How Is the Turtle Trading Strategy Used on the Cryptocurrency Market?

Why Richard Dennis’s method remains relevant 40 years on.

How Is the Turtle Trading Strategy Used on the Cryptocurrency Market?

Why Richard Dennis’s method remains relevant 40 years on.

Why the crypto market is not immune to survivorship bias

What links American bombers of the second world war and failed investments.

What is an automated market maker?

What is an automated market maker (AMM) and how does it work? How are liquidity pools related? What are the drawbacks of AMMs? We explain in a new set of cards.

Shorts and longs in crypto: what they are and how to use them

What are shorts and longs in trading? What do “bulls” and “bears” have to do with it? When is it better to short, and when to go long? We answer in cards.

Risk–reward in crypto trading: why it matters

How do you calculate the risk–reward ratio in crypto trading? Why does it matter? What does 1:3 mean? Answers in brief.

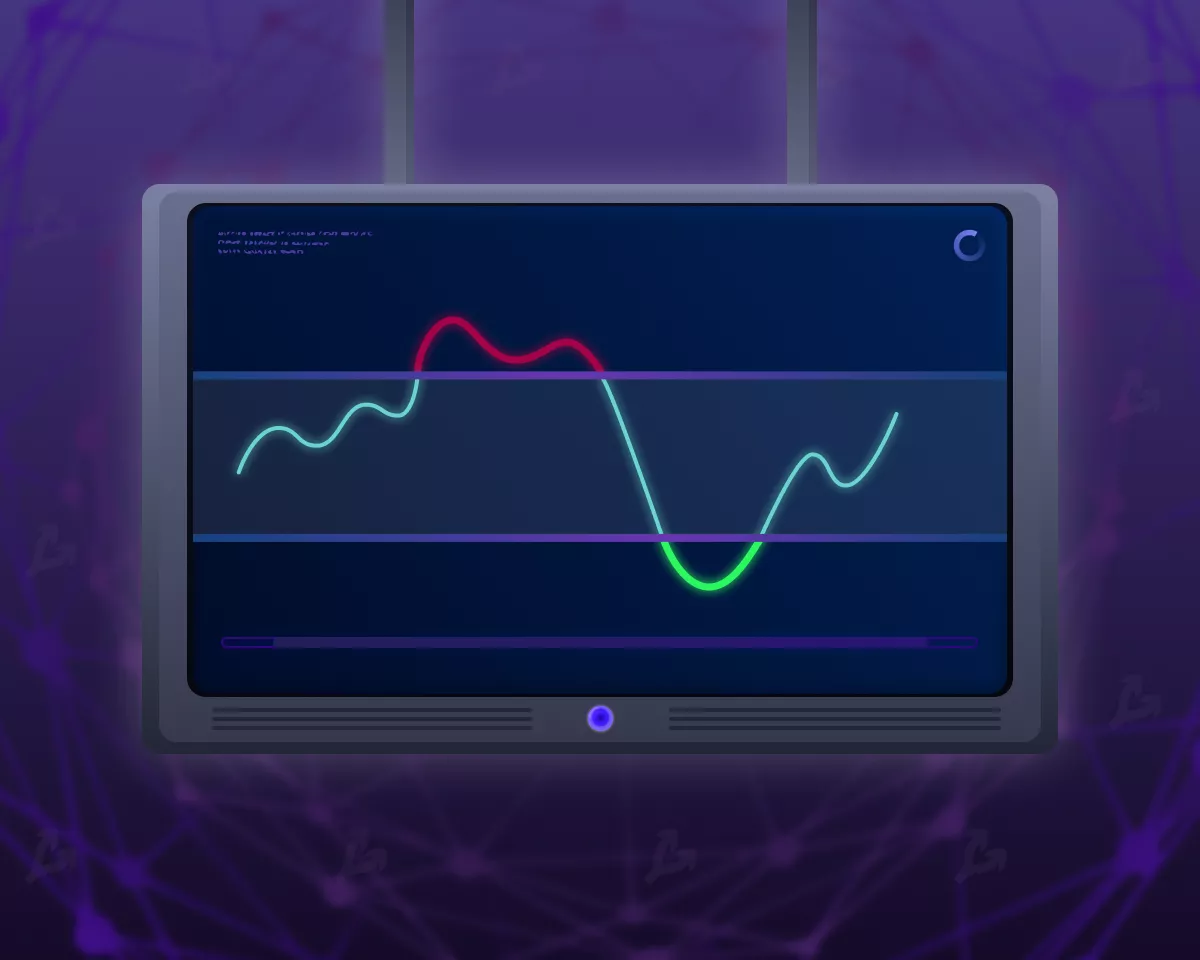

Bollinger Bands: using the indicator in crypto trading

What are Bollinger Bands for? How do you set them up correctly? What are the risks of using this indicator? We answer in cards.

Mt. Gox: the biggest hack in cryptocurrency history

Why did Mt. Gox’s administrators fail to spot a years-long breach? How many bitcoins did hackers steal from users? Have the masterminds and perpetrators been found? We retrace Mt. Gox’s rise and collapse in this “Cryptorium” overview.

SOPR: finding bitcoin’s highs and lows

How SOPR helps map bitcoin’s cycles, what variants exist, and the risks of relying on the metric—explained.

What the RSI is for—and whether it suits cryptocurrencies

What is the RSI? What is it used for in crypto technical analysis? What are its pros and cons? Explained in cards.We use cookies to improve the quality of our service.

By using this website, you agree to the Privacy policy.