QCP Capital Anticipates Continued Bitcoin Growth in October

Stimulus measures from China’s central bank and a rate cut by the Fed are expected to maintain optimism towards risk assets, including stocks and bitcoin, in October, according to QCP Capital, reports The Block.

Analysts noted a 7.3% increase in the price of digital gold in September, defying seasonal trends.

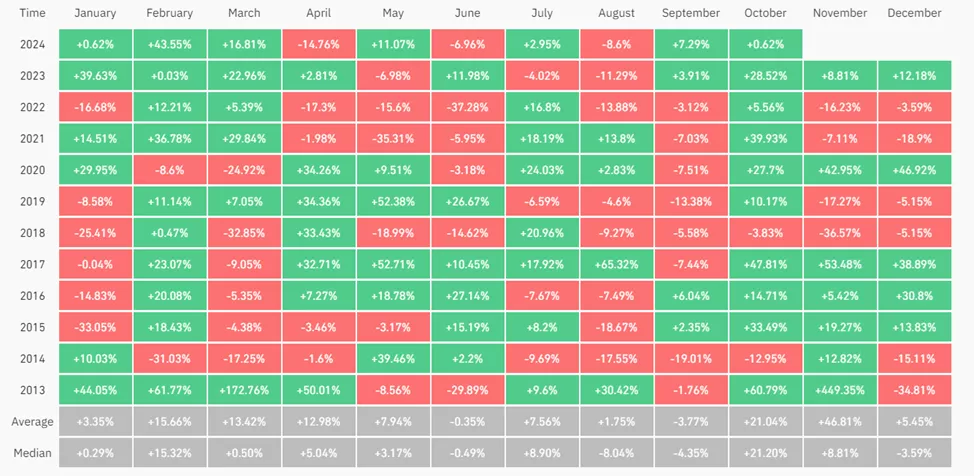

This performance was a record for the month. Since 2013, the leading cryptocurrency has typically depreciated by an average of 3.77% during this period.

According to Coinglass, positive Septembers in 2015, 2016, and 2023 led to favorable outcomes in the following months up to the new year. There have been only two negative Octobers in history—2014 and 2018. On average, bitcoin grows by 21% in October.

A breakthrough of $70,000 would confirm the optimistic scenario, specialists indicated. They warned about the quarterly earnings season in the US starting on October 15.

“Bitcoin will benefit from any stock pullback, as it is a risk asset amid global monetary easing,” concluded the experts.

Technical analyst Ali Martinez reminded investors to “buckle up”—every post-halving October, digital gold exhibits parabolic growth.

Historically, #Bitcoin kicks off a parabolic bull run every October following the halving! pic.twitter.com/sWHSkY0eEc

— Ali (@ali_charts) October 1, 2024

Previously, CryptoQuant linked a more than 3% drop in bitcoin’s price on September 30 to a long squeeze in perpetual contracts.

The anticipated November 4 employment report in the US is expected to be a key factor for the cryptocurrency market in the coming days.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!