Study finds 43% of corporate blockchains in the financial sector

81% of launched corporate blockchains exhibit a low degree of decentralisation and only 19% are governed by direct competitors. Almost half are built on Hyperledger Fabric and 43% are deployed in the financial sector. These figures appear in Cambridge University’s second Global Enterprise Blockchain Report.

2019 10 Ccaf Second Global Enterprise Blockchain Report by ForkLog on Scribd

Its basis lay in survey data from 227 companies, startups, central banks and other state-sector institutions across 59 countries, collected between July 2018 and June 2019.

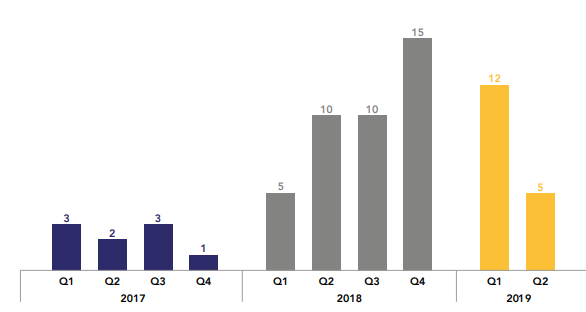

Deployment dynamics of corporate blockchains. Source: University of Cambridge.

As with the first study, which covered July–November 2018, the majority of launched corporate networks still fall under financial services. Of the 67 networks examined, 43 use cases involve supply-chain tracking, trading infrastructure, and document certification.

Use cases for corporate blockchains. Source: University of Cambridge.

Most projects require lengthy implementation times. On average, from proof of concept to deployment, about 25 months pass. For some large projects, full launch took more than 4.5 years.

Timelines for implementing corporate blockchains. Source: University of Cambridge.

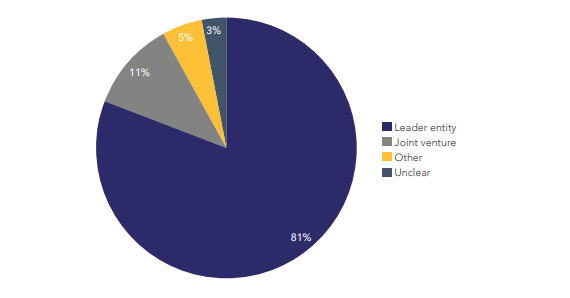

Most launched projects feature a high degree of centralisation. In 54 of the 67 networks there is a single main validator that dominates governance (centralised social consensus). The rest largely rely on external service providers to host and manage nodes on behalf of network participants (centralised network consensus).

Degree of centralisation of corporate blockchains. Source: University of Cambridge.

Managed blockchains offer greater control and higher levels of confidentiality. This matters in sectors where data constitute commercially sensitive information. The downside is concerns that excessive centralisation could give leading organisations an unfair advantage and potentially block other participants from accessing aggregated results.

Cambridge researchers found that four of five projects used only one service to deploy blockchain nodes and mining. 48% of the blockchains studied are based on IBM’s Hyperledger Fabric, and 15% on Corda from R3.

Frameworks supported by corporate blockchains. Source: University of Cambridge.

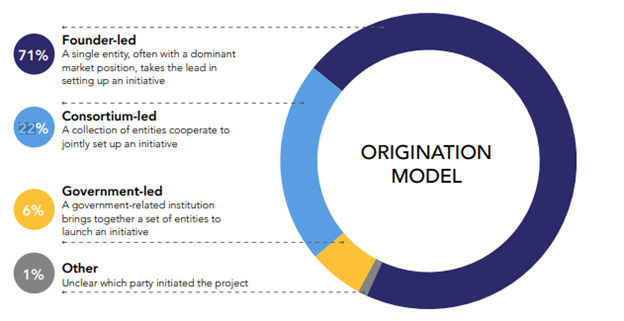

Widely deployed are corporate blockchain models that centre on a single major participant, counting on other firms in the sector to join the initiative (71%). Industry consortia deployed 22% of corporate blockchains. Working under leaders’ aegis allows some networks to grow faster, but they may struggle to attract rivals to their platform.

Models of corporate blockchains by type of creation. Source: University of Cambridge.

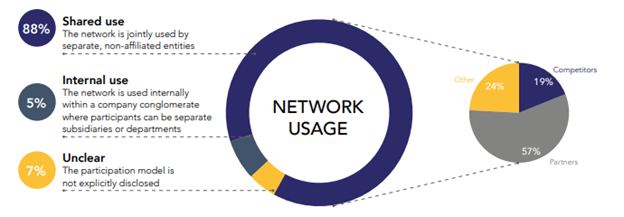

According to the researchers’ calculations, only one in five corporate networks deployed for shared use is operated by direct competitors.

Corporate blockchain models by purpose type. Source: University of Cambridge.

Australia will allocate nearly 800 million Australian dollars (about $575 million) to support technological initiatives.

Earlier, the University of Cambridge issued another study that examined trends in cryptocurrency adoption.

Follow ForkLog’s news on VK!

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!