QCP Capital: Bitcoin Options Market Bets on Surge to $74,000

A surge in the purchase of bitcoin call options expiring at the end of June above $74,000 indicates heightened expectations for a “decisive breakthrough” of the historical peak. This conclusion was reached by QCP Capital, as reported by The Block.

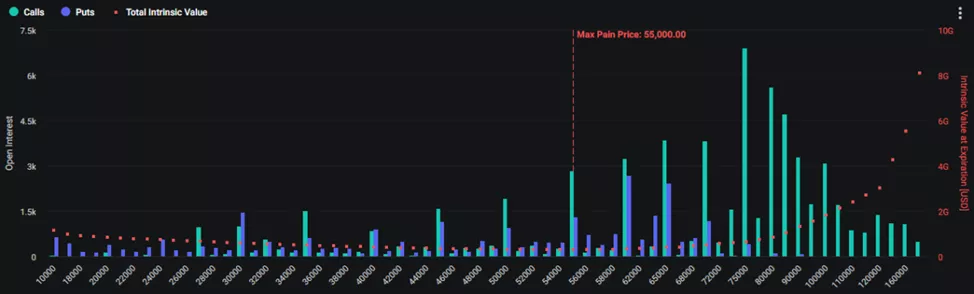

There is a concentration of calls at the $75,000 strike price.

On June 5, the largest platform in the segment, Deribit, recorded the highest trading volume in options with a strike price of $80,000 (1723 contracts with a notional value of $123 million).

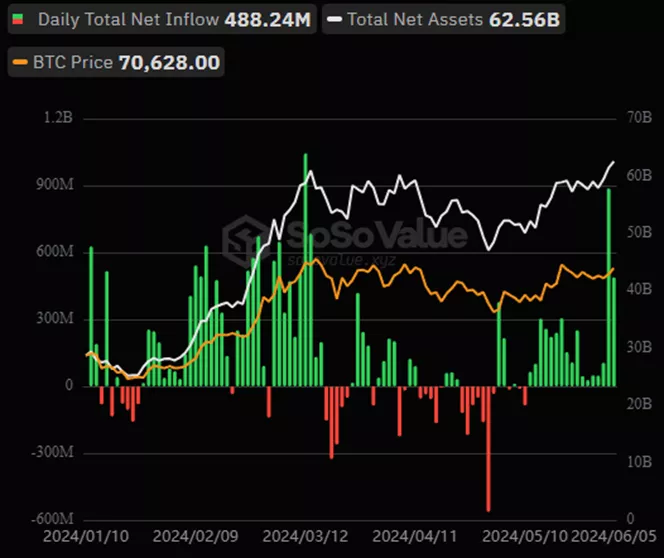

Analyst Neil Rorti from Stocklytics explained the positioning in the derivatives market by the acceleration of inflows into BTC-ETF.

According to SoSoValue, on April 4, inflows surged to $886.75 million — the second-highest in history. The next day, the pace slowed to $488.24 million, which is still significantly above the May-June average. The positive trend continued for 17 consecutive days, matching the record streak of January-February.

In Rorti’s view, the resilience of ETF inflows will determine the macroeconomic backdrop.

“The question now is whether these institutional investors will remain bullish. This will be closely tied to interest rates,” commented the expert.

Charles Edwards, founder of Capriole Investments, highlighted an “optimal signal” for buying digital gold in the “difficulty ribbon” indicator.

Earlier, Glassnode recorded a renewed interest in bitcoin purchases.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!