Santiment Identifies Strategy Stock Decline as a Hidden Bitcoin Bottom Signal

Santiment sees Strategy stock drop as a hidden bullish signal for Bitcoin.

Santiment analysts have warned of a record level of fear surrounding Strategy and its founder Michael Saylor. Amidst the stagnation of the leading cryptocurrency, discussions have intensified about the potential forced liquidation of the firm’s bitcoin assets.

😠 The crypto crowd has gradually turned on Microstrategy and Saylor more and more as 2025 has gotten toward its finish line. Our latest insight looks at how the pitchfork brigade may actually signal a soon price bounce. 👇https://t.co/GTDWG48dqE pic.twitter.com/EQnrMB9wbg

— Santiment (@santimentfeed) December 24, 2025

According to experts, MSTR shares have plummeted by 65% from a local high on July 16 — from ~$456 to ~$158. This correction was accompanied by a rise in negative mentions on social media.

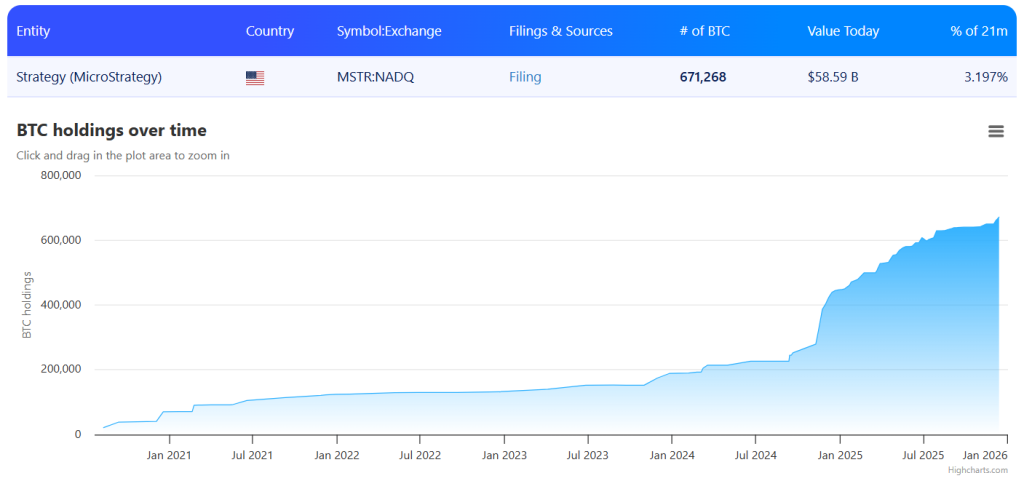

The main argument of critics is Strategy’s aggressive debt policy. The company has issued convertible bonds for years to purchase digital gold. The firm holds 671,268 BTC valued at approximately $58.6 billion.

Market participants fear that a sharp drop in the price of the leading cryptocurrency could prevent the company from servicing its debt. However, Santiment has called these comparisons inaccurate. Strategy’s debt structure differs from leveraged traders’ positions: the firm does not face margin call risks, and the debt maturities are spread over time.

Adding to the negativity are forecasts on the Polymarket platform. At the time of writing, traders estimate a 74% probability of Strategy being excluded from the MSCI index by March 31.

Santiment experts consider the current panic a “hidden bullish signal.” They note that historically, peak fear often coincides with market bottoms.

“When retail investors are widely discussing bankruptcy and asset sales, it means that ‘weak hands’ have already exited positions. There are almost no sellers left in the market,” the analysts noted.

Observations support the theory: during bitcoin’s free fall in early November, traders were extremely hostile towards Saylor. Stabilization of sentiment or a shift to neutral rhetoric often precedes a recovery in prices.

CryptoQuant data also points to market normalization.

Whale Capitulation on Pause.

Realized losses from new whales significantly impacted the price drop from $124K to $84K.

Since the recent low, these losses have declined and are now flat. pic.twitter.com/cCn5YsUxX8

— CryptoQuant.com (@cryptoquant_com) December 23, 2025

Experts have noted a pause in whale capitulation. Realized losses by new major players were the main driver of bitcoin’s price drop from $124,000 to $84,000. After reaching a local low, the volume of loss realization has decreased.

On December 15, Strategy acquired 10,624 BTC for $962.7 million. This occurred before the decline in digital gold prices.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!