Crypto venture-capital funding exceeds $3 billion

In 2020, total venture funding in the crypto industry was valued at $3.1 billion across 774 deals. The largest acquisitions were CoinMarketCap, Blockfolio and Tagomi.Business activities involving the consolidation of companies or assets.

Crypto venture-capital funding exceeds $3 billion

In 2020, total venture funding in the crypto industry was valued at $3.1 billion across 774 deals. The largest acquisitions were CoinMarketCap, Blockfolio and Tagomi.

Despite the pandemic and crisis, how the Bitcoin industry attracted investment in 2020

The cryptocurrency industry continues to grow and develop, despite the COVID-19 pandemic and the slowdown in activity in traditional sectors of the economy. This is evident, among other things, in venture-capital activity. ForkLog examined who funded whom in 2020, and, most importantly, for what purpose.

yEarn.Finance to absorb its perennial rival SushiSwap, a fork of Uniswap

yEarn.Finance announced the acquisition of SushiSwap, a fork of Uniswap.

yEarn.Finance to absorb Cream Finance after Pickle Finance merger

Founder of the DeFi project yEarn.Finance, Andre Cronje, presented details of the integration with the lending protocol Cream, which operates on the model of the Compound and Aave projects. He said this two days after the merger of yEarn.Finance with Pickle Finance.

ConsenSys acquires Ethereum startup Truffle Suite

ConsenSys, an Ethereum-focused company, has acquired the Truffle Suite startup. Financial terms of the deal were not disclosed.

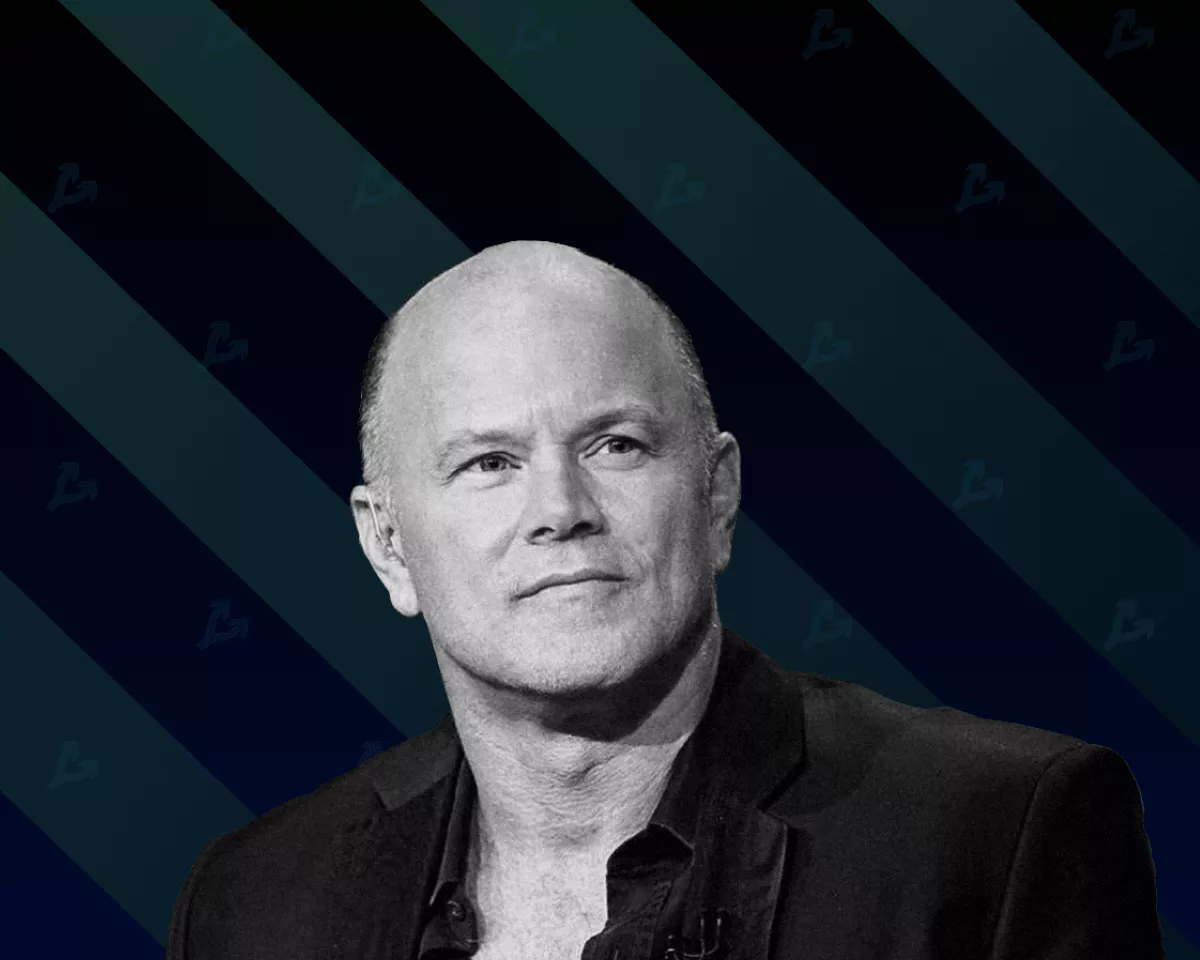

Galaxy Digital acquires DrawBridge Lending and Blue Fire Capital

Galaxy Digital, led by Mike Novogratz, acquired DrawBridge Lending and Blue Fire Capital. The acquisition will allow the crypto bank to expand its trading solutions and strengthen its expertise in lending and derivatives, according to the press release.We use cookies to improve the quality of our service.

By using this website, you agree to the Privacy policy.