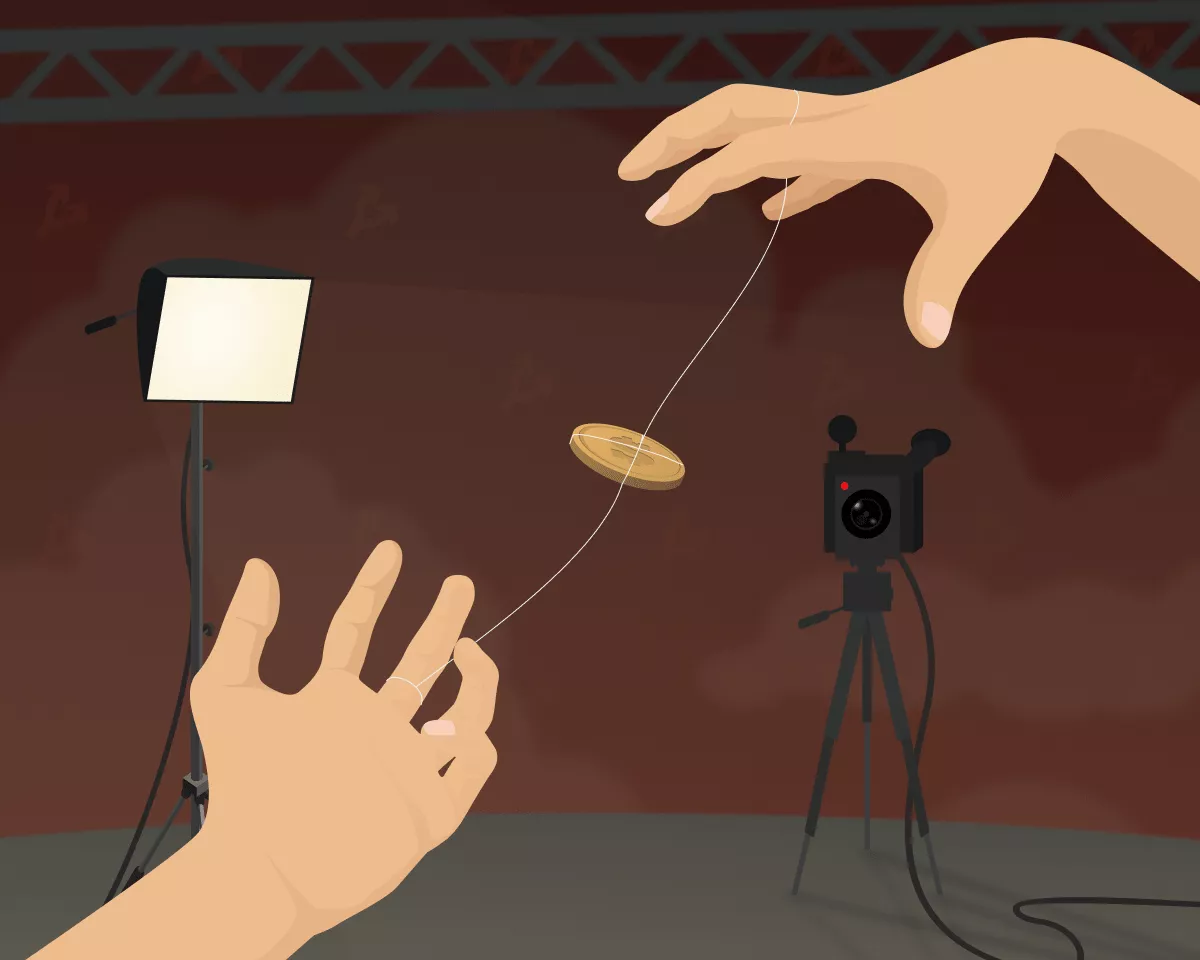

Over the past year, QAnon-aligned figures within the conspiracy-theory community persuaded thousands of followers to invest in fraudulent tokens. This is evidenced by an investigation by Logically.

Analysts say that two influential Telegram channels in the conspiracy community—WhipLash347 and Quantum Stellar Initiative (QSI)—promoted fraudulent assets to their sizable audiences. At the time of writing, they collectively boasted almost 310,000 followers.

The channels’ operators claimed to have access to some secret data, and therefore knew which assets to invest in. They also claimed links to “Trump, Musk and Kennedy.”

Many of the tokens promoted by the channels were built on the Stellar blockchain under the Indus.gold brand. It was claimed that the “company” invested in gold worldwide. The Indian bank IndusInd Bank has a product named Indus Gold, but it has no connection to the assets promoted by WhipLash347 and QSI.

Indus.gold issued dozens of tokens, 15 of them sold on a large scale. Many assets bore names resembling those of real companies to engender greater investor confidence. None of them were actually linked to real firms.

For instance, the token Sungold, promoted on WhipLash347 and QSI, was described as a “Kazakhstan gold mine-backed” asset. It was allegedly linked to a Russian company of the same name. Researchers found no evidence of this link, yet the Sungold scheme earned the QAnon-affiliated promoters around $2 million, Logically calculated:

“Indus.gold and the Sungold token are just one of dozens of examples in a long list published weekly on the WhipLash347/QSI channels. In most cases, the assets were linked based on blockchain analysis, or through the IP addresses of the domain names of sites advertising the tokens.”

Many tokens are marked as fraudulent on the Stellar network.

Dozens of people fell victim to these schemes, collectively losing millions of dollars. One investor took his own life after nearly losing more than $100,000 invested in the WhipLash347-promoted tokens, Logically found.

The channel administrators, in response to researchers’ questions, said they did not give investment advice, and that users were to blame for losing their funds.

According to the U.S. Federal Trade Commission, from January 2021 to March 2022 investors lost more than $1 billion in digital-asset scams.

Read ForkLog’s bitcoin news on our Telegram — cryptocurrency news, prices and analysis.