Sharpe Ratio Signals Final Stage of Bear Market

Sharpe ratio for Bitcoin hits -10, indicating final bear market stage, says analyst.

The Sharpe ratio for the leading cryptocurrency has dropped to -10, the lowest since March 2023. CryptoQuant analyst known as Darkfost believes that the indicator’s move into negative territory historically signals the final stage of a bear market.

📊 The Sharpe ratio has just entered a particularly interesting zone, one that has historically aligned with the final phases of bear markets.

This is not a signal that the bear market is over, but rather that we are approaching a point where the risk to reward profile is… pic.twitter.com/w4EmsRZYlW

— Darkfost (@Darkfost_Coc) February 7, 2026

Similar values were recorded at the price bottoms of the cycles in late 2018 and 2022. In November 2025, the indicator fell to zero when Bitcoin found a local minimum at $82,000.

The Sharpe ratio helps assess investment efficiency adjusted for risk.

Although investment risks currently still outweigh potential profits, this trend usually precedes a trend reversal. Darkfost warned that this phase could last several months, and Bitcoin’s price may continue to correct before a full-fledged growth begins.

10x Research shares a similar view.

10x Weekly Crypto Kickoff – Is a Final Washout Still Ahead?

The report covers derivatives positioning, volatility trends, and funding dynamics across Bitcoin and Ethereum, along with sentiment, technical signals, ETF and stablecoin flows, option activity, expected trading ranges… pic.twitter.com/qv1ZbR1uQl

— 10x Research (@10x_Research) February 8, 2026

Analysts noted extreme sentiment indicator values while maintaining a broad downward trend. Without clear growth drivers, experts see no reason for urgent purchases.

Decline in Interest and ‘Extreme Fear’

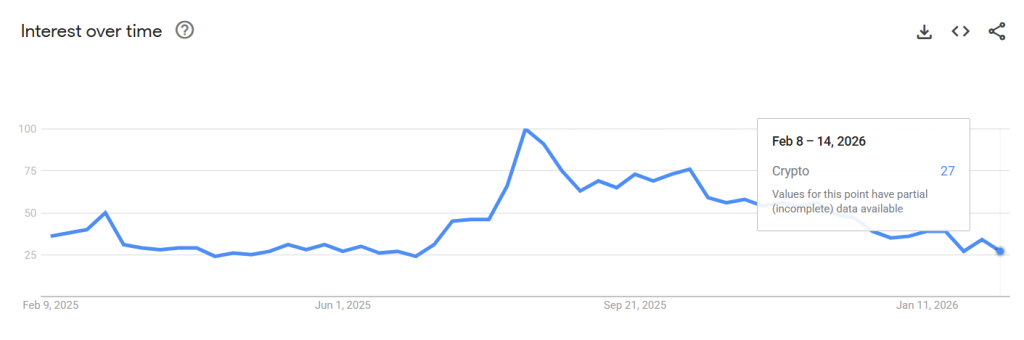

Global user interest in cryptocurrencies on Google has fallen to annual lows. The decline in search activity coincides with capital outflows from the digital asset market.

According to Google Trends, the search term “cryptocurrency” dropped to 27 out of 100. The peak activity was in August 2025, when the market capitalization reached a historic high of $4.2 trillion (currently about $2.4 trillion).

The Cryptocurrency Sentiment Index is in the “extreme fear” zone (14 points). On February 7, the indicator dropped to 6.

Santiment analysts described the crowd sentiment as “fiercely bearish.” The number of negative comments on social media reached a peak since December 1, indicating traders’ attempts to find bottom signals.

‘Whale’ Accumulation

Large players used the recent market correction for aggressive accumulation of the leading cryptocurrency. This was stated by on-chain analyst under the pseudonym CW8900.

Whales have been accumulating massive amounts of Bitcoin during the recent drop.

“On February 6th, 66.94k $BTC in-flowed to accumulator addresses. This was the largest inflow amount in this cycle.” – By @CW8900 pic.twitter.com/F4YkRjTNcp

— CryptoQuant.com (@cryptoquant_com) February 9, 2026

The price drop triggered large-scale purchases. Investors moved coins to special accumulation addresses.

According to the expert, on February 6, these wallets received 66,940 BTC. The analyst noted that this is the largest inflow for the current market cycle.

On February 6, the price of the leading cryptocurrency fell to $60,000, marking a new low since September 2024.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!