Report: Long-term investors built Bitcoin reserves in 2021

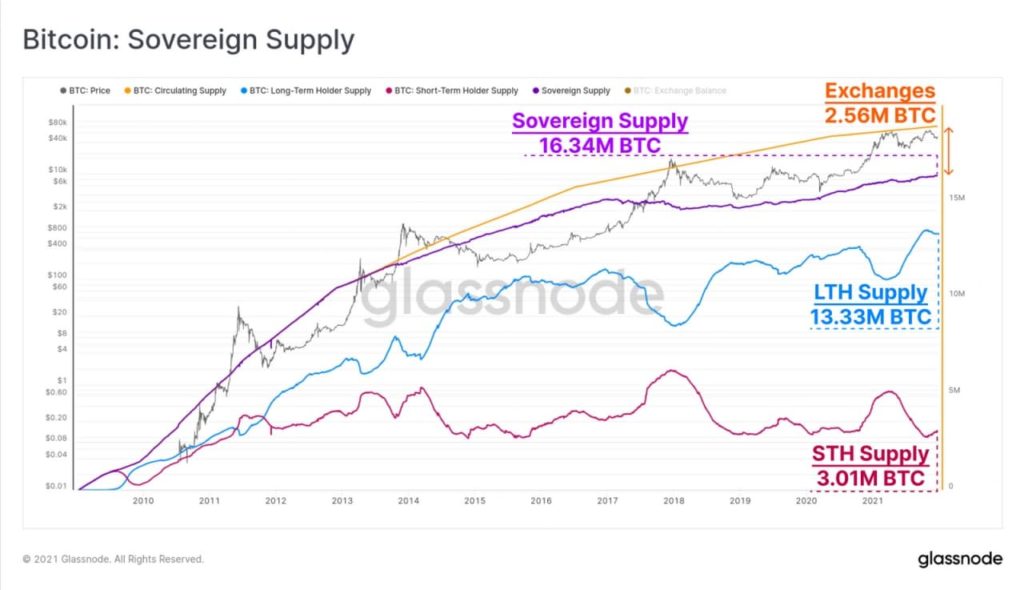

In 2021, long-term Bitcoin reserves rose by 1.846 million BTC (+16%), reaching 13.33 million BTC. The corresponding figure for short-term investors over the year fell by 32%, to 3.01 million BTC, according to the annual ForkLog report.

Large players tend to accumulate and hold crypto assets long term, buying coins during deep drawdowns. Their buying can dampen the intensity of future pullbacks, reducing bearish pressure on price from speculators. The latter tend to sell during pullbacks.

Against the backdrop of price corrections in late November 2021, outflows of Bitcoin from centralized exchanges (CEX) were followed by inflows. A similar dynamic was seen for Ethereum.

Over the year, the BTC supply on centralized exchanges declined by just 1.08%. Inflows to exchanges in late November point to deteriorating sentiment among short-term investors, as well as their desire to hedge risks.

The share of ETH locked in smart contracts of decentralized applications rose steadily throughout 2021. If the figure stood at 16.25% on January 1, 2021, it reached 26.93% in January 2022.

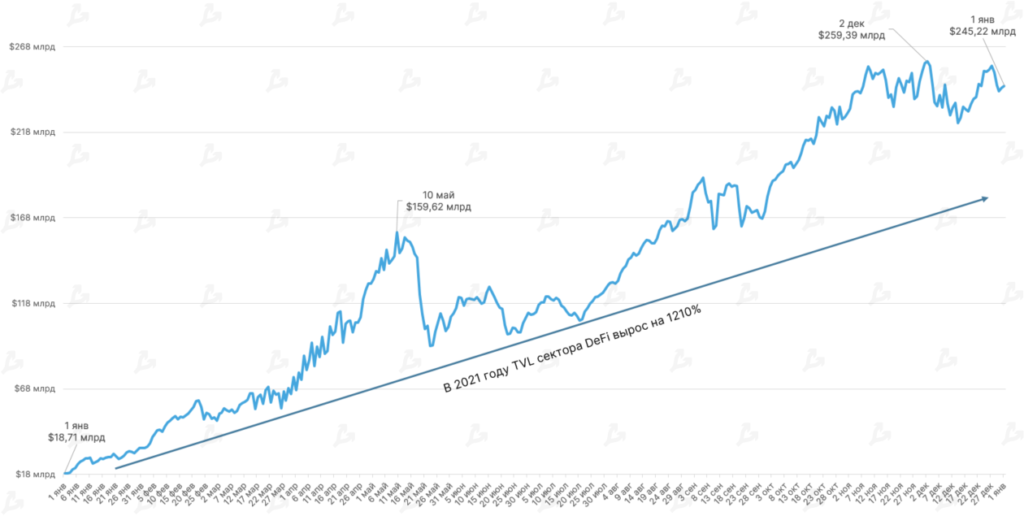

Growth in locked funds occurred amid the development of DeFi, where Ethereum dominates. By year-end, the sector’s total liquidity had grown 13-fold, reaching $245 billion.

In 2021 the Ethereum ecosystem led in the number of active developers (more than 4,000). Yet projects such as Solana and Polkadot grew at faster paces.

Sponsor of the ‘Bitcoin Industry in Numbers’ column — the global blockchain ecosystem Binance.

As CryptoRank notes, on centralized exchange addresses there is 1.3 million BTC — 6.5% of the total market supply. The majority of these coins (over 44%) are held in Coinbase’s exchange wallets.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!