate assessment, experts suggested measuring the cryptocurrency's price in gold.

The latest historic peak of digital gold may not reflect a genuine increase in value but rather the impact of dollar inflation, according to analysts from Presto Research.

🚨 Measuring Bitcoin’s true worth in gold 🪙

In fiat terms, BTC is near all-time highs. But priced in gold, the story changes:

— BTC/gold ratio is below 2021 peak and 2024 post-election euphoria

-Suggests the rally is inflation-driven, not purely adoption-led

-Gold is a better… pic.twitter.com/qh5fp1zVX5— Presto Research (@Presto_Research) August 18, 2025

On August 14, Bitcoin reached a new price record of $124,000. By the time of writing, the asset’s rate had adjusted to $115,292.

Experts compared valuing the first cryptocurrency in dollars to measuring length with a “ruler with shifting divisions.” Since central banks can arbitrarily increase the money supply, any nominal expression of value in fiat becomes subjective, the specialists noted.

For a more accurate assessment, they suggested measuring Bitcoin’s price in gold—an asset with limited supply and a status not controlled by the state. Despite positive trends in recent years, the cryptocurrency’s rate in terms of the precious metal remains below the peaks of 2021 and post-election levels of 2024.

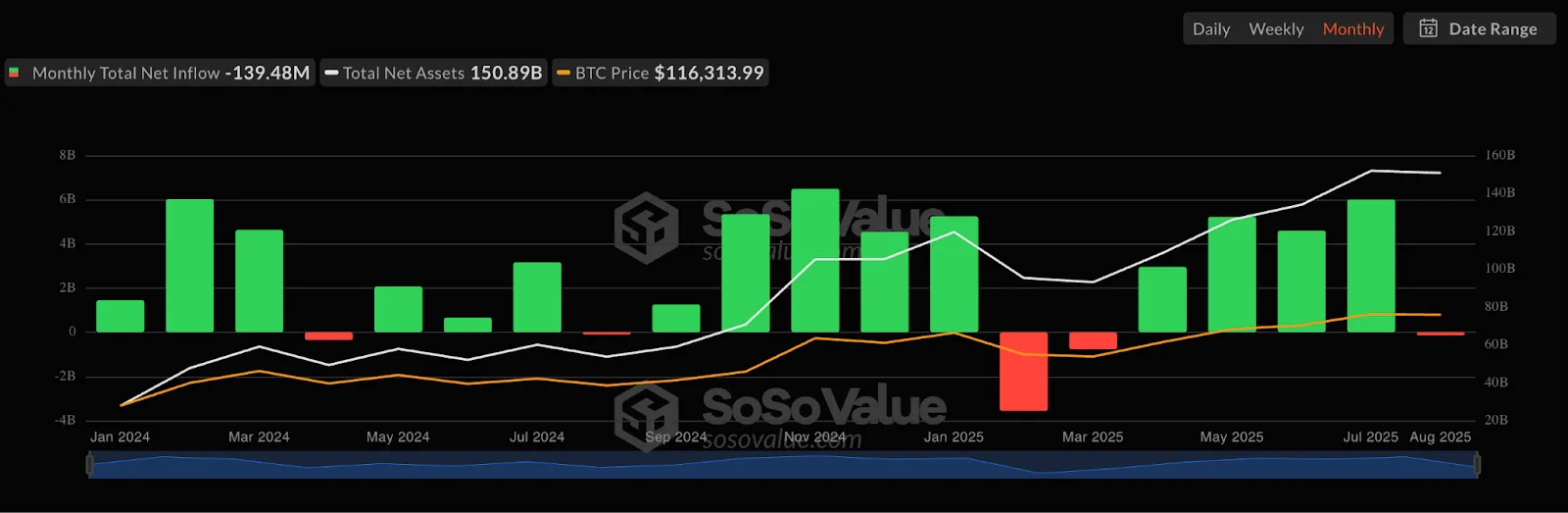

According to analysts, the current growth is more likely driven by inflationary expectations than genuine adoption. However, they acknowledge that considering inflows into ETFs and corporate investments, Bitcoin appears “undervalued.”

Presto’s conclusions resonate with debates in Washington about revaluing gold reserves. The U.S. Treasury still values 260 million ounces at the legally set 1973 price of $42.22 ($10.9 billion), while the market value of the assets is approximately $750 billion.

Treasury Secretary Scott Bessent rejected the idea of revaluing the precious metal, citing legal obstacles and inflation risks, referring to the experience of 1934.

Senator Cynthia Lummis proposed an alternative: revalue gold reserves at current prices and use the difference to create a strategic Bitcoin reserve without increasing the U.S. debt of $37 trillion.

Back in August, Bessent stated that the government does not plan to purchase additional cryptocurrency to form a reserve. He mentioned that the regulator is exploring budget-neutral ways to acquire Bitcoin.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!