Unpacking the Zcash Paradox

Does Zcash have a chance to become the cypherpunks’ coin of choice

Amid a correction in bitcoin and most large altcoins, the price of Zcash (ZEC) — a coin that has historically positioned itself as a privacy cryptocurrency — began to surge.

We revisit how this project emerged and who is behind it, and ask whether ZEC can replace bitcoin as the heir to the cypherpunks’ economic ideas.

What Zcash is

Zcash is a peer-to-peer, decentralised blockchain system with open-source code, focused on transaction privacy. It is based on the Zerocash protocol, which employs zero-knowledge proofs (zk-SNARK). Its unit of account is the ZEC cryptocurrency.

A zero-knowledge proof is a cryptographic protocol that allows one party (the prover) to confirm the truth of a statement to another party (the verifier) without revealing any additional information about that other party in the process (neither the content nor the source from which the prover learned of its truthfulness).

The foundations of Zcash were laid in 2013 with the appearance of Zerocoin. A year later Matthew Green, Eli Ben-Sasson and a small group of researchers refined the project. In a technical paper they criticised the first cryptocurrency’s lack of privacy and proposed a new solution — Zerocash. The authors noted that the protocol could be implemented on top of “any distributed ledger system, such as bitcoin”.

In 2015, cybersecurity specialist Zooko Wilcox, who identifies as a cypherpunk, founded Electric Coin Co (ECC) to refine Zerocash and turn it into a full-fledged decentralised system with a focus on privacy. A year later the team unveiled ZCash.

Before mainnet launch, the developers conducted a so-called trusted setup ceremony, during which each participant destroyed fragments of the private key and the hardware used, for the protocol’s security.

In 2018 the procedure was repeated in preparation for network upgrades. Around 90 community and developer-team members took part, using different approaches to parameter generation.

In preparing this article, we found no fully independent external audit confirming that all hardware and each key were indeed destroyed during the ceremonies. One participant, programmer Peter Todd, acknowledged:

“[…] you are simply forced to trust me and five other participants […]. It is impossible to prove to a third party that we did not collude to keep the secret key.”

In 2020 Forbes wryly noted that the “cypherpunk” Wilcox had commissioned the RAND Corporation, which works closely with the U.S. government, to study possible illicit uses of Zcash. In 2022 it also became known that former NSA and CIA employee Edward Snowden took part in the coin’s launch.

Initially the protocol featured two types of addresses: transparent “t”-addresses and private “z”-addresses. Users could transfer ZEC:

- from “t” to “t” — a public transaction;

- from “t” to “z” — a shielded transaction;

- from “z” to “t” — a deshielded transaction;

- from “z” to “z” — a private transaction.

In 2022, as part of the major Network Upgrade 5, the developers introduced unified addresses — a format that gives users a single Zcash address compatible with all existing pools.

On 31 October 2025, ECC published its roadmap for Q4 2025. Key priorities include introducing one-time addresses for ZEC swaps via the Near Intents protocol and automatically generating new addresses after receiving funds. This coincided with rising interest in the privacy-coin sector and the emergence of a narrative casting Zcash as a possible “ideological successor” to bitcoin.

A new leader

In late May, the market capitalisation of privacy-focused coins exceeded $10bn. According to CoinGecko, at the time of writing it stands at $26.6bn.

The sector’s trajectory ran counter to broader market sentiment. Some analysts linked this to growing pressure on privacy: from the introduction of digital IDs to a ban in the EU on anonymous crypto accounts and the use of privacy coins.

Particular concern was prompted by the “Chat Control” bill now before European authorities. The draft provides for monitoring users’ private messages with AI to search for prohibited content.

“Surveillance and censorship are not easing, but intensifying. Privacy will only become more valuable. More and more people will begin to realize how transparent their actions are online, and technologies resistant to censorship will become our shield. For ZEC, this is only the beginning,” wrote former White House adviser and Zcash advisory board member Tor Torrence.

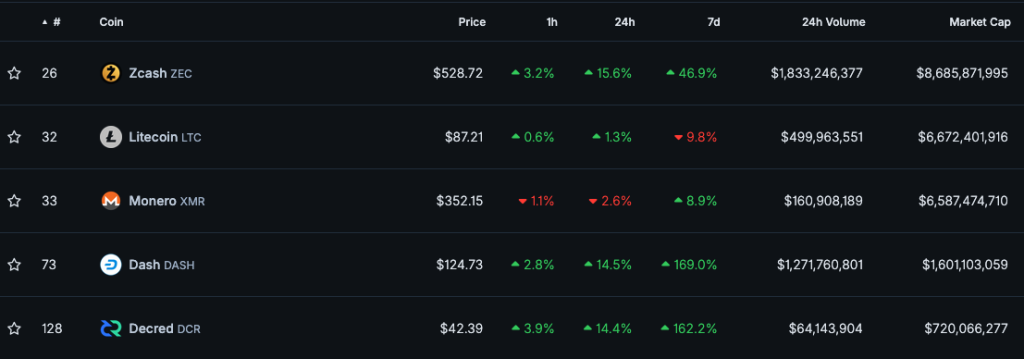

Against this backdrop ZEC stood out: over several months the asset managed to overtake Monero in the privacy-coin rankings. On November 6th the coin’s price topped $500 and its market capitalisation reached $8.68bn.

The volume of Zcash private transactions hit a record 4.96m ZEC — over 30% of total supply, according to ZecHub.

Some took the rise in ZEC as a signal of growing demand for privacy solutions. Mert Mumtaz, CEO of Solana Helius Labs, noted that tools like Zcash “truly strengthen the privacy of cryptocurrency systems”, while venture capitalist Naval Ravikant called the privacy coin “insurance against bitcoin”.

Galaxy Digital analyst Will Owens suggested that Zcash could become the “spiritual successor” to the first cryptocurrency. According to him, supporters of the privacy coin call it “encrypted bitcoin”, a contrast to the situation around digital gold, where ETFs entrench the role of centralised custodians.

A Web3 researcher, Vladimir Menaskop, told Forklog he doubts Zcash has inherited the role bitcoin originally played. He added that he would like to see such a development, and that today the first cryptocurrency is increasingly prone to centralisation:

“Yes, for now private holders are more than 50–60%, but, first, they are losing ground; and, second, we increasingly meet bitcoin maximalists who do not understand that a single chain that rules over everyone — and even more so a single coin — is the worst thing that could happen to Web3.”

Speaking to the editors, libertarian economist and supporter of the Austrian school Yevgeny Romanenko recalled that the main idea of cryptocurrencies “was, is and will be anonymity”.

“Bitcoin […] does not align with the interests of the authorities, and they naturally try to seize it in their paws. This threatens privacy, the need for which philosophically will not disappear anywhere. The result will be rising demand for other ‘private money’ — solutions that still provide privacy. In this sense bitcoin has alternatives,” the expert noted.

In his view, Zcash could well be such an alternative.

Questions remain, however — not only about the privacy coin itself and its actual level of confidentiality, but also about the prospects for such projects under stringent regulatory requirements.

Take off or be forgotten

Privacy coins have long irked regulators and drawn close scrutiny. As institutional, corporate and state interest in crypto grows, the pressure only intensifies — including from industry participants themselves.

Despite this, experts agree that in current conditions it is indeed possible to build privacy-oriented projects. Romanenko argues that, despite a legal veneer, state interference amounts to an encroachment on personal freedom and property. Menaskop, for his part, noted that government bans work poorly.

In Menaskop’s view, ZEC’s current rally is little more than marketing. Indeed, for most of its existence the project has been a niche solution, overshadowed by Monero.

“Another matter is that besides this there is a side trend, which I described in 2020 — the growing importance of anonymous cryptocurrencies and private DeFi. And this trend has not gone anywhere; it has only strengthened thanks to the current hype,” the expert added.

It is highly unlikely that Zcash will overnight become the cypherpunks’ main coin, and this story is not about continuity with Satoshi Nakamoto’s ideals. Rather, in a world where control is becoming the norm, privacy is turning into a necessity.

Text: Alisa Ditz

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!