Report: Open Interest in the Futures Market Falls Sharply Amid Bitcoin Correction

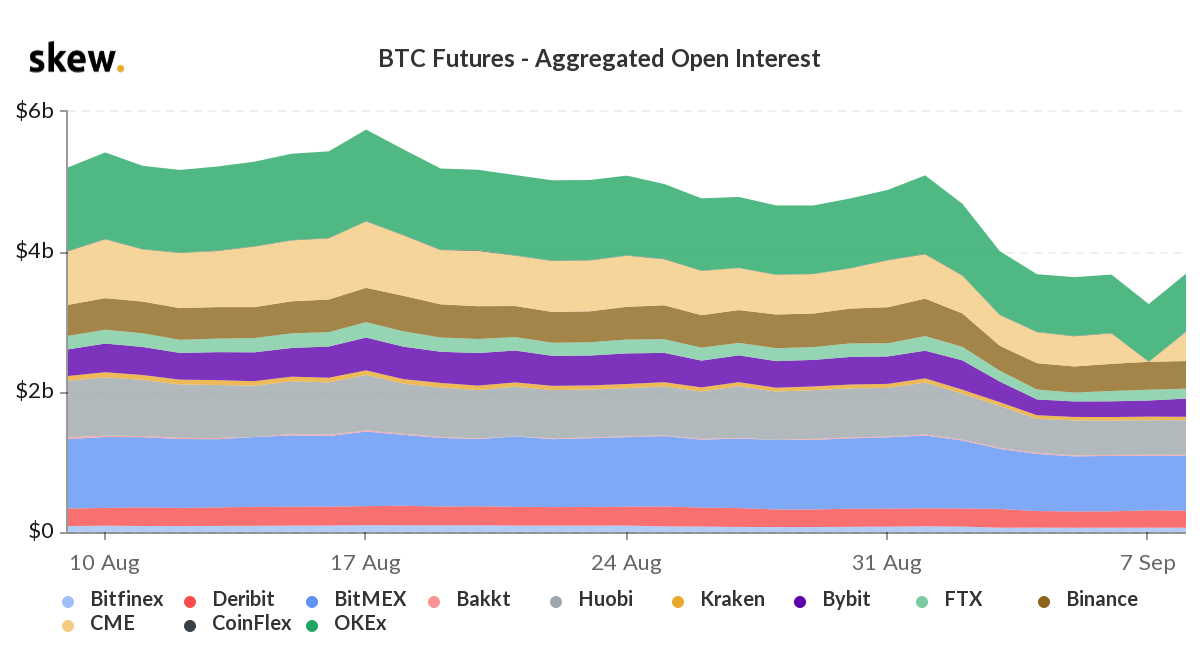

Since the start of September, the price of the first cryptocurrency has fallen by about 20%. In that period, open interest (OI) in the Bitcoin futures market declined by 28%, according to Arcane Research.

Open Interest in free fall🧐

The recent BTC correction has led the open interest in the

bitcoin futures market to fall sharply — down 28% this month.Data: @skewdotcom pic.twitter.com/Swin0sxul2

— Arcane Research (@ArcaneResearch) September 8, 2020

On September 1, aggregate open interest across futures stood at $5.1 billion. Over the course of the week, the figure fell to $3.7 billion.

Data: skew.

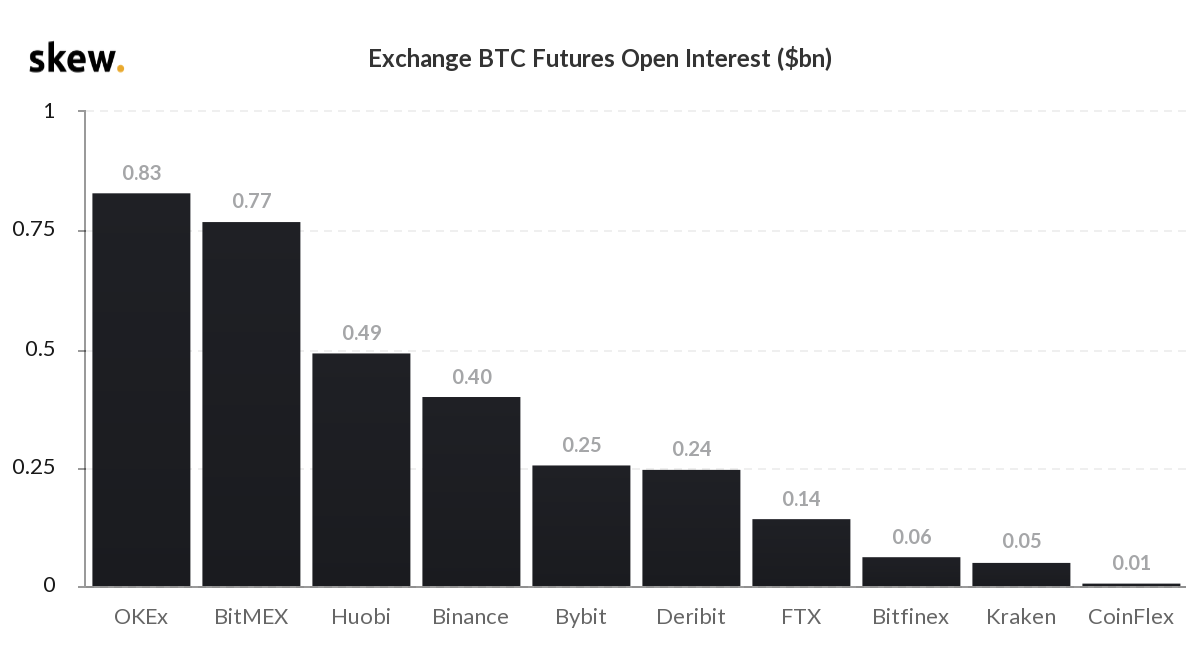

The largest open interest on the exchange is on OKEx — $0.83 billion, while in daily trading volume Binance Futures leads with $3.43 billion.

On August 17, open interest on the Chicago Mercantile Exchange (CME) reached a peak of $948 million. The current OI on this regulated platform stands at $435 million — a drop of 54% from the maximum.

Have bearish sentiments among institutions begun to prevail?

However, researchers are confident there is no reason for panic — price rallies cannot occur without periodic corrections.

According to them, much depends on the integrity of the $10,250 level. If the weekly candle closes above this level, Bitcoin is likely to retest highs.

On September 1, Bitcoin traded around $12,000, but the quotes of the first cryptocurrency are now near the key support level of $10,250. The weekly BTC/USD chart from Coinbase on TradingView.

If the level does not hold under bear pressure, the next support level will be $9,000.

Earlier, Kraken analysts said that they expect Bitcoin’s price to rise 50–200% in the coming months.

Subscribe to ForkLog’s channel on YouTube!

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!