Report: Bitcoin–S&P 500 correlation rises amid geopolitical tensions

Heightened geopolitical tensions have increased the correlation between Bitcoin and the US stock index S&P 500, according to an Arcane Research analysis.

The Weekly Update: Week 7

🔹Fear grows in both the stock and crypto markets

🔹Stablecoins continue to grow faster than the overall crypto market

🔹Remarkable #bitcoin performance differences between the first half of the month versus the second halfhttps://t.co/bwj5FmHe53— Arcane Research (@ArcaneResearch) February 22, 2022

According to researchers, the 90-day correlation between BTC and the “Fear and Greed Index” has reached its highest level since October 2020. The statistical linkage between Bitcoin and gold, by contrast, has become negative.

“Gold acts as a low-risk asset in this period of significant geopolitical uncertainty,” experts said.

Arcane Research also noted the crypto “Fear and Greed Index” returning to around 20, indicating prevailing panics among market participants.

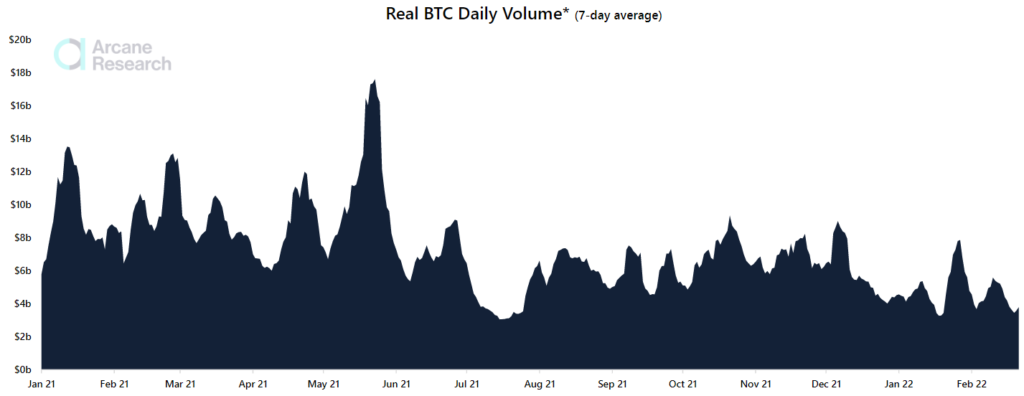

Bitcoin’s spot trading volume on centralized exchanges fell to levels last seen in December 2020.

In terms of technical analysis, experts noted that Bitcoin has found support at $36,500, a level that also held in February. If this level does not hold, the price could fall to $34,000.

However, analysts are confident that the most important support range is $28,000-$30,000. It represents the bottom of the bear market in the summer of 2021.

As a key resistance level, experts cited the $40,000 mark.

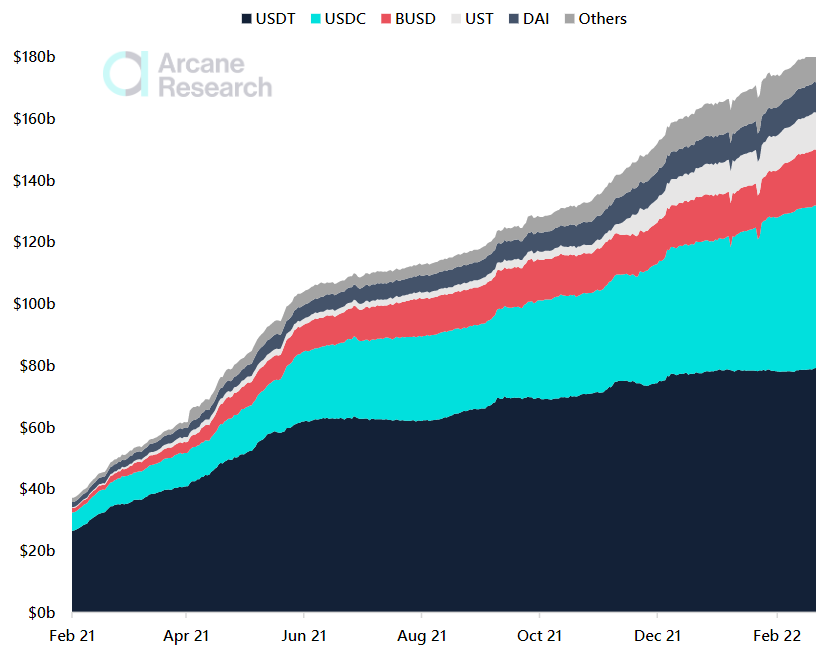

Against deteriorating market sentiment, the total capitalization of stablecoins continues to rise, approaching the $200 billion mark.

Tether (USDT) remains the leader in the segment, holding a 44% market share. USDC follows with 29% and BUSD with 20%.

Earlier, Glassnode analysts pointed out the risks of further declines in Bitcoin price amid expectations of a Federal Reserve rate hike and geopolitical tensions.

Subscribe to ForkLog’s channel on YouTube!

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!