SEC Sues ConsenSys; Solana-ETF Applications Filed in the US

A court upheld most of the SEC’s allegations against Binance, the regulator filed claims against ConsenSys, the first applications for launching a Solana-ETF were submitted in the US, and other events of the past week.

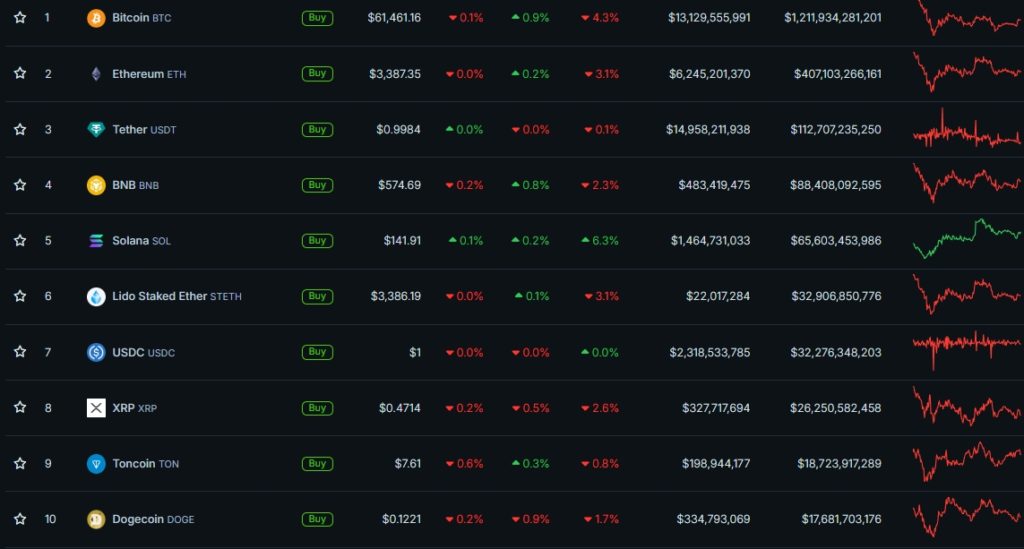

Bitcoin Price Holds Above $61,000

At the start of the week, the price of the leading cryptocurrency fell below $60,000. This market reaction followed the announcement by the Mt.Gox trustee about plans to begin compensation payments in cryptocurrencies and fiat at the beginning of July.

At the time of writing, the rate had recovered to around $61,600.

Almost all digital assets in the top 10 by market capitalization ended in the “red zone.” The exception was Solana (+6.3%).

The total cryptocurrency market capitalization is $2.39 trillion. Bitcoin’s dominance index is 50.8%.

Court Upholds Most SEC Allegations Against Binance; Regulator Sues ConsenSys

Binance’s lawyers managed to achieve a partial dismissal of the lawsuit in the ongoing proceedings with the SEC, but most allegations remain.

Judge Amy Berman Jackson of the District Court for the District of Columbia granted the motion to dismiss the Commission’s claims regarding secondary sales of the BNB token, the offering of the BUSD stablecoin, and the Simple Earn product.

The consideration of the SEC’s allegations regarding the ICO and subsequent sales of BNB by the platform, the BNB Vault program, failure to register, and non-compliance with anti-fraud rules will continue. The same applies to the staking service on Binance.US.

Allegations against former Binance head Changpeng Zhao, that he as a controlling person allowed violations of the Exchange Act, remain in the case.

The SEC has filed a lawsuit against MetaMask wallet developer ConsenSys.

The regulator claims that:

- since October 2020, ConsenSys has been “operating as an unregistered securities broker”;

- since January 2023, the company has been offering and selling unregistered securities through MetaMask Staking. Specifically mentioned are the liquid staking services Lido and Rocket Pool.

“As an unregistered broker, ConsenSys has collected over $250 million in fees,” the Commission stated.

Meanwhile, the largest American cryptocurrency exchange Coinbase has filed a lawsuit against the SEC and FDIC over attempts to cut off the digital asset industry from the banking sector.

The platform accused the regulators of non-compliance with the Freedom of Information Act (FOIA). These requests allow the public to demand documents from any federal agency.

Bybit Announces Thorough Checks of Russian Clients to Comply with Sanctions

Exchange Bybit thoroughly checks Russian clients and follows “very strict rules” for compliance with sanctions. CEO of the platform Ben Zhou told Bloomberg.

According to him, Russia and CIS countries account for about 20% of the exchange’s trading volumes.

Bybit is currently seeking a license to operate in Georgia after obtaining a similar permit in Kazakhstan in May 2023.

In March, the platform rose to second place in trading volume among cryptocurrency exchanges. From October to June, its share doubled from 8% to 16%. It is second only to Binance with a 54% share, noted Kaiko.

What to Discuss with Friends?

- Kazakhstan approved Toncoin for trading on licensed platforms.

- WikiLeaks founder Julian Assange was released in the courtroom.

- Market maker Gotbit admitted to dumping the WATER token by 70%.

- Robert Kiyosaki advised “most” to sell bitcoin.

VanEck and 21Shares File Applications for Solana-ETF Launch

On June 27, investment firm VanEck filed an S-1 form with the SEC to register an exchange-traded fund based on the Solana (SOL) cryptocurrency.

According to the description, the VanEck Solana Trust will track the dynamics of the network’s native token based on the Solana Benchmark Rate index from MarketVector Indexes. The benchmark represents aggregated data from five leading centralized trading platforms for SOL according to the CCData Centralized Exchange Benchmark review.

The product is expected to be listed on the Cboe BZX platform, with the firm yet to determine the ticker.

The following day, Swiss crypto fund manager 21Shares took a similar step.

The product is also expected to trade on Cboe BZX. Coinbase Custody Trust Company will act as the custodian for SOL.

According to Bloomberg exchange analyst Eric Balchunas, the chances of approving spot Solana-ETFs in the next 12 months are closely tied to the prospect of a change in the US presidency.

The expert noted that under the current SEC leadership, approval of the products should not be expected due to the absence of futures funds based on SOL. A new administration could change the situation, he added.

According to analysts at market maker GSR, if Solana-ETF is approved, the cryptocurrency could increase in value by 1.4–8.9 times. They also expressed hope for the return of Donald Trump to the presidency, who has recently expressed support for the industry.

L2 Project Blast Conducts Airdrop of Its Token

On June 26, the development team of the second-layer network Blast completed the first phase of the BLAST token airdrop. The start of the second season of distribution was announced.

As part of the campaign, a total of 17 billion tokens (17% of the total issuance) were distributed. Of this amount, 7 billion tokens were allocated to holders of Blast Points, earned for providing initial liquidity in the form of ETH or the stablecoin USDB.

Another 7 billion BLAST were distributed among users rewarded with Blast Gold for interacting with decentralized applications on the network.

3 billion coins are intended for the Blur Foundation for subsequent distributions among the Blur NFT marketplace community, including through airdrops.

Also on ForkLog:

- The EU banned transactions with crypto companies serving the Russian military-industrial complex.

- Vitalik Buterin called blockchain a protection against authoritarian regimes.

- Jess Powell donated $1 million in cryptocurrencies to Donald Trump.

- The reward for information on OneCoin founder increased to $5 million.

SEC Delays Approval of Spot ETH-ETFs

The US Securities and Exchange Commission returned S-2 forms to potential issuers of spot exchange-traded funds based on Ethereum for revisions.

A source from The Block reported that the regulator made “minor comments” and expects the revised applications to be returned by July 8.

However, this will not be the final submission. At least one more round of document exchange will be required, he added.

Eric Balchunas confirmed the information about minor changes. However, the analyst noted that the review is currently delayed by the holiday week (July 4 — Independence Day in the US), and then it will hit the vacation season.

Unfort think we gonna have to push back our over/under till after holiday. Sounds like SEC took extra time to get back to ppl this wk (altho again very light tweaks) and from what I hear next wk is dead bc holiday = July 8th the process resumes and soon after that they’ll launch… https://t.co/0ZQR7yiBLt

— Eric Balchunas (@EricBalchunas) June 28, 2024

Reuters, citing its own information, stated that the Commission’s approval of the products was expected on July 4.

Bernstein analysts warned that Ethereum-ETF will face less demand compared to similar bitcoin products. But the options market has bet on the cryptocurrency rising to $4,000 by September, likely in anticipation of the launch of spot exchange-traded funds.

Steno Research suggested that the net inflow into the products will amount to $15-20 billion within a year after trading begins, and the cryptocurrency’s quotes will reach $6,500.

What Else to Read?

This week ForkLog explored how bitcoin miners are changing the DeFi market, which projects in the emerging GameFi segment are worth watching, and delved into the phenomenon of the popular clicker Hamster Kombat.

The traditional digest compiled the main events of the week in the field of cybersecurity.

The most important venture deals in the industry were published in a separate review.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!