S&P cuts Tether’s stability score to the lowest tier

S&P downgrades Tether’s stability score to its lowest tier.

Ratings agency S&P Global Ratings downgraded the stability assessment of Tether to level five — the lowest on its own scale.

Analysts attributed the move to a rising share of risky assets in the backing of the stablecoin USDT. In their view, the current capital buffer may be insufficient to absorb losses if bitcoin’s price falls.

Bitcoin currently accounts for about 5.6% of the stablecoin’s circulating supply. That exceeds the 3.9% buffer recorded in the attestation for the third quarter. A sharp drop in bitcoin, combined with losses on other high-risk positions, threatens the stablecoin with losing full backing.

The share of risky assets in Tether’s reserves rose to 24% as of 30 September, from 17% a year earlier. In this bucket S&P includes bitcoin, gold, secured loans, corporate bonds and investments with limited disclosure. The agency also noted insufficient transparency on the issuer’s custodians and partners.

A significant portion of USDT’s reserves remains in short-term US Treasury bills. However, the asset-storage structure does not protect investors to the standards of regulated markets.

Reserves are not segregated from the company’s own funds, and access to redemptions remains cumbersome. The score could improve if the share of risky instruments falls and if details on the creditworthiness of banking partners are disclosed.

Ardoino outraged

Tether CEO Paolo Ardoino rejected the agency’s conclusions. He said the company “wears your loathing with pride.”

to S&P regarding your Tether rating:

We wear your loathing with pride.

The classical rating models built for legacy financial institutions, historically led private and institutional investors to invest their wealth into companies that despite being attributed investment grade…

— Paolo Ardoino 🤖 (@paoloardoino) November 26, 2025

He called the assessment models outdated and ill-suited to the new financial system. He stressed that the issuer has excess capital and high profitability.

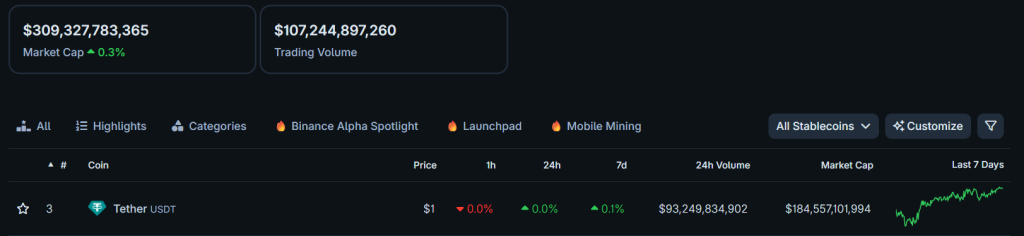

USDT remains the dominant stablecoin with a market capitalisation of $184.5bn.

Trouble in Uruguay

Tether will cease operating in Uruguay, writes El Observador, citing sources at the Ministry of Labour and Social Security. The decision will lead to the dismissal of 30 of the 38 employees at the local unit.

The main reasons for the exit are high electricity tariffs and the lack of flexible pricing for large investors.

Tether had planned to invest $500m in Uruguay’s economy. The project envisaged three data centres in the departments of Florida and Tacuarembó with 165 MW of consumption, along with a 300 MW in-house wind and solar plant.

Of the planned amount, the company invested more than $100m. A further $50m was earmarked for infrastructure intended for transfer to the state energy company UTE.

The business became unprofitable because of existing grid fees and the contractual model. Since November 2023 Tether had sought more competitive tariffs and proposed switching to a different connection scheme beneficial to both sides.

Talks with regulators failed, and the company deemed further investment uneconomic.

Transfers in the USDT0 stablecoin

Cumulative transaction volume in USDT0 from Everdawn Labs surpassed $50bn. One-fifth of that total came in November alone.

The network hit the mark within ten months of its January 2025 launch. Over that period the asset was used in more than 415,000 transactions across 15 blockchains. Supported networks include Ethereum, Arbitrum, Solana, HyperLiquid, as well as L2 solutions on Bitcoin — Corn and Rootstock.

USDT0 is an on-chain version of the original USDT. It lets users deploy the stablecoin on networks where it lacks native issuance. Tokens are minted via LayerZero’s Omnichain Fungible Token standard and are backed 1:1 with the original coins.

Tether CEO Paolo Ardoino called the technology “an evolution of the user experience” that turns “stablecoins” from an asset of a single blockchain into “a truly connective monetary infrastructure”.

Issuer Everdawn Labs also manages a cross-chain version of the gold token XAUT0. According to project co-founder Kevin M., the initiative began as “a startup within the Tether ecosystem”. The asset’s initial issuance took place on Kraken’s Ink L2 network.

As reported earlier, for the first nine months of 2025 Tether International’s net profit surpassed $10bn.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!