RWA Protocol Breaches Exceed $14.6 Million in Six Months

This is twice as much as last year's $6 million.

Attacks on RWA projects resulted in losses amounting to $14.6 million in the first six months of 2025. This figure more than doubles last year’s total of $6 million, analysts at CertiK noted.

RWAs could reach $16T by 2030. But with new value comes new risks across asset, legal, operational, data, and on-chain layers.

Which protocols lead in security? What threats does this sector face?

Learn more in the 2025 RWA Security Report

👉https://t.co/Db8Mn8DbXy pic.twitter.com/8bqh8JkOq3— CertiK (@CertiK) August 21, 2025

Experts suggest that this figure could surpass the record levels of 2023, when real-world asset tokenization protocols lost $17.9 million.

CertiK highlighted that many vulnerabilities were due to operational failures rather than smart contract errors, indicating a shift in the threat landscape from 2023 to 2025.

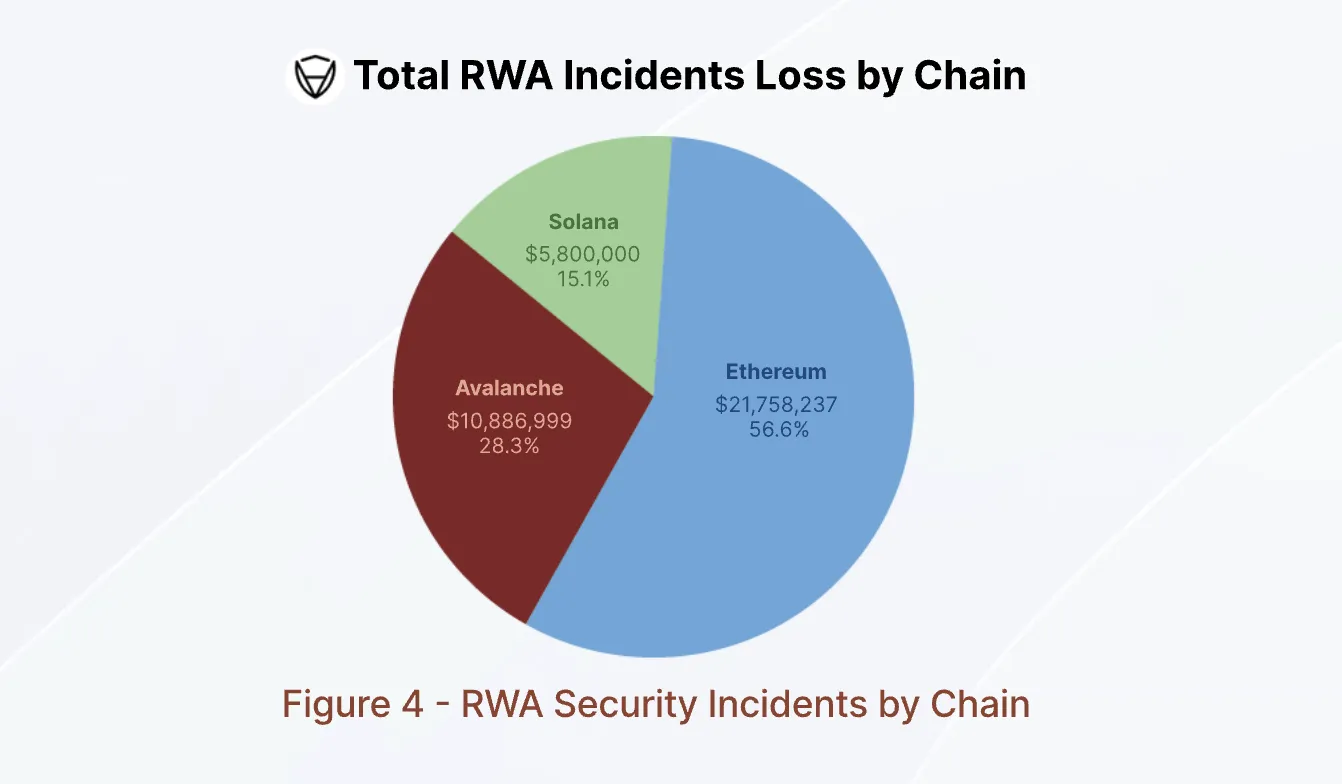

The majority of breaches (56.6%) occurred on Ethereum, amounting to $21.7 million. This is attributed to the market share held by the network of the second-largest cryptocurrency by capitalization.

The largest incident in the first half of the year involved the Zoth project, which in March lost $8.5 million. The perpetrator gained access to the private key of a service wallet managing the protocol’s smart contracts.

The second-largest breach was an attack on Loopscale, resulting in hackers stealing $5.8 million.

CertiK specialists noted that RWA protocols carry “hybrid” risks, as they combine blockchain technologies with traditional assets. Key threats include:

- oracle manipulation;

- fraudulent reserve confirmations;

- failure to fulfill legal obligations.

Sector Outlook

Despite the risks, the RWA market continues to grow. Experts say the sector has “become a key pillar of the crypto industry.” Its volume has increased from $5 billion in 2022 to over $26 billion by mid-2025.

“The primary driver of growth has been the tokenization of U.S. Treasury bonds—this solution perfectly met market demands and attracted billions of dollars in liquidity to the blockchain,” the report states.

Significant market share has been captured by BlackRock and Franklin Templeton, who have “set high standards for institutional products.” This is evidenced by the rapid growth of RWA-backed stablecoins, specialists emphasized. For instance, USDe from Ethena and RLUSD from Ripple, whose combined issuance has reached $1 billion.

Analysts also pointed to the market for tokenized private loans, which has become the largest category in the sector with a volume of about $14 billion.

“In an environment of high interest rates, demand for such high-yield instruments will grow. Platforms like Centrifuge and Maple Finance are successfully transforming real loans into DeFi assets,” they added.

The involvement of major financial institutions “has added trust to the industry, attracting capital, stimulating development, and innovation.”

CertiK expects this trend to continue. The segment’s growth will be supported by clear regulation and technological progress, experts concluded.

CoinGecko identified RWA as one of the most profitable narratives in 2024. With an average return of 820%, the segment was second only to AI and meme coins.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!