Russia’s Finance Ministry wants to tokenise gold. Experts explain why

Russia eyes gold tokenisation for cross-border payments, but hurdles remain.

Tokenising gold is “a very promising solution” for Russia that could be implemented in the near term, said Alexei Yakovlev, director of the finance ministry’s policy department.

He said the digitalisation of the precious metal would enable solutions for cross-border payments and international settlements “in the new reality”.

In parallel, a deputy governor of the central bank, Alexei Guznov, said that amendments to the legislation on DFAs will allow expenses on issuing digital debt obligations to be included in the general corporate income-tax base.

“It is precisely about institutionalising [them], to single out digital debt DFAs as a separate instrument,” explained Guznov.

At present, all operations with digital financial assets must be accounted for in a separate tax base. This reduces interest in the instrument because of the complexity of filing returns.

What would tokenisation achieve?

Maria Agranovskaya, managing partner at Agranovskaya & Partners, told ForkLog that tokenised gold definitely cannot be used to pay, because money surrogates cannot be used to settle for goods and services.

“However, in the form of DFAs — quite possible. Rather, it is an intra-group instrument, or an investment one, for stabilisation. There were recent defaults on digital assets. It is useful if they finally implement DFA-for-DFA exchange. Use for foreign economic activity is likely, but one must take into account sanctions risks for transparent Russian instruments,” added Agranovskaya.

She also suggested a variant with a token issued from abroad and backed by Russian gold. But many questions remain about how the initiative would be implemented.

Crypto investor and founder of the Telegram channel “24 slova” (24 words) Artem Tolkachev suggested that tokenised gold could be used as an alternative settlement instrument amid restricted access to the dollar infrastructure.

“This is a more convenient form of distributing an asset. A token can become an analogue of an unallocated precious-metal account, but with simpler transfer of rights and the possibility of fractional investments. A step towards the general digitalisation of finance. Launching such instruments makes it possible to road-test the infrastructure — custody, accounting, circulation. This can become the basis for the next products (tokenisation of debt, equities, commodities),” he specified.

But looked at critically, it will work only if international counterparties are indeed ready to accept such a token, Tolkachev continued. And why they would do so is a big question.

“Whether they will trust a putative central bank or another custodian that holds the gold and ensures redemption of the tokens into physical metal is also doubtful,” believes Tolkachev.

He highlighted the main point: tokenising gold creates liquidity and convenience of settlements, but does not provide a “base layer of yield”, like Treasuries or money-market funds. Therefore the prospects depend not on the technology but on the emergence of real users ready to use digital gold for settlements or storage.

According to Tolkachev, implementing the initiative is technically straightforward: place the gold in a depository, issue a token and bind it with a legal construct.

“The main question comes next: what to do with it? Moving an asset on-chain is the easiest part of the task. It is much harder to understand which real use-cases this token solves, and to build the infrastructure so that it is in demand. Tokenisation by itself gives nothing. A clear usage scenario is needed,” he added.

Agranovskaya recalled the already existing technology of utilitarian digital rights (UDRs), which has not spread significantly because the tax aspect has not been fully worked through.

“There are hybrid assets — DFAs and UDRs. I think they will develop. But who needs them abroad is still not a fully clear story. Of course, digitalisation is primarily aimed, as they say, at overcoming geographical barriers. It is a cross-border technology,” she stressed.

Global trend

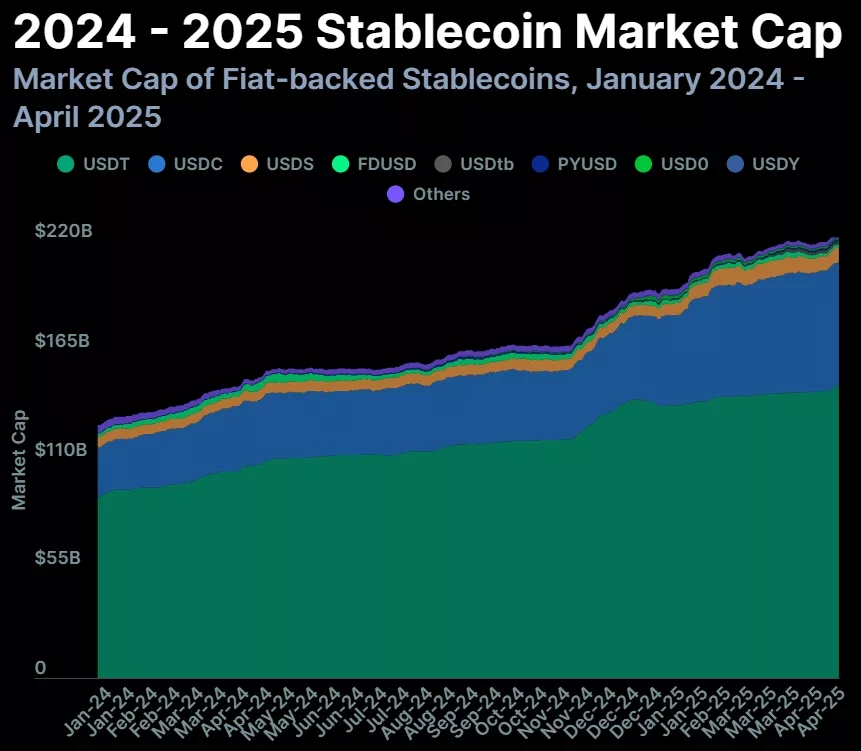

From the start of 2024 to June 2025, the global RWA market added more than $100bn in capitalisation. The segment of tokenised Treasury bonds reached a record $5.6bn.

However, in the global context, tokenised assets need standardisation of regulatory requirements, noted Agranovskaya.

“In Dubai they are regulated one way, in the United States another. In Europe any tokenisation is, of course, MiCA. There is its own qualification of tokens, and that means tax consequences, licensing of secondary trading, and so on. RWAs are an undeniable trend. The direction has firmly taken its place in history, but more and more it is becoming similar simply to digital securities or bills of lading,” she said.

Tolkachev explained that today tokenisation primarily covers US Treasury bonds, money-market funds and other highly liquid instruments that pay a stable yield and can serve as a base layer of return for DeFi.

A second vector of tokenisation is equities, where the digital layer solves the access problem.

“Crypto investors can take positions straight from a wallet: that is, not leave the crypto world, but work with traditional financial instruments right inside it, not only buying and selling shares, but also providing liquidity via AMMs and performing more complex operations that are simply unavailable in the world of traditional finance,” Tolkachev explained.

But tokenisation is always closely linked to regulation: without a clear legal regime a crypto-asset is just an entry on a blockchain. He noted that a token becomes a full-fledged financial instrument only if the law recognises property rights.

Therefore progress in tokenisation is being made in jurisdictions where special regimes already exist, such as the United States and the European Union.

“The second important part is the custodian. For most assets tokenisation is impossible without a trusted party that holds the asset and issues the token. It is the custodian that acts as the guarantor that the coin is genuinely backed, and the market’s acceptance of such an instrument directly depends on its reliability and reputation. In the end, trust in the infrastructure turns out to be no less important than the technology itself,” Tolkachev concluded.

Earlier, Tristero Research warned of a repeat of the 2008 crisis in the real‑world‑asset sector.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!