Several insurers invested in Grayscale Investments’ crypto products

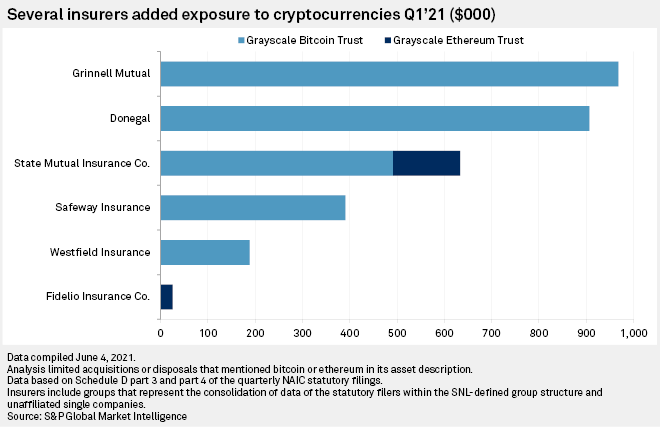

Six US insurers for the first time bought Grayscale Investments’ Bitcoin- and Ethereum-based trusts, according to the analytics firm S&P Global Market Intelligence.

The largest sum ($968,000) was allocated by Grinnell Mutual. The largest investments in the Ethereum-based product ($141,500) were made by State Mutual Insurance.

In December 2020, MassMutual, an insurer serving 5 million clients, executed the largest investments in the sector ($100 million). The partner was cryptocurrency funds manager New York Digital Investment Group (NYDIG). New York Life Insurance invested twice as much in NYDIG’s funds, according to S&P Global Market Intelligence.

In April, NYDIG acquired the commercial lender Arctos Capital. Through the deal, the manager aims to attract additional funds from banks and life-insurance companies into the developed products.

Also in April, NYDIG launched a Bitcoin-based solutions line for the global insurance industry.

In May, NYDIG entered into a partnership with fintech giant Fidelity National Information Services to develop a product that will give customers of hundreds of American banks access to Bitcoin.

Follow ForkLog news on Twitter!

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!