Ruble–USDT trading volume triples amid Wagner PMC rebellion

On June 24, amid events related to the Wagner PMC, CCData analysts recorded a sharp spike in ruble–USDT trading activity. This was reported by Fortune.

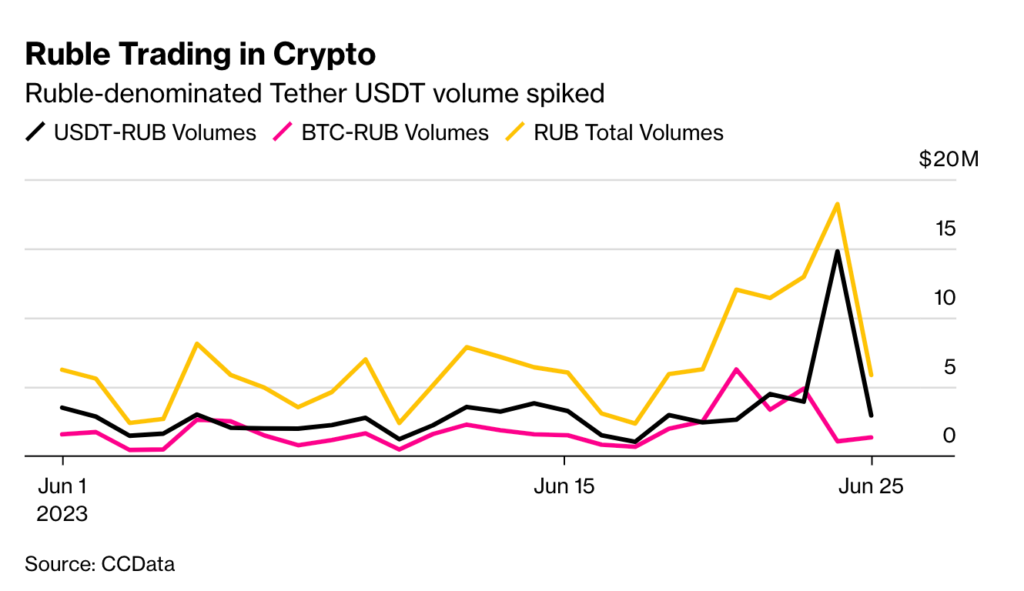

According to CCData, trading volume on the ruble–USDT pair rose more than threefold to around $15 million.

The largest platforms for ruble transactions this month were Binance, Cryptonex, HitBTC and Coinsbit.

As CCData communications manager Jamie Sly clarified, the spike in trading volume did not directly indicate that ruble-denominated investors were buying Tether. He suggested that “market participants were seeking a less volatile asset relative to the ruble, since no similar trends were observed for Bitcoin trading volumes.”

Representatives of Kaiko confirmed that the ruble-denominated Tether trading volume reached its highest level since December 2022. This occurred despite the fact that the corresponding pairs had been delisted by many platforms amid tightened sanctions against Russia.

On Friday, June 23, Wagner PMC fighters under Yevgeny Prigozhin moved toward Moscow. However, by the evening of June 24 after talks with Belarusian President Alexander Lukashenko, the rebellion was halted. On the same day, a criminal case for armed mutiny was opened against Prigozhin, and on June 27 the FSB terminated the proceedings.

Back in March 2022, after currency operations were banned in Russia, the black segment of the cryptocurrency market intensified. Turnover of Moscow-City exchanges increased at least fivefold since the start of the full-scale war in Ukraine. Meanwhile, the average earnings on deals rose from 0.1% to at least 1%.

According to Chainalysis, dozens of cryptocurrency firms from Moscow-City are linked to money laundering by cybercriminals.

In February 2023, Sberbank recorded record volumes of illicit transfers to overseas cryptocurrency wallets using Russian bitcoin exchanges.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!