QCP Capital Warns of Increased Bitcoin Correction Risks

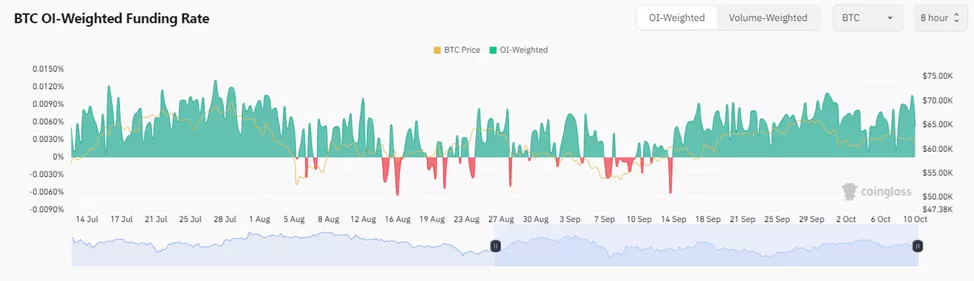

The rise in funding rates for perpetual contracts signals the cryptocurrency market’s vulnerability to a correction, according to QCP Capital, as reported by The Block.

“The increase in metrics on Deribit and Binance […] combined with the frenzied demand for meme coins makes us wary of a downward movement. It often occurs when investors least expect it,” the report states.

Experts maintain a bullish outlook for the medium and long term, recommending accumulation strategies, anticipating corrections to be short-lived.

Valentin Fournier from BRN noted the potential for increased volatility following the release of CPI and PPI reports on October 10 and 11.

“If inflation shows signs of easing, as expected, Bitcoin could receive another boost,” the analyst explained.

Earlier, Bitwise outlined conditions for the first cryptocurrency’s price to rise above $80,000 by the end of the year.

Back in Standard Chartered, a fivefold increase in Solana was forecasted should Republican candidate Donald Trump win the U.S. presidential election.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!