Report: Shapella upgrade in Ethereum network did not affect prices

Activation Shapella hard fork in the Ethereum blockchain sparked interest in staking, not confirming concerns about negative impact on the asset’s price. This is reported by ForkLog.

In April, the second-largest cryptocurrency by market capitalization increased by 2.7% in value.

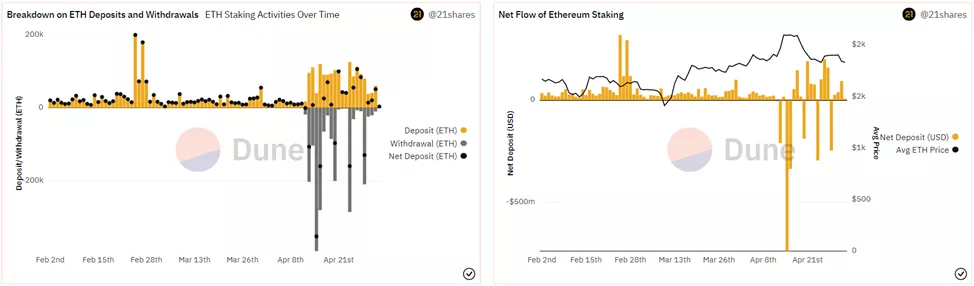

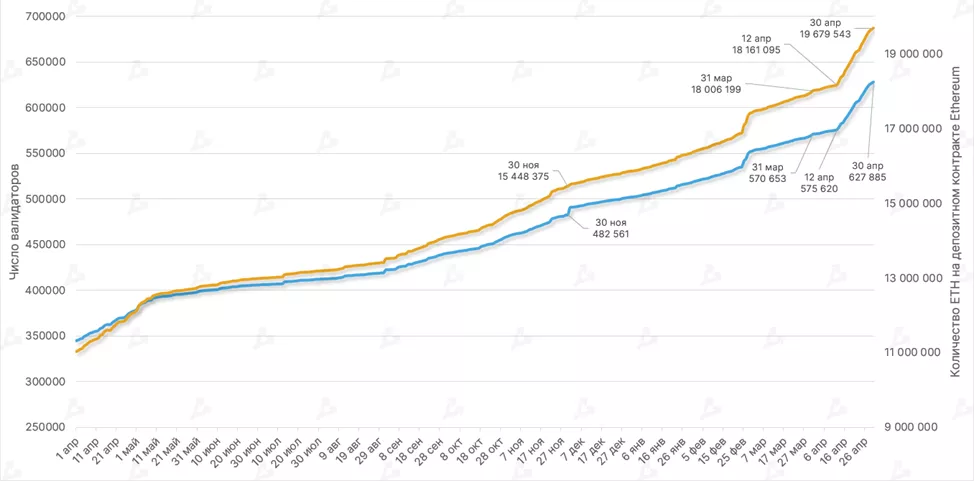

Thanks to features of the withdrawal mechanism for staking, a significant outflow of Ethereum from the deposit contract did not occur — as expected. Instead, in April there was the opposite dynamic —net inflow amounted to 9% (~1.5 million ETH), accelerating markedly after the activation of Shapella.

The update sparked interest in staking, particularly in the liquid staking segment. Demand also played a significant role from institutional clients.

The number of network validators also rose by 10%, indicating growing user confidence in staking the second-largest cryptocurrency by market cap.

Since Shapella’s activation, validators have withdrawn more than 1.97 million ETH (about $3.62 billion at the rate at the time of preparing the report). Network participants were actively withdrawing funds in the first days after the hard fork. Partial withdrawals dominated the withdrawal mix.

According to Ultrasound Money, over the last 30 days Ethereum supply has contracted by about 59,000 ETH — the network remains deflationary. The largest number of coins (~25,100 ETH) were taken out of circulation in operations related to the Uniswap protocol. In second place are transfers between network participants.

As reported, Ethereum options on the CMEset records after the activation of Shapella.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!