Tether Confirms 7.7 Tonnes of Gold Backing for XAUT

- The issuer conducted the first official attestation of the “gold” stablecoin XAUT.

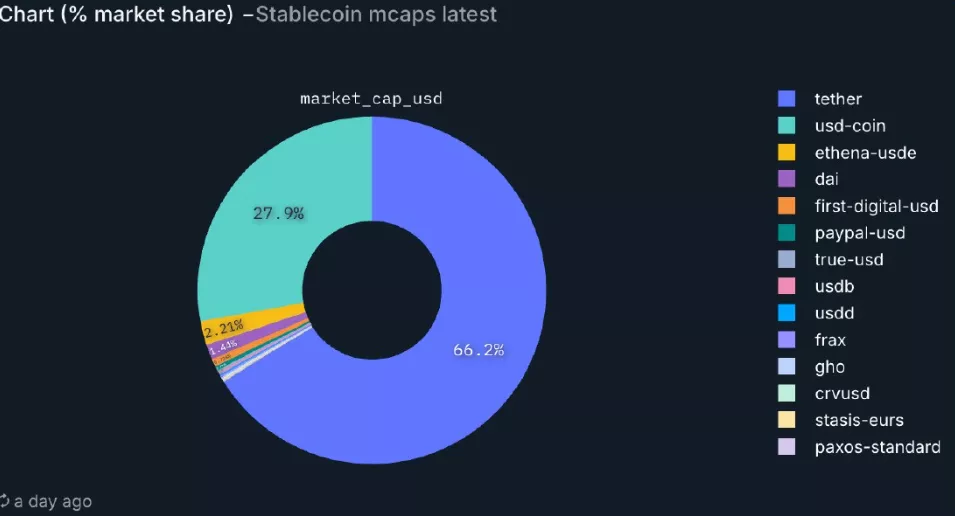

- USDT continues to lead the stablecoin market with a share exceeding 66%.

- Participation of institutional investors and political elites reflects a global trend towards legitimising digital assets.

Tether reported that the gold backing for the stablecoin XAUT amounted to 7.7 tonnes at the end of the first quarter. This marks the first official attestation of the stablecoin, launched in 2020.

“Tether Gold maintains its position as the most capitalised, secure, and compliant tokenised gold product on the market,” the issuer stated.

XAUT is not as popular as the company’s stablecoin USDT. However, its value is rising alongside the increasing price of the precious metal.

Over the past month, gold has appreciated by approximately 8%, while Bitcoin has risen by 14%. According to Tether, XAUT reached an all-time high of $3423 last week.

At the end of the first quarter, the market capitalisation of the gold-backed asset was $770 million, company representatives noted.

“Each XAUT is backed by one troy ounce of physical gold stored in a secure vault in Switzerland,” Tether reported.

Leader Among Stablecoins

As of April 25, USDT’s share of the stablecoin market exceeded 66%, while Circle’s USDC held around 28%, writes Cointelegraph citing a Nansen report.

The Ethena USDe stablecoin ranks third with a share slightly above 2%.

Analysts noted Tether’s consistent leadership despite competitors’ improved positions due to new regulatory rules in the US and the emergence of institutional players.

Since November, USDC’s circulation has been growing faster than USDT’s, experts highlighted. However, according to Nansen, Tether significantly outpaces its rivals in terms of users and transactions.

Analysts believe the market will maintain a “majority with the leader” model. Clients prefer the most liquid and stable assets, even if it means sacrificing potential returns.

Is Competition Growing?

Reeve Collins, a co-founder and former director of Tether, told Cointelegraph that competition in the stablecoin segment is intensifying, and the dollar is losing its monopoly.

He noted that while USD-pegged stablecoins remain dominant, other currencies and asset types are increasingly used for backing.

According to Collins, issuing stablecoins backed not only by currency but also by commodities or gold expands opportunities for users and creates additional demand.

The expert emphasised that such assets can offer investors higher returns compared to traditional dollar instruments and may become serious competitors in the financial market over time.

Collins also highlighted the potential for using real assets as collateral for stablecoins. He believes tokenisation will enable the creation of a broader range of “stablecoins.”

The specialist also commented on the launch of the USD1 stablecoin by the DeFi project of the Trump family World Liberty Financial. He noted that the involvement of the US president signals broad recognition of this new asset class.

In Collins’ view, this move sets a global trend where institutional and fintech companies will increasingly engage with digital currencies.

Earlier, Standard Chartered estimated the stablecoin market capitalisation to reach $2 trillion by 2028.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!