SEC Fines TrustToken and TrueCoin Over TUSD Stablecoin Sales

TrueCoin and TrustToken have reached a settlement with the SEC over allegations of fraudulent and unregistered sales of investment contracts in the form of the TrueUSD (TUSD) stablecoin.

According to the lawsuit, TrueCoin acted as the coin’s issuer, while TrustToken operated the TrueFi lending protocol.

From November 2020 to April 2023, the companies offered investors the purchase of TUSD and the opportunity to earn profits through the asset on the lending platform. TrueCoin and TrustToken claimed the stablecoin was 100% backed by U.S. dollars and marketed the products as risk-free and reliable.

In reality, a significant portion of the stablecoin’s reserves was invested in a “speculative offshore fund.”

By autumn 2022, the accused parties became aware of the fund’s difficulties in meeting its obligations but continued to promote investments in TUSD as safe, according to the SEC. As of September 2024, the fund held 99% of the stablecoin’s backing.

“TrueCoin and TrustToken sought to profit by exposing investors to significant undisclosed risks through misrepresentations about the safety of investments. This case is a stark reminder of the importance of registration, as users of the products remain deprived of key information necessary to make fully informed decisions,” stated Jorge Tenreiro, Acting Chief of the SEC’s Crypto Assets and Cyber Unit.

Without admitting or denying the allegations, the companies agreed to a settlement with the entry of a final court judgment. The terms include:

- a prohibition on violating securities laws;

- each firm paying a civil penalty of $163,766;

- TrueCoin reimbursing $340,930 in ill-gotten gains and paying $31,538 for pre-judgment interest.

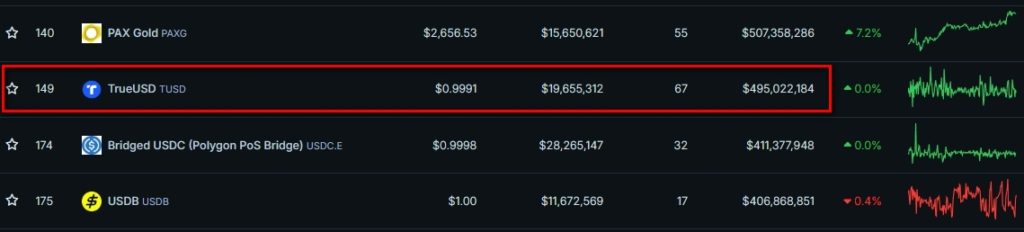

According to CoinGecko, TUSD’s market capitalization stands at $495 million, ranking 11th in the stablecoin segment, which has a total value exceeding $173.3 billion. The market is dominated by USDT from Tether and USDC from Circle, at $119.2 billion and $35.9 billion respectively.

In the 2024 fiscal year, the SEC collected a record $4.7 billion in penalties from crypto startups.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!