Public Bitcoin Miners Ramp Up Sales

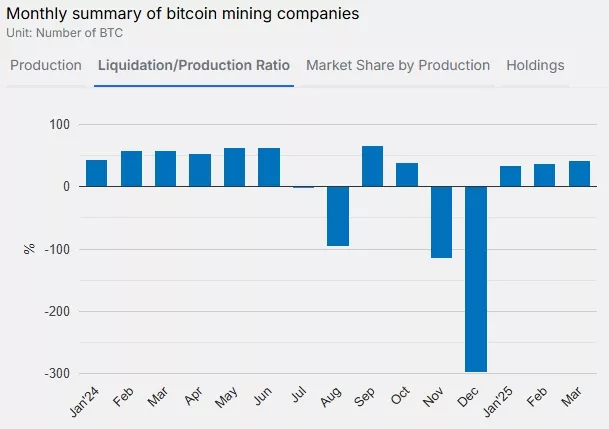

In March, public mining companies increased their Bitcoin sales, reaching the highest volume since October 2024, reports TheMinerMag.

Fifteen publicly traded miners sold more than 40% of their production last month. HIVE, Bitfarms, and Ionic Digital exceeded 100%.

Following the U.S. presidential elections, industry participants adopted a more aggressive HODL strategy. In the fourth quarter of 2024, companies like Riot, Hut 8, and MARA even purchased additional Bitcoin to bolster their crypto reserves.

The shift towards sales in March is attributed by experts to declining mining profitability amid stagnation of the hash price near its lowest levels and increasing uncertainty due to trade wars.

Since January, Bit Digital, Argo, Terawulf, and Stronghold have stopped disclosing information about their cryptocurrency sales.

CleanSpark confirmed plans to sell some of their mined Bitcoin to cover operational expenses and use reserves to finance business expansion.

Today CleanSpark announced we have expanded our capital strategy to include an increase in our credit facility with Coinbase Prime (Nasdaq: $COIN) to $200 million. Additionally, $CLSK‘s Digital Asset Management team has officially launched its institutional grade Bitcoin treasury… pic.twitter.com/nv2Ahz2JwD

— CleanSpark Inc. (@CleanSpark_Inc) April 15, 2025

The company had adhered to a policy of holding 100% of its digital gold production since mid-2023.

“No Panic!”

CryptoQuant’s Axel Adler Jr. also linked the current increase in miner sales to economic pressure from trade tariffs. He stated that this does not resemble “capitulation or panic.”

Miners are holding up well. Even with the recent price drop, their sentiment is on the rise -a clear sign they still believe in Bitcoin’s long-term potential.

The current wave of selling looks more like a response to economic pressure from trade tariffs than any sign of… pic.twitter.com/t5nVkcKv6Y

— Axel ?? Adler Jr (@AxelAdlerJr) April 17, 2025

“Miners are holding up well. Even with the recent price drop, their sentiment is on the rise — a clear sign they still believe in Bitcoin’s long-term potential,” the analyst noted.

According to Glassnode, on April 8, the hash rate of the leading cryptocurrency (smoothed by a seven-day moving average) reached a peak of 925.4 EH/s. After a slight pullback, it recovered to 905.5 EH/s.

It is forecasted that the next difficulty adjustment will increase mining difficulty by 4%, further reducing profitability.

Analysts described the divergence between hash rate dynamics and Bitcoin price movement as concerning. Conversely, CryptoQuant considered this a positive sign, indicating the strength of the cryptocurrency’s fundamentals.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!