Shares of Bitcoin Firm Twenty One Capital Drop 20% on First Trading Day

Strive announced raising $500 million to purchase the leading cryptocurrency.

The shares of Twenty One Capital, a firm established by Cantor Fitzgerald, plummeted by approximately 20% following its debut session.

Trading of XXI shares commenced on the NYSE on December 9. The opening price was $10.74, below the closing level of the SPAC company Cantor Equity Partners ($14.27), with which Twenty One Capital merged to go public.

By the close of trading, the share price reached $11.42, marking a 19.9% decline from the previous session’s result.

The company’s market capitalization is estimated at $4 billion.

The launch of Twenty One Capital was announced in April. It is led by Jack Mallers, founder and CEO of Strike.

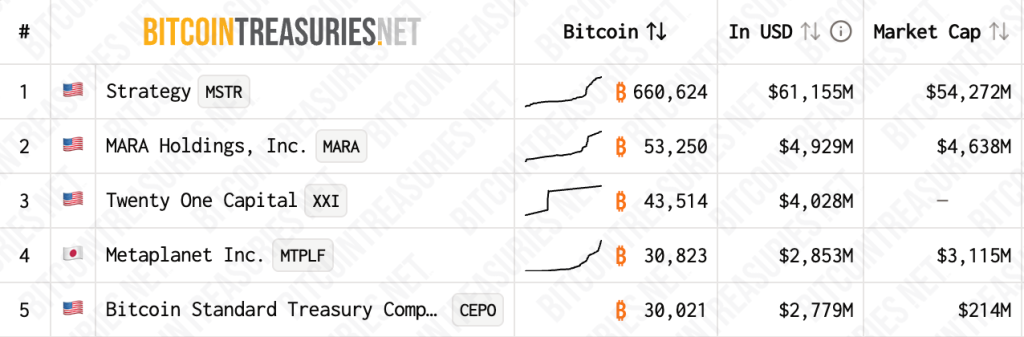

The organization’s capital amounts to 42,000 BTC (~$3.9 billion). The project is supported by Tether, Bitfinex, and Japan’s Softbank Group.

The firm ranks third among public holders of the leading cryptocurrency.

Not a Treasury

Twenty One Capital has not presented a detailed business plan despite going public. The documents lack a clear description of the operational model.

In an interview with CNBC, Mallers stated that the firm does not intend to become a crypto treasury, following the strategy of Michael Saylor’s Strategy.

“We don’t want the market to perceive and evaluate us merely as a company with bitcoin on the balance sheet. We indeed have significant cryptocurrency reserves, but our goal is to build a full-fledged business around it,” he said.

The head of Twenty One Capital added that the firm sees “many opportunities in brokerage services, exchange trading, lending, and borrowing.” He did not specify details about the launch of specific products, promising to reveal plans soon.

“We see bitcoin as the main opportunity that everyone overlooks. The mission of our shares is to focus exclusively on BTC and create value for shareholders primarily through its potential,” Mallers concluded.

Strive’s Plans

On December 9, Strive Asset Management, associated with Vivek Ramaswamy, announced a $500 million share placement. The goal is to raise capital for further bitcoin accumulation.

In addition to purchasing cryptocurrency, the funds will be used for general corporate purposes and investment in income-generating assets to develop the core business. The company did not disclose details of these investments.

Currently, Strive ranks 14th among corporate holders of digital gold, managing 7,525 BTC worth $699 million.

In December, analysts at Glassnode calculated that since 2023, public and private companies have increased their reserves in the leading cryptocurrency by 448%. The volume of coins on balances grew from 197,000 BTC to 1.08 million BTC.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!