Solana inflation jumps by 30% after SIMD‑0096 rollout

Solana’s (SOL) annual inflation rate rose by 30.5% after the platform implemented a new fee-distribution model, according to Blockworks researcher Carlos Gonzalez Campo.

1/ What are the effects of SIMD 96 one week after going live?

— SOL inflation is up

— Token holder net income is down

— Median priority fees remain unchangedLet’s dive into the data ? pic.twitter.com/Lg5HEZWvq5

— Carlos (@0xcarlosg) February 19, 2025

On 12 February the network implemented SIMD-0096. Introduced in May 2024, the proposal directs 100% of priority fees to validators, up from 50% previously.

However, Gonzalez Campo noted that the amount of tokens burned daily fell from 17,700 SOL to 1,000 SOL. The rate at which coins are removed from circulation dropped below 1%.

Annual inflation rose from 3.6% to 4.7%.

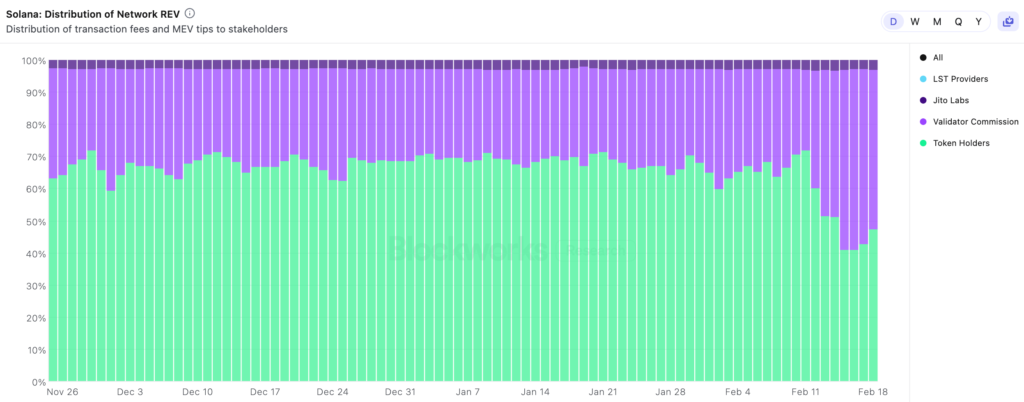

The rollout of SIMD-0096 also hurt the share of REV (fees and tips) distributed to token holders. The 30‑day average before the upgrade was 67%; after the change it dropped to 46%. For validators, the corresponding figure rose from 30% to 51%.

“Some people, myself included, argued that SIMD-0096 would lead to lower priority fees. That did not happen. Aside from the spikes caused by recent volatility events (TRUMP, LIBRA), the median SOL fee for expediting transactions has remained unchanged,” the researcher conceded.

He added that hopes in the Solana community now rest on SIMD-228. The proposal would reform the inflation mechanism by introducing a dynamic factor based on the amount of staked tokens.

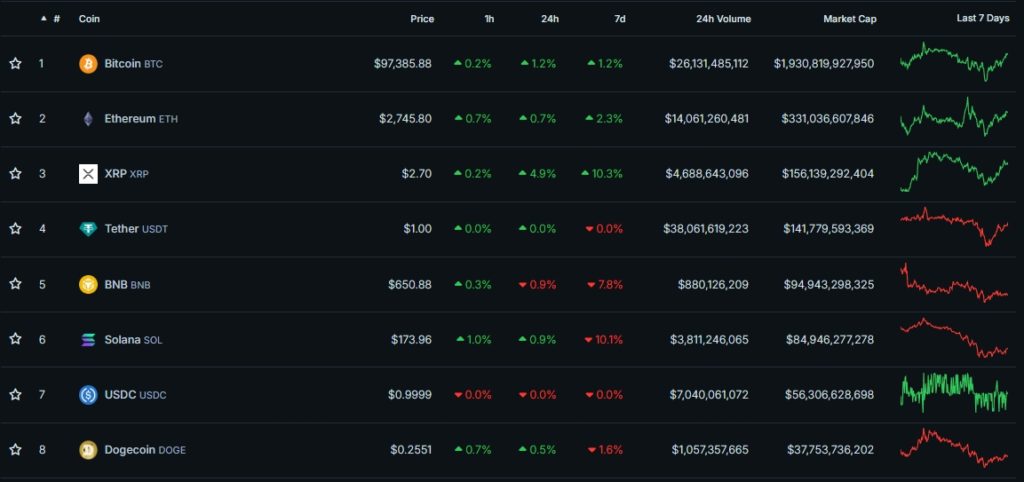

Solana has fallen more than 10% over the week and over 27% over the month. At the time of writing the asset trades around ~$174 (CoinGecko).

By comparison, bitcoin has gained 1.2% over the past seven days and Ethereum 2.3%.

Analysts strike an upbeat note

On 16 February, analyst Ali Martinez noted that Solana’s price had broken a key support level on the daily chart. He later spotted a positive signal: an inverse head-and-shoulders breakout on lower time frames. In his view, that sets up a move toward $180.

#Solana $SOL is breaking out of an inverse head-and-shoulders pattern on the lower time frames, setting up a potential 6% move toward $180! pic.twitter.com/9jHoNEu83U

— Ali (@ali_charts) February 19, 2025

An investor known as Lucky, who has 2.2m followers on X, also voiced confidence in an imminent breakout well above current levels.

$SOL at $170 won’t last long; it looks poised for a significant rise!

The @solana ecosystem is expanding rapidly, with massive trading volume and new, promising projects emerging daily.

Honestly, $SOL is incredibly undervalued; the upcoming wave will be bigger than ever! ?… pic.twitter.com/iCwca7evmT

— Lucky (@LLuciano_BTC) February 19, 2025

“The Solana ecosystem is expanding rapidly, trading volumes are massive, and new promising projects are emerging daily. Honestly, SOL is incredibly undervalued. The upcoming wave will be bigger than ever!” he said.

The trader known as OX believes the cryptocurrency will return to $190—or even $210—within “the next few weeks”.

Musician, producer and macro analyst MartyParty compiled a set of Solana price forecasts for 2025 from firms and influencers, ranging from $520 (VanEck) to $1,500 (Dami-DeFi).

$SOL price predictions for 2025 pic.twitter.com/Xo1sDlrCfz

— MartyParty (@martypartymusic) February 20, 2025

Following the hard fork Dencun, Ethereum has already seen inflation pick up. Traders nevertheless expect the SOL/ETH ratio to keep moving against Solana amid a string of scandals involving meme coins issued on the network.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!