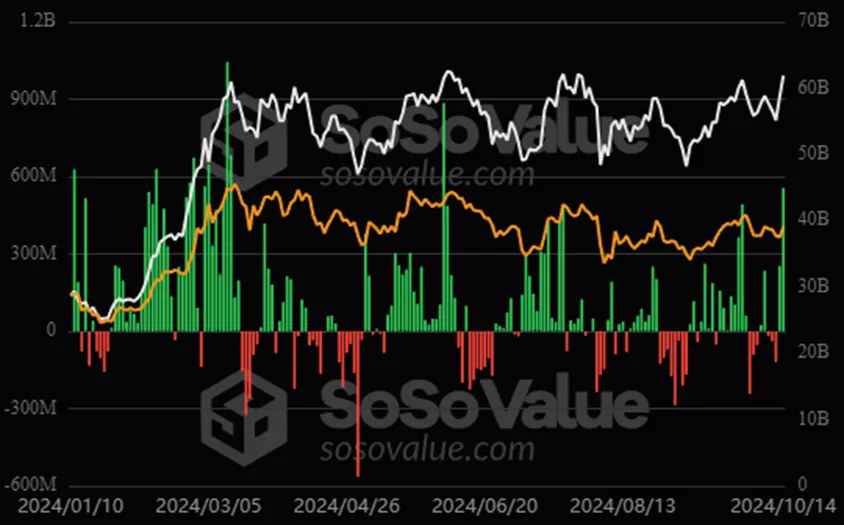

Spot Bitcoin ETFs Attract Highest Inflows Since June, Reaching $556 Million

On October 14, inflows into spot Bitcoin ETFs reached $555.9 million—the highest since June 4, according to SoSoValue.

Positive changes were recorded in 10 out of 12 products, with the remaining showing no change.

The leaders were FBTC from Fidelity ($239.3 million) and BITB from Bitwise ($100 million).

Inflows for other instruments were as follows:

- IBIT from BlackRock — $79.5 million;

- ARKB from Ark and 21Shares — $69.8 million;

- GBTC from Grayscale — $37.8 million;

- HODL from VanEck — $11.2 million;

- EZBC from Franklin Templeton — $5.7 million;

- BTCO from Invesco — $4.9 million;

- BRRR from Valkyrie — $2.8 million.

Cumulative inflows since the approval of BTC-ETFs in January have increased to $19.4 billion.

Earlier, inflows into cryptocurrency investment funds from October 6 to 12 amounted to $407 million. According to CoinShares, a key factor was the increased chances of Republican candidate Donald Trump in the presidential race.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!