Reduced Odds of Fed Rate Cut Slow Crypto Fund Inflows

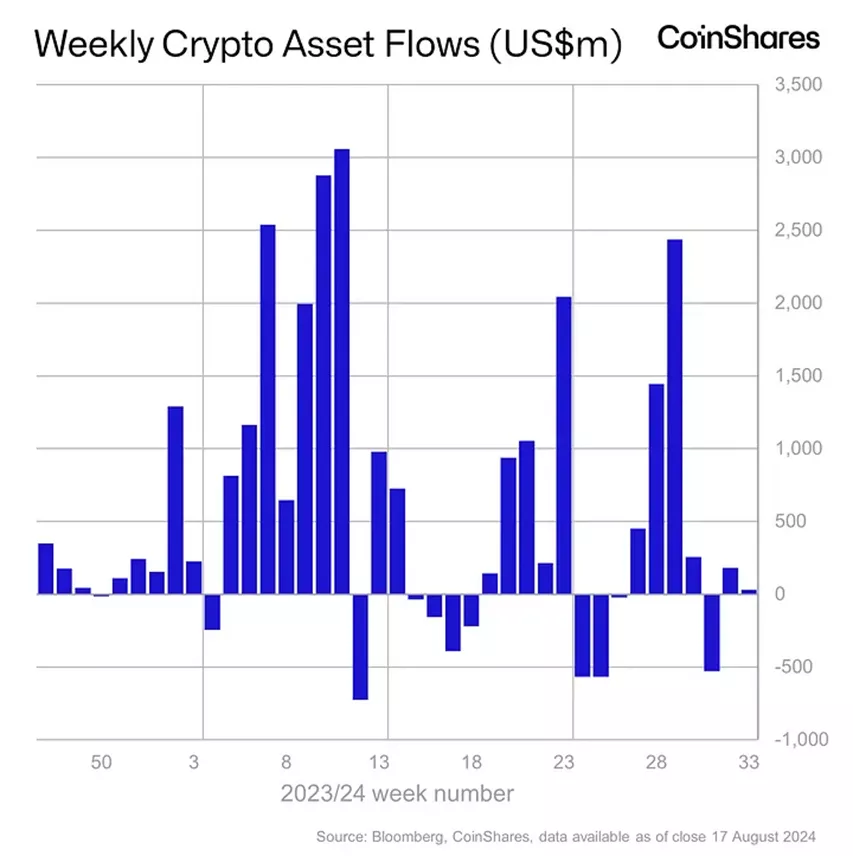

Inflows into cryptocurrency investment funds amounted to $30 million from August 11 to 17, following $176 million the previous week, according to data from CoinShares.

Analysts attributed the weakening positive trend to recent macroeconomic data, which reduced the likelihood of the Fed being prepared to cut the key rate by 50 basis points in September.

Turnover of ETP nearly halved to $7.6 billion.

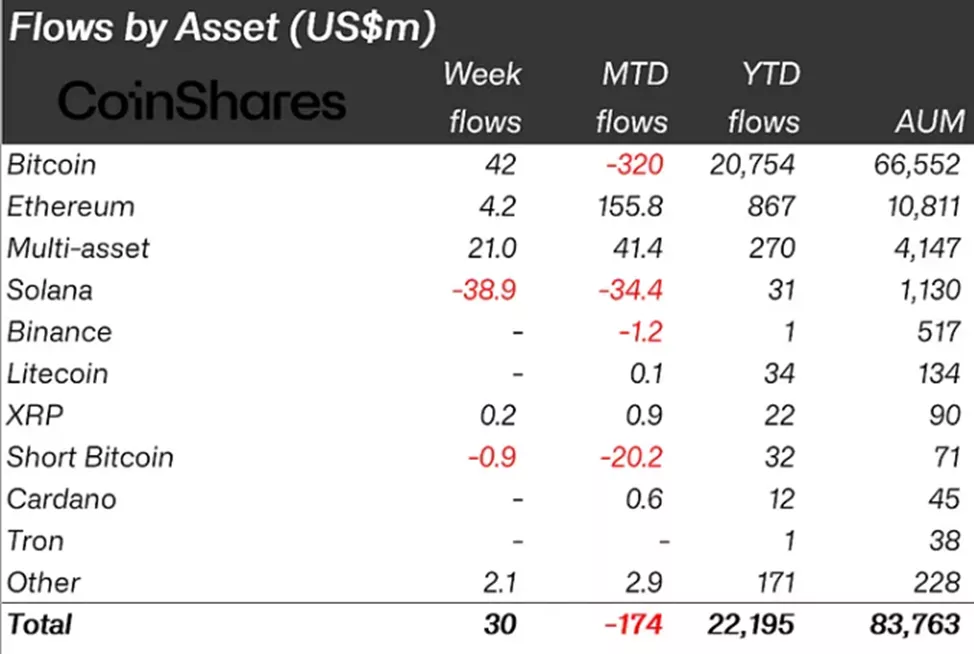

Funds based on Solana experienced a record outflow of $39 million amid a sharp decline in meme token trading volume.

Products linked to Bitcoin saw client additions of $42 million, up from $13 million the previous week.

Investors withdrew $0.9 million from structures allowing short positions on digital gold, following a peak of $16 million since May 2023.

Inflows into Ethereum funds totaled $4.2 million, down from $155 million.

Instruments based on a basket of altcoins attracted $21 million, compared to $18.3 million the week before.

Bitcoin’s drop below $58,000 led to the emergence of a “death cross,” a sign of a potential new wave of selling. Experts suggest that news surrounding the potential distribution by U.S. authorities of coins seized in the Silk Road darknet marketplace case is exerting pressure on prices.

On August 15, it was reported that 10,000 BTC were moved to a Coinbase Prime wallet. Another address associated with the U.S. government still holds 19,800 BTC ($1.15 billion) related to the shadow platform case.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!