Renewed Interest in Bitcoin Purchases Observed by Analysts

After two months of sideways movement, digital gold has shown initial signs of a return to speculative activity, with potential for increased volatility. This conclusion was reached by Glassnode.

Experts noted the sharp market reaction following reports of the movement of Mt.Gox BTC worth $9.8 billion. This could significantly impact several on-chain metrics.

Adjusting for coin holders, the realized capitalization metric provides a clear picture of capital flows. Currently, the indicator stands at $580 billion. Since late April, as the market consolidated, the influx of new liquidity has slowed.

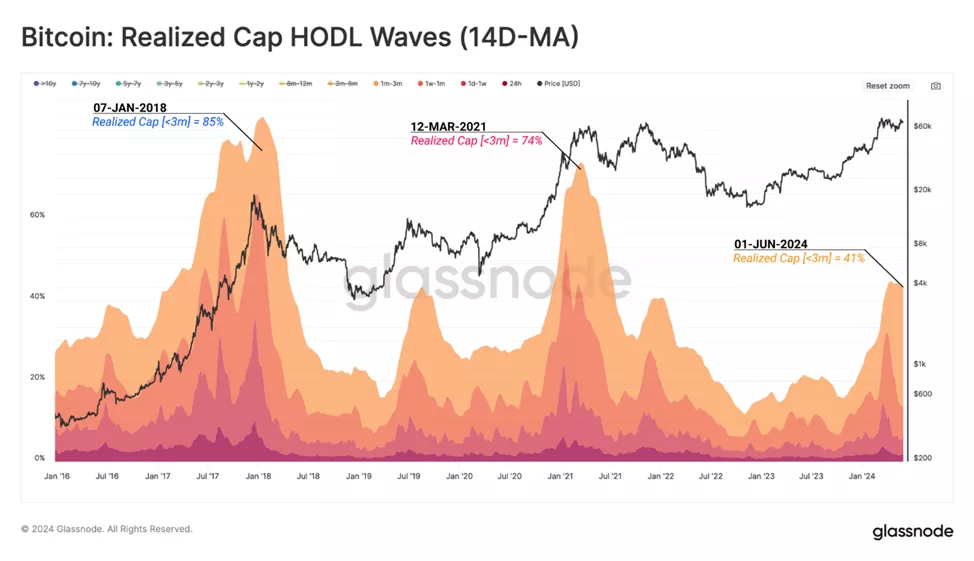

Based on the Realized Cap HODL Waves metric applied to bitcoins less than three months old, analysts estimated that 41% of the ‘wealth’ is attributed to ‘new demand’.

In the past, at its peak, the indicator exceeded 70%. In other words, hodlers have spent a relatively smaller volume of supply compared to previous cycles.

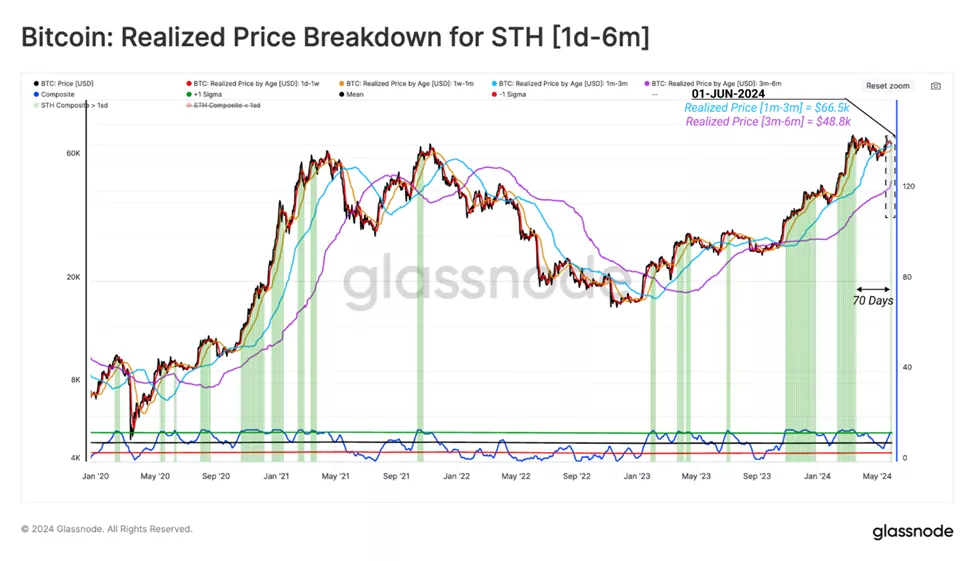

The return to $68,000 prompted a significant portion of short-term players to hold onto unrealized profits. According to specialists, this indicates that most recent buyers now have a ‘cost basis’ below the current rate. The indicator stands at $66,500 for coins aged one to three months.

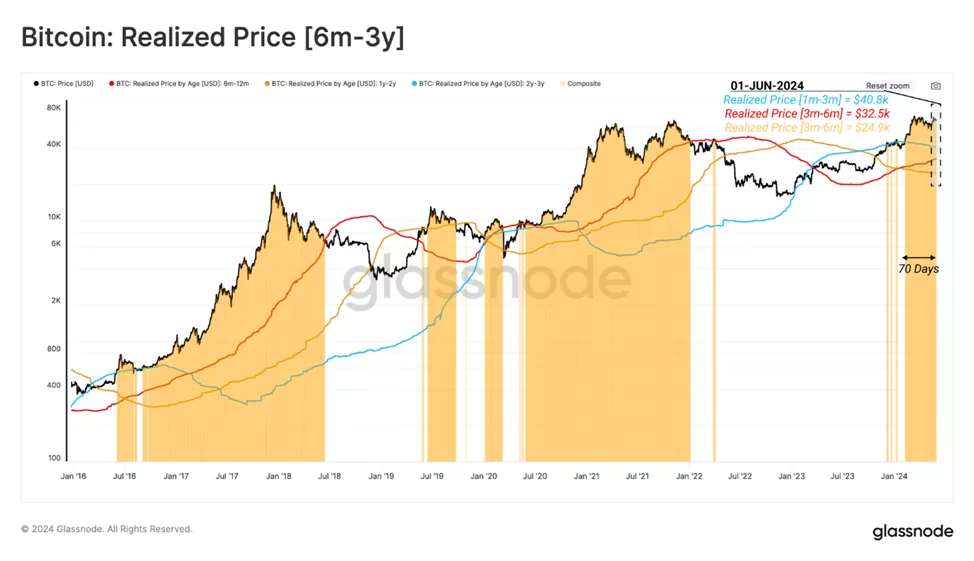

Experts also highlighted the group of investors holding bitcoins for six months to three years. After the price surpassed $40,000, most holders transitioned to hodlers, increasing unrealized profits.

The market absorbed a large volume of distribution from this category when quotes reached the ATH of $73,000. Glassnode expects this group to resume selling if new highs are reached.

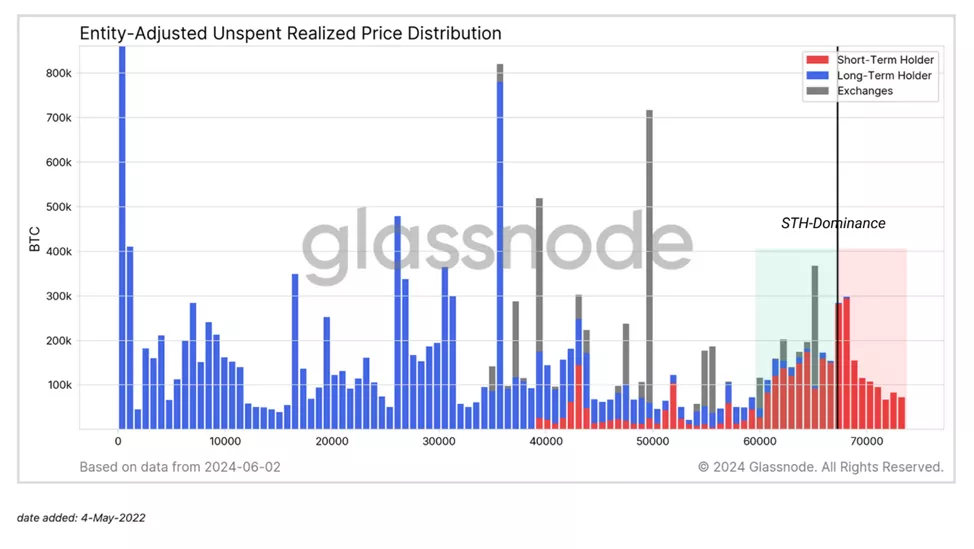

Analysts examined the supply structure based on the purchase price of bitcoins. They found a significant concentration of purchases by short-term holders near the current spot price. This also indicates increased investor sensitivity to any price fluctuations.

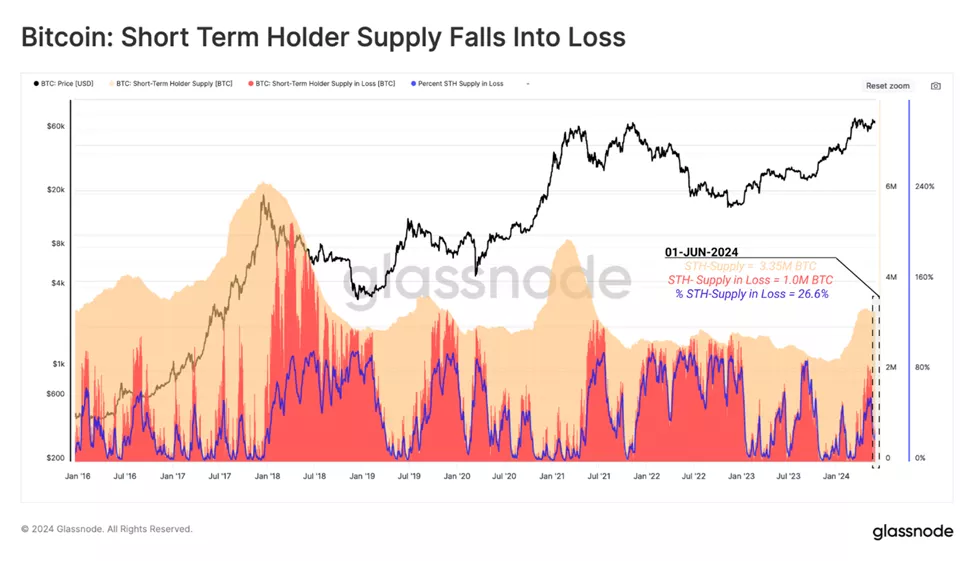

Specialists assessed the share of loss-making coins held by speculators (purchased less than 155 days ago) at 26.6%. Amid a correction to $58,000 (21% from ATH), this share momentarily reached 56% (1.9 million BTC), but the magnitude of unrealized losses was typical of bull market corrections and is beginning to decrease as the market stabilizes.

To analyze hodler and speculator activity, experts used the Sell-Side Risk Ratio:

- High values indicate that investors are spending coins with significant profit or loss relative to their cost. This state is typical during periods when the market likely needs to restore equilibrium. Such a pattern usually forms after highly volatile price movements.

- Low values suggest that most coins are spent relatively close to their break-even cost. This is a sign of achieving a certain balance and low volatility, indicating the exhaustion of ‘profits and losses’ within the current range.

Currently, for short-term market participants, the second situation applies — achieving equilibrium within price consolidation.

For long-term investors, the Sell-Side Risk Ratio has significantly increased, as profits were realized before and after reaching the ATH of $73,000.

In retrospect, the metric remains at a lower level compared to previous breakthroughs of historical highs. Such a situation may signal expectations of higher prices for a transition to more active distribution.

Earlier, CryptoQuant pointed to hodlers’ reluctance to ‘cash out’ after Bitcoin rose to $70,000. Prior to this, specialists stated that the rally was not yet over.

Previously, Charles Edwards, founder of Capriole Investments, highlighted an ‘optimal signal’ for buying digital gold in the ‘difficulty ribbon’ indicator.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!