Square’s $50m Bitcoin Purchase by Jack Dorsey, John McAfee Arrest and Other Events of the Week

Looking back on the past week, we note Square’s $50 million Bitcoin purchase, the arrest of John McAfee, leadership changes at BitMEX, and other key events.

Bitcoin back above $11,000

The price of the leading cryptocurrency breached the psychological level of $11,000 and held above it. At one point BTC quotes approached $11,500.

4-panel BTC/USD chart (Bitstamp). Source: TradingView.

Earlier, analysts noted the importance of the resistance level at $11,200. Since October 10, bitcoin has traded above it. At the time of writing, the price was around $11,370.

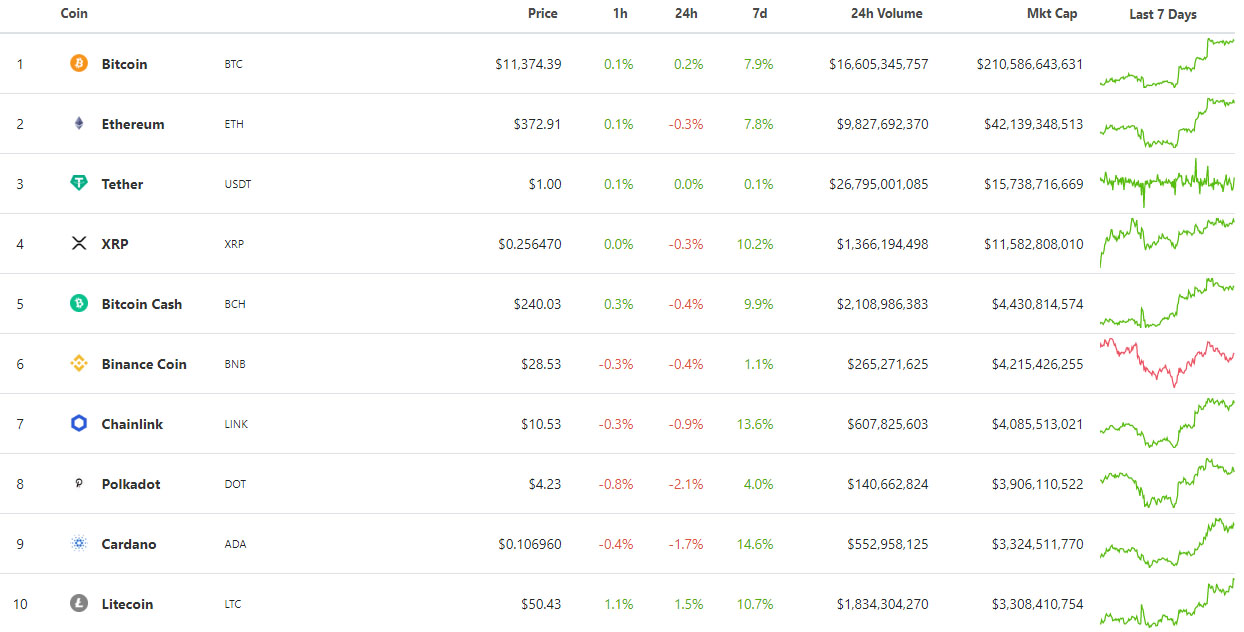

Source: CoinGecko.

Market capitalization surpassed $365 billion with Bitcoin’s dominance at 57.7%.

Price moves came amid the achievement of the Bitcoin network’s hashrate reaching an all-time high of 170 EH/s. A new peak in compute power was recorded in the Ethereum network — 250 TH/s.

One of the main drivers of Bitcoin’s price rally was Square’s $50 million purchase of BTC.

Square invested $50 million in Bitcoin

On October 8, the payments company Square led by Jack Dorsey announced the purchase of Bitcoin worth $50 million.

“Given the rapid evolution of cryptocurrency and unprecedented uncertainty from macroeconomic and currency regimes, we believe that now is the right time to expand our balance, largely denominated in USD, and make meaningful investments in Bitcoin,” noted at Square.

The company allocated about 1% of its total assets as of the end of Q2 2020 to BTC.

Square said it was important to discuss motives for the crypto purchase, the methods used, and the safeguards in place, because “other firms are also considering similar possibilities.”

To preserve privacy and lower the cost of the purchase, the company bought Bitcoin on the over-the-counter market. Square arranged with an OTC broker a spread over the public Bitcoin index. The parties used the volume-weighted average price over the agreed 24-hour period.

The company uses a self-developed cold storage solution SubZero with a hardware security module, introduced in 2018.

SEC files suit against John McAfee. He was arrested

The U.S. Securities and Exchange Commission (SEC) filed suit against entrepreneur John McAfee for promoting ICO projects on Twitter, while the U.S. Department of Justice charged him with tax evasion.

McAfee was arrested in Spain and faces possible extradition.

SEC alleges McAfee earned more than $23.1 million promoting at least seven token sales that sold “digital securities.” In the regulator’s view, McAfee’s statements misled investors.

The regulator seeks to recover ill-gotten gains, imposes penalties, and bans him from participating in the sale of digital securities. The case will be heard in the U.S. Southern District of New York court.

For each of the five counts of evasion listed in the DOJ indictment, he faces up to five years in prison.

For a portrait of one of the most colourful and controversial figures in the bitcoin industry, read ForkLog’s feature linked below.

Tax evasion, ICO advertising and Belize escape: the unusual life of John McAfee

Experts named the main reasons exchanges are reluctant to serve users in Ukraine

The Blockchain Association of Ukraine (BAU) shared with ForkLog the main reasons for restrictions on Ukrainians by crypto platforms.

Among the main reasons, BAU highlighted general features in the regulatory-financial landscape, “which are tied to the Soviet legacy and a long-standing reluctance to bring legislation into an international format for free movement of assets”.

Another reason cited by experts is concerns that exchanges would serve residents of unrecognised jurisdictions.

Also, platforms may fear that Ukraine will not fully comply with FATF requirements.

Unknown moved 1,000 bitcoins that had lain dormant for 10 years

Came into motion 1,000 BTC that had not moved for 10 years. The Telegram channel Goldfoundinshit drew attention to this.

The coins were moved to address 35DRQxCBMBe3Erbcue791t89JVB2VwsJi4, after which the amount was split into 10 BTC chunks.

Based on on-chain data, Goldfoundinshit concluded that the dormant BTC belonged to a single owner.

Later transactions continued, and some coins were transferred to an address belonging to the Free Software Foundation.

The organization was founded in 1985 by Richard M. Stallman—the author of the “copyleft” concept in opposition to copyright. Using copyleft licenses, authors and rights holders grant rights to distribute copies of the original work and its modified versions. Authors of derivative works are required to distribute them with the same rights preserved.

Stallman is also the founder of the free software movement, the GNU project, and the Free Software Foundation.

Goldfoundinshit reminded that on March 11 there was also a transaction of 1,000 BTC mined in 2010. In the senders’ behavior there is a similar pattern — first they gather coins on a P2SH address, then fragment into many bech32 addresses.

Arthur Hayes leaves BitMEX CEO post

One week after the filing by the US CFTC of a suit against BitMEX and its founders, the crypto-derivatives exchange 100x Group announced leadership changes.

Two defendants in the suit, Arthur Hayes and Samuel Reed, stepped down from the posts of CEO and CTO of the BitMEX operator, respectively.

According to the statement, Hayes, Reed, and another BitMEX co-founder Ben Delo will not hold any positions in the company.

The head of business development Greg Dwyer went on leave. He, like the three BitMEX co-founders, was charged by the U.S. DOJ with violations of the Bank Secrecy Act.

The arrested Samuel Reed on October 1 in the U.S. was released on a $5 million bail. Reed pledged to appear at proceedings and, if convicted, to serve his sentence. It is believed that he and his wife also had their passports seized.

After BitMEX’s regulatory troubles, Chainalysis classified the exchange as high-risk. Since October 1, Chainalysis KYT has started flagging all transfers related to the platform.

Amid regulatory concerns over the past week, BitMEX’s Bitcoin reserves fell 38.4% to 120,889 BTC. This dropped the platform from fourth to sixth place, according to CryptoQuant data.

Analyst Vetle Lunde of Arcane Research said this would only benefit the market by increasing competition.

Kuna refused to disclose BYSOL fund data to Belarus authorities

Ukrainian crypto exchange Kuna declined to disclose information about the non-profit “Belarusian Solidarity Fund” paying out in Bitcoin to Belarusian workers.

Authorities said they suspected the NGO of conducting suspicious financial operations under the guise of charitable aid. The agency requested data on BYSOL participants from Kuna.

Founder and head of Kuna, Mikhail Chobanyan, refused to cooperate with the agency and set up a fundraising page on Kuna.

“I openly declare my support for the brotherly people. I contacted the BYSOL organizers, and we created a crowdfunding page for them. Now it is easier to help Belarusians,” he added.

Apple urged Telegram to block channels with personal data of Belarusian security forces

Apple demanded Telegram block three channels that publish the personal data of Belarusian law enforcement officers.

Representatives from Apple argued that publishing the personal data of security personnel could incite violence.

Later, Apple said it had not demanded the deletion of Telegram channels publishing Belarusian law enforcement data. In their words, the Telegram team was handed user complaints about the disclosure of personal data without consent.

UK regulator banned sale of crypto derivatives to retail investors

The UK Financial Conduct Authority (FCA) banned the sale of crypto derivatives and exchange-traded notes (ETNs) based on cryptocurrencies to retail traders.

The FCA believes that these products are not suitable for retail investors for a number of reasons. Among them: investors’ limited understanding of crypto assets and the volatility of digital currencies. Consequently, retail traders cannot adequately assess the risks involved, the regulator argues.

According to the regulator, the ban will help reduce losses for retail investors by up to £101 million per year.

The ban will take effect on 6 January 2021.

The FCA had called for banning retail investors from selling crypto derivatives as far back as 2018.

Last year the regulator began consultations on the issue.

Dash says their cryptocurrency is a payment method, not anonymity

Dash should no longer be viewed as one of the privacy-focused cryptocurrencies. Its best definition is a payment instrument, said Fernando Gutierrez, marketing director of Dash Core Group.

“Dash is a cryptocurrency for payments. Its strengths lie in speed, cost, ease of use, and user protection with added privacy,” he emphasized.

Gutierrez noted that Dash users can send cryptocurrency anonymously using the PrivateSend option. It is based on the CoinJoin protocol, a Bitcoin transaction anonymity technique, explained the Dash representative.

- Tesla investor predicted growth in Bitcoin’s market capitalization to $5 trillion.

- Europol identified Wasabi and Samourai Bitcoin wallets as key threats on the darknet.

- In 2020, 75 cryptocurrency exchanges shut down.

- Bittrex attempted to lure users away from Binance amid recent issues with Roskomnadzor.

- Ripple threatened to leave the United States over excessive cryptocurrency regulation.

What else to read and watch?

The Cambridge Centre for Alternative Finance presented its annual—third—study of the global crypto market. ForkLog has distilled the highlights in a piece.

Over the past years, a string of darknet markets have closed. The closures were driven not only by law-enforcement action, but also by exit scams. ForkLog invites readers to recall the most significant of these events.

On ForkLog Max Bit, Stepan Gershuni, CEO of Credentia, discussed how the lifecycle of blockchain companies begins and why some are doomed to fail despite multi-million-dollar funding.

Subscribe to ForkLog News on Telegram: ForkLog Feed — the full news stream, ForkLog — the most important news and polls.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!