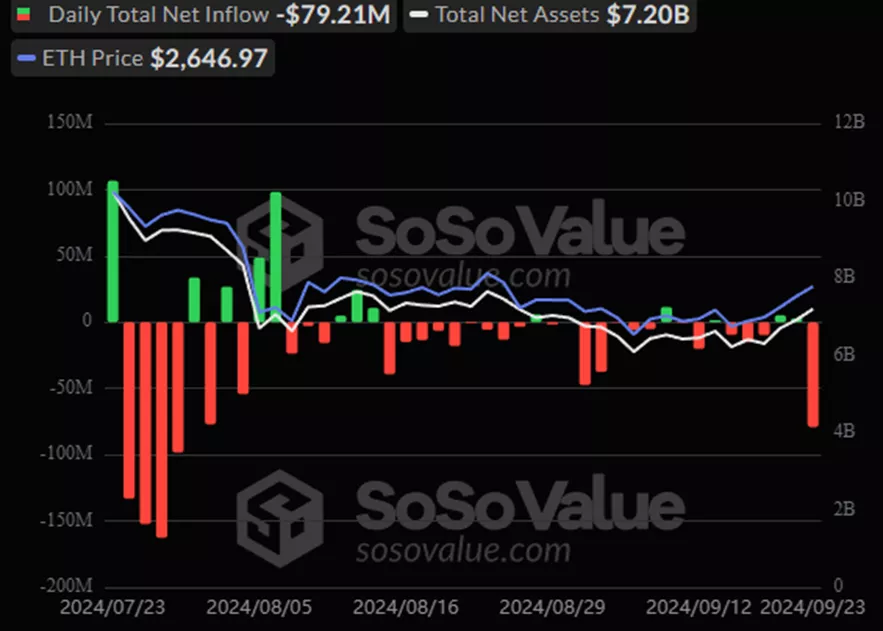

Record $79.2 Million Withdrawn from Ethereum ETF Since July

On September 23, outflows from spot Ethereum-ETFs reached $79.2 million, according to SoSoValue. The last time such high levels were recorded was on July 29.

The net withdrawal for the entire period increased to $686.7 million.

The cumulative outflow from Grayscale Ethereum Trust (ETHE) rose to $2.85 billion. On September 23, the figure increased by $80.6 million, the highest since July 31.

Clients added $1.3 million to Bitwise’s ETHW.

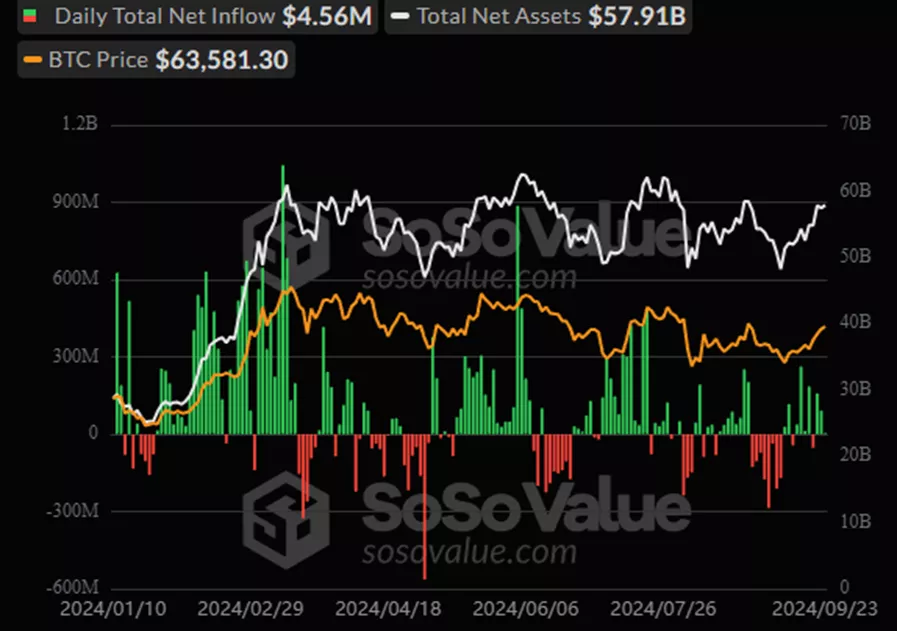

BTC-ETF

On September 23, inflows into spot Bitcoin-ETFs amounted to $4.6 million, according to SoSoValue. This positive trend continued for the third consecutive day.

Investors increased positions in Fidelity’s FBTC by $20.9 million, BlackRock’s IBIT by $11.5 million, and Grayscale’s BTC by $8.4 million. From the “senior fund” GBTC, companies withdrew $40.3 million.

Cumulative inflows since the approval of BTC-ETFs in January have increased to $17.7 billion.

Earlier, on September 20, the SEC approved the listing and trading of options on a Bitcoin-based exchange fund from BlackRock. Bloomberg analyst Eric Balchunas suggested that options for other companies’ instruments may soon be approved as well.

Read about the impact of these products on the cryptocurrency market in ForkLog’s article:

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!