Strategy amasses 717,131 BTC after $168m bitcoin purchase

Strategy bought 2,486 BTC for $168.4m last week at an average price of $67,710.

Over the past week Strategy purchased 2,486 BTC for $168.4m at an average price of $67,710.

Strategy has acquired 2,486 BTC for ~$168.4 million at ~$67,710 per bitcoin. As of 2/16/2026, we hodl 717,131 $BTC acquired for ~$54.52 billion at ~$76,027 per bitcoin. $MSTR $STRC https://t.co/wvxRYZlQ3Y

— Michael Saylor (@saylor) February 17, 2026

The corporation began its bitcoin accumulation strategy in August 2020. Following the latest buys, Strategy’s reserve reached 717,131 BTC acquired for about $54.5bn—roughly $76,027 per coin.

At the time of writing, digital gold was trading around ~$67,000.

Since the start of the year the asset has lost nearly 23%. February could be the fifth straight month the cryptocurrency closes lower (CoinGlass).

According to Strategy, the latest purchases were financed by selling $95.5m of MSTR common stock and $78.4m of STRC preferred shares.

MSTR fell 3.5% after Tuesday’s open. Over the past 12 months Strategy’s share price has dropped by more than 60%.

The firm’s market capitalisation is about $42.88bn; the value of its bitcoin fund is roughly $48.05bn. A key metric for assessing crypto-treasury companies, mNAV, has slipped below 1 at Strategy.

In February founder and chairman Michael Saylor said the corporation would remain financially resilient even if the price of bitcoin fell to $8,000. Trader Vladimir Cohen called the claim “typical marketing”. The key risks for Strategy, he noted, are not the depth of any decline, but the duration of the downtrend and potential investor disappointment.

“Asia’s Strategy” reports a $619m annual loss

Japan’s Metaplanet reported a net loss of ~$619m for 2025, versus net profit of ~$28.9m in the previous period.

The negative result stemmed from a revaluation of the firm’s bitcoin reserve, which came to a negative $664.8m.

Metaplanet has amassed 35,102 BTC compared with 1,762 BTC as of December 31, 2024. The bitcoin reserve is worth about $3.5bn.

The firm described its balance sheet as resilient:

- debt of ~$304m;

- revenue for the year of ~$58m;

- operating profit of roughly $6.9m.

Financial operations in bitcoin (mostly options) generated ~$55.2m of income for the year.

With a market capitalisation of $2.58bn, the Japanese company maintains mNAV above 1.3.

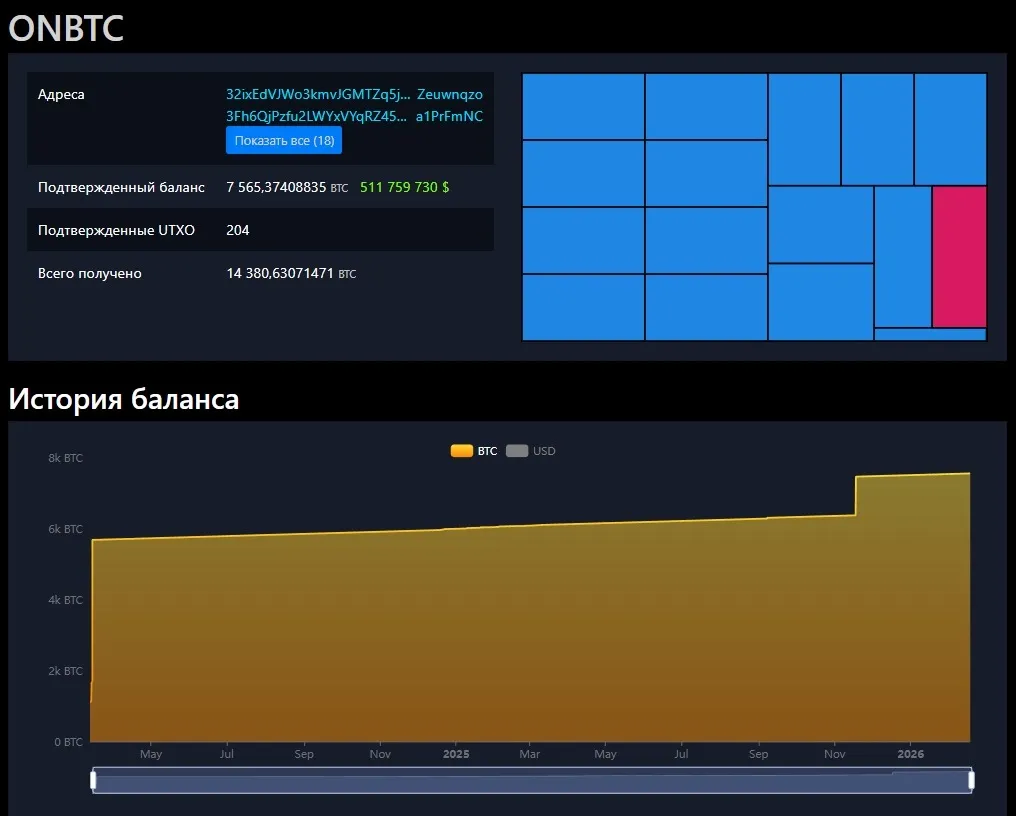

El Salvador’s bitcoin reserve reaches 7,564 BTC

The government of El Salvador has continued its strategy of buying one bitcoin per day. As of February 16, the national reserve held ~7,564.4 BTC worth roughly $512m.

It remains unclear how the authorities are topping up the crypto fund. Under a December 2024 loan agreement with the IMF, the country pledged to halt purchases of digital gold. However, the head of El Salvador’s National Bitcoin Office, Stacy Herbert, announced an acceleration of buying.

In August 2025 specialists from the international organisation confirmed El Salvador’s compliance with the agreement. Changes in the bitcoin balance were explained as wallet rebalancing.

Since 2021 El Salvador has mined bitcoin at a state geothermal power plant. The initiative was launched in test mode roughly a month after the law recognising bitcoin as legal tender took effect.

In June 2023 the authorities announced the Volcano Energy project with 241 MW of capacity, intended to use renewable energy for mining digital gold. One of the investors was Tether, the company behind the stablecoin USDT.

According to Hashrate Index, in the fourth quarter of 2025 El Salvador generated bitcoin hashrate of 1.1 EH/s. At the current network difficulty these resources yield 3–4 BTC per day.

Traditionally the national reserve is topped up by one bitcoin a day, but on November 18, 2025 it received 1,090 BTC at once.

BitMine stakes 3m ETH

BitMine Immersion Technologies bought 45,759 ETH last week, taking the company’s Ethereum treasury to 4,371,497 ETH.

🧵

1/

BitMine provided its latest holdings update for February 17th, 2026:$10.7 billion in total crypto + “moonshots”:

— 4,371,497 ETH at $1,998 (@coinbase)

— 193 Bitcoin (BTC)

— $200 million stake in Beast Industries @MrBeast

— $17 million stake in Eightco Holdings… pic.twitter.com/bgpQqyjytq— Bitmine (NYSE-BMNR) $ETH (@BitMNR) February 17, 2026

The firm also holds 193 BTC, stakes in Eightco Holdings ($17m) and Beast Industries ($200m). Free cash totals $670m, and the value of all assets is $10.7bn.

BitMine has locked staking of 3,040,483 ETH. On current prices and a composite yield of 2.84%, that implies potential annual passive income of $176m.

In early February analysts noted that the unrealised loss from the company’s crypto strategy had approached $7bn. Over the past 14 days Ethereum has fallen about 6%, and more than 40% over the month (CoinGecko).

Earlier, BitMine chairman Tom Lee predicted an imminent V-shaped reversal in the price of the second-largest cryptocurrency.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!