Record Inflows into Spot Bitcoin ETFs Come to an End

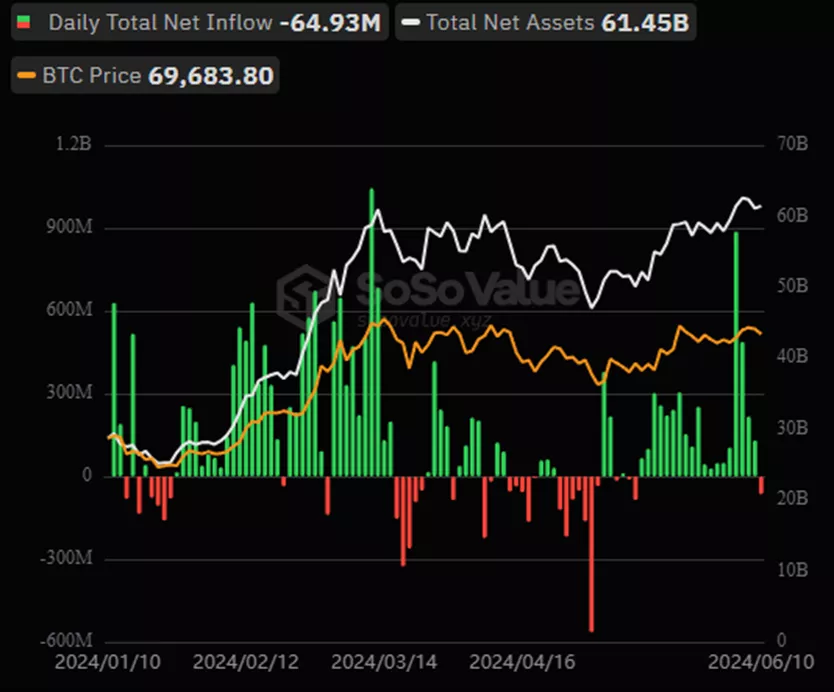

On June 10, investors withdrew $64.9 million from spot Bitcoin exchange-traded funds (ETFs), halting a positive trend that had persisted for 19 days, according to SoSoValue.

In total, the longest wave of inflows into BTC-ETFs amounted to approximately $4 billion, with $15.62 billion since the approval of these instruments in January.

Clients of Grayscale’s GBTC reduced their positions by $40 million, Invesco’s BTCO by $20 million, and Valkyrie’s VKRR by $16 million. Other products saw either no changes or minor inflows. Bitwise’s BITB attracted $8 million, while BlackRock’s IBIT drew in $6 million.

Investor sentiment was affected by an unfavourable US employment report. Following the release of macroeconomic statistics, the price of the leading cryptocurrency fell below $70,000.

Meanwhile, Bitcoin’s price dropped below $68,000, and Ethereum’s to $3600.

In the previous trading week, from June 3 to 7, US spot Bitcoin ETF issuers purchased 25,729 BTC (~$1.8 billion at the average rate), while miners produced only 3,150 BTC during the same period.

The first seven days of summer marked the most active period for ETF purchases since mid-March, as the price of digital gold reached a historic high.

Former BitMEX CEO Arthur Hayes highlighted the changing macroeconomic backdrop and urged the purchase of the leading cryptocurrency.

Experts at Bitfinex believe that during the current bull market, Bitcoin will form a peak at some point in the fourth quarter of 2024. They also noted the potential for further growth.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!