What is a cryptocurrency airdrop?

An explainer on the marketing tactic of giving away tokens to draw attention to a project.

What is a cryptocurrency airdrop?

An explainer on the marketing tactic of giving away tokens to draw attention to a project.

What is coin burning and how does it affect prices?

We explain why many projects periodically burn their native tokens.

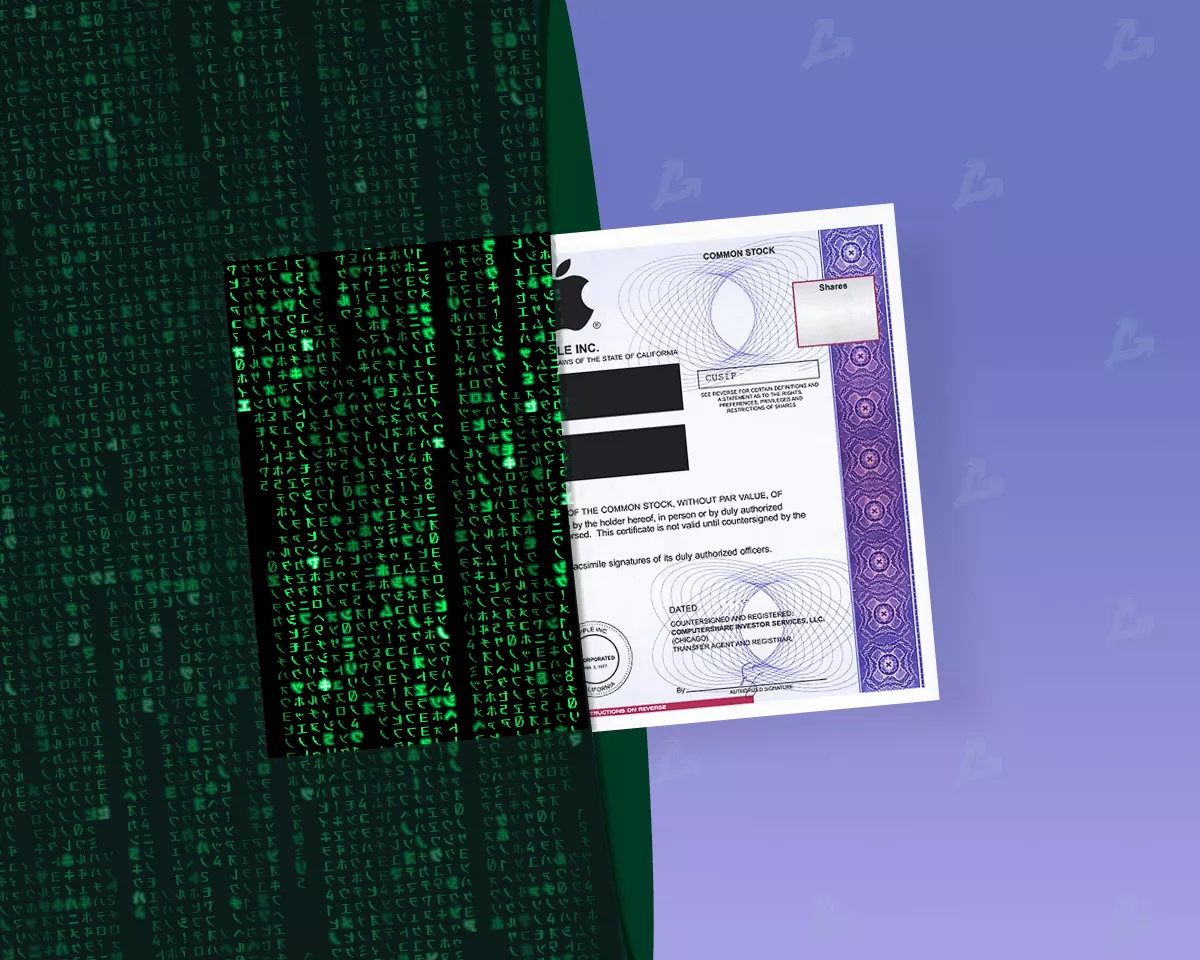

What are tokenised stocks and how do you trade them?

Tokenised stocks are tokens whose price is pegged to equities. They resemble stablecoins: a custodian buys the underlying shares and issues tokens against them.

What is impermanent loss (IL)?

Impermanent loss (IL) is the temporary, notional loss that arises when providing liquidity to an AMM-based decentralised exchange, measured against simply holding the same assets in a wallet.

What is PancakeSwap? A Uniswap-style DEX on Binance Smart Chain

A non-custodial platform on Binance Smart Chain for swaps and yield farming with BEP-20 tokens.

What are flash loans?

Flash loans—also called instant loans—are a feature of several popular DeFi protocols that allow users to borrow cryptoassets without collateral, provided the debt is repaid within the same transaction block.

MOVE contracts on FTX: what they are and how to profit

MOVE are futures contracts on the FTX exchange. A MOVE’s price reflects the absolute change in the underlying asset’s price from the start of the contract.

What is ZKSwap and how does it use ZK-Rollup technology?

ZKSwap is a protocol and decentralised exchange built on ZK-Rollup technology.

What is yield farming?

What is yield farming? Attention! The article is outdated and awaiting an update. Yield farming is the practice of earning additional returns—typically governance tokens—by users of DeFi protocols for lending, borrowing and providing liquidity to decentralised exchanges (DEXs). The first success is widely attributed to Synthetix, but the boom began after Compound launched its governance token (COMP), which drew liquidity providers and pushed the token price higher. Other projects quickly followed.

What are bracket orders?

What is a bracket order? An order is a trader’s instruction to buy or sell an asset under specified conditions. When placing an order, a user sets quantity and price; if a matching order exists, it is executed. Crypto exchanges offer market, limit and pending orders, including take-profit and stop-loss.

What are leveraged tokens and how can you profit from them?

Leveraged tokens are instruments with fixed leverage, automatic reinvestment and a low risk of liquidation. In trending markets they can outperform futures, though choppy conditions favour neither. Exchanges rebalance daily, charge 0.1% for issuance and 0.03% per day for rebalancing, and offer various types such as BULL, BEAR, HEDGE and HALF. Examples show higher returns than comparable 3x futures in steady trends and lower liquidation risk due to rebalancing.We use cookies to improve the quality of our service.

By using this website, you agree to the Privacy policy.