Survey Reveals Shift from DeFi to Core Blockchain Infrastructure by Venture Capitalists

Investors shift focus from DeFi to blockchain infrastructure, citing liquidity issues.

Major investors are opting to channel funds into core blockchain infrastructure rather than DeFi applications. This shift is attributed to issues with liquidity and the reliability of the system itself, according to a survey by CfC St. Moritz.

The survey included 242 participants, comprising institutional players, founders and top executives of leading crypto projects, regulators, and family office managers.

A significant 85% of respondents identified infrastructure development as their top investment priority, surpassing not only DeFi but also crucial areas like compliance, cybersecurity, and user experience enhancement.

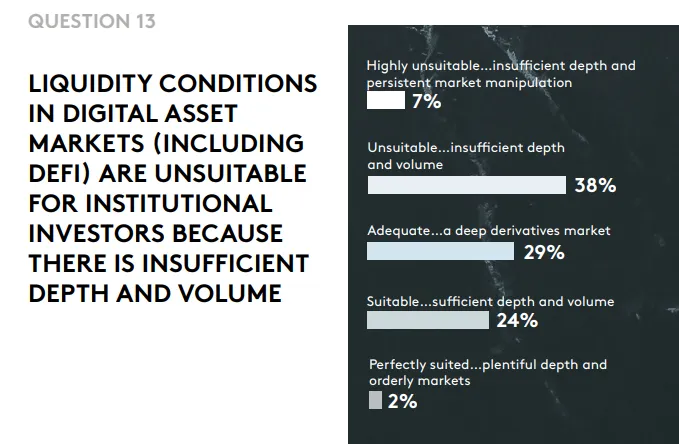

Despite a general optimism about revenue growth and innovation, respondents view liquidity shortages as the most pressing risk for the entire sector.

Liquidity

Amid concerns over liquidity, survey participants highlighted two main barriers to institutional capital:

- Insufficient market depth.

- Limited throughput of settlement systems.

These “bottlenecks,” they believe, are hindering the influx of major players.

Approximately 84% of participants assessed macroeconomic conditions as favorable for the growth of the crypto industry. However, they emphasized that the current market infrastructure is not yet ready to scale for truly large volumes of capital.

Sentiments

The survey also recorded a shift in sentiment. While most expect technological progress to accelerate by 2026, significantly fewer respondents predicted explosive growth compared to last year.

CfC St. Moritz believes this indicates the maturation of the industry: the focus is shifting from speculative expectations to the phased and pragmatic implementation of existing technologies.

This trend aligns with observed changes in the industry. Instead of chasing consumer applications, investments and developments are concentrating on foundational layers: creating reliable custodial solutions, efficient clearing systems, resilient infrastructure for stablecoins, and legal frameworks for mass asset tokenization.

Regulation

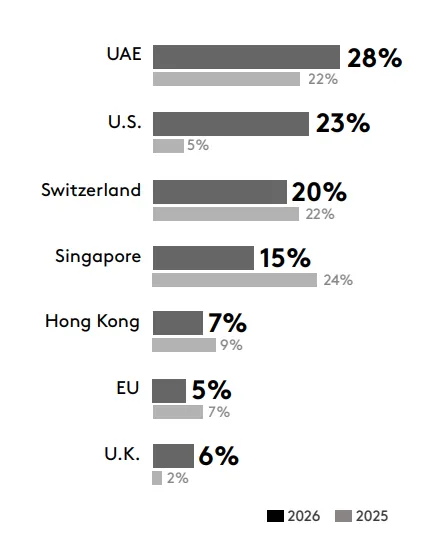

The survey also revealed an improvement in the perception of the US regulatory landscape. The country ranked second among the most favorable jurisdictions for digital assets, trailing only the UAE.

Experts attribute this progress to the adoption of the stablecoin law (Genius Act) and the development of clearer rules for banks and regulated financial institutions dealing with digital assets (Clarity Act).

Concurrently, optimism regarding the IPO of crypto companies has noticeably declined. Last year was marked by a series of public listings—Circle, BitGo, Bullish, and Gemini went public.

While most participants still anticipate new listings, far fewer express confidence in the continuation of the boom. They cite a global reassessment of asset valuations and persistent structural liquidity constraints in the market as reasons for their caution.

As reported in a JPMorgan report, the world’s largest family offices have bet on artificial intelligence, leaving cryptocurrencies overlooked.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!