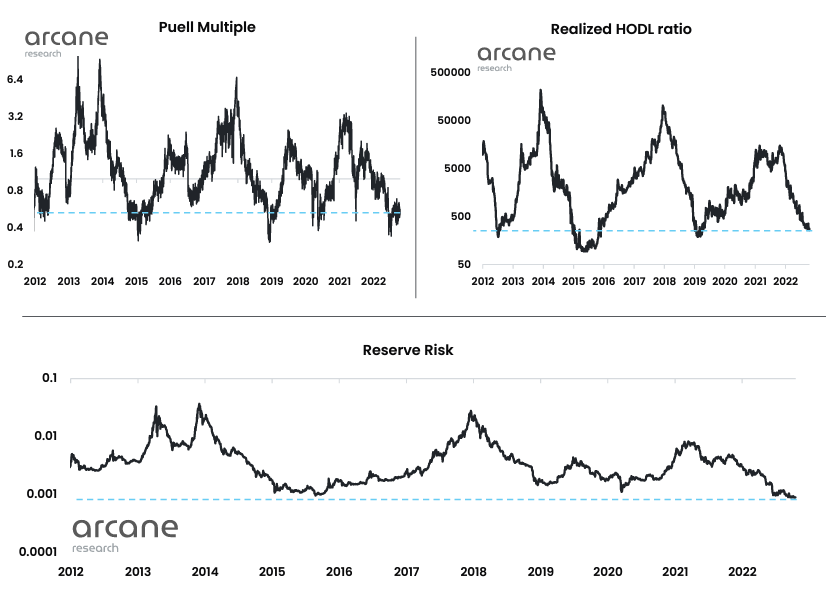

Report: Many on-chain metrics point to bottom of market cycle

Many on-chain metrics, including Puell Multiple, RHODL Ratio and Reserve Risk, signal a deep oversold condition for Bitcoin and the likely bottom of the bear market phase. This is stated in the ForkLog October analytical report.

At the same time, some indicators indicate a risk of a new wave of redistribution and price consolidation in the range of $16,500–$21,100.

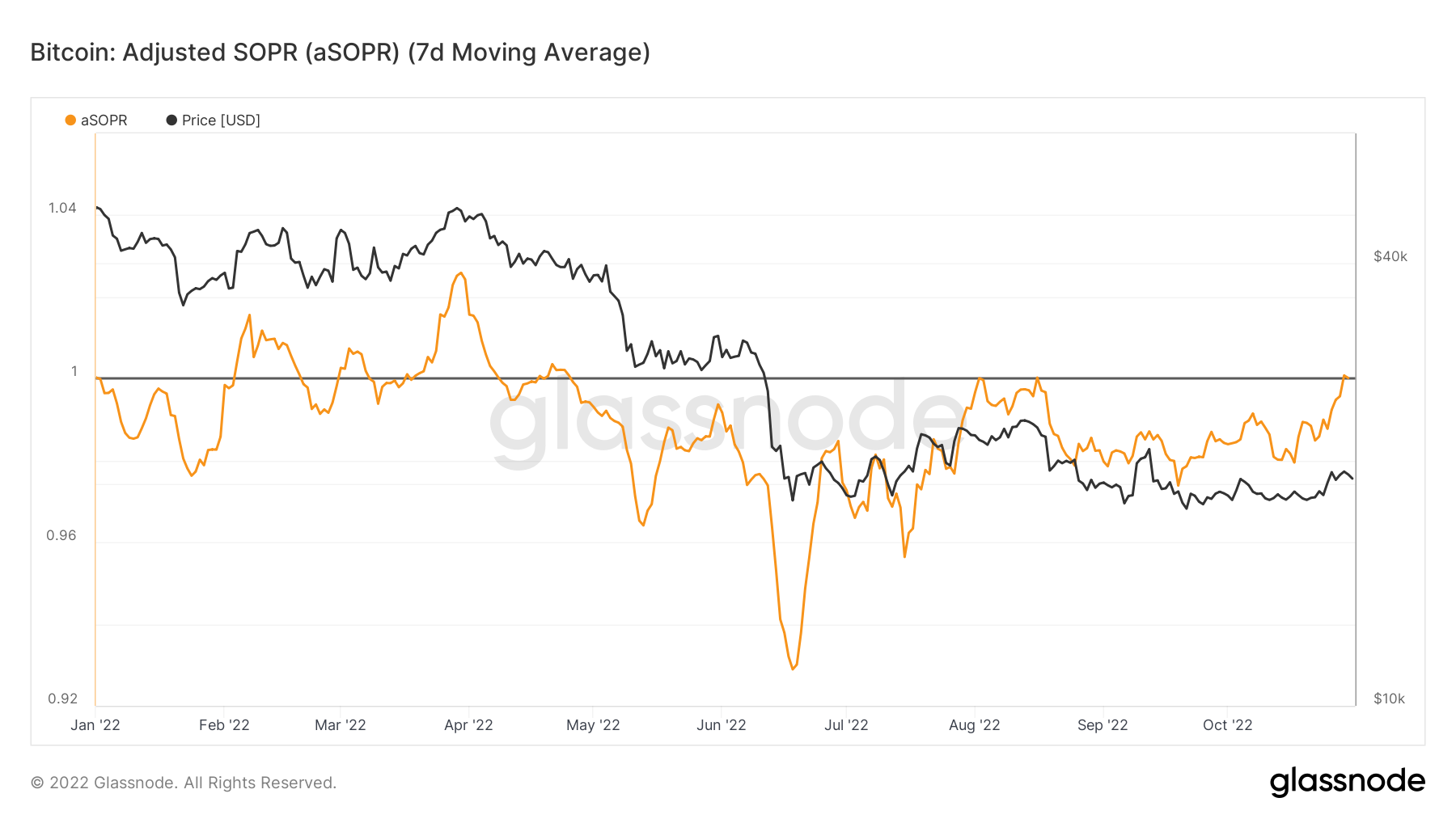

MVRV indicates that Bitcoin’s realized capitalization is higher than its market capitalization. Previously, such low readings of the indicator coincided with the extremes of previous bear phases.

The total volume of lost bitcoins, as well as coins on the wallets of long-term crypto investors has reached a five-year high. This means that the active supply of cryptocurrency is shrinking, portending optimistic prospects for the price provided demand grows or remains unchanged.

In October, Galaxy Digital founder Mike Novogratz suggested that the bear market phase will last another two to six months.

Read ForkLog’s Bitcoin news in our Telegram — cryptocurrency news, prices and analytics.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!