From Peer-to-Peer to Fraud-to-Fraud

What happened to peer-to-peer crypto trading?

Remember when peer-to-peer deals were actually struck between real participants in the crypto market? Do not worry, everyone else has forgotten too.

Today, P2P in Russia has become a money-laundering mill, a breeding ground for grey schemes and a haven for scammers. As usual, ordinary users pay the price.

We examine how the segment went off the rails and why dealing with suspicious counterparties is perilous.

Dodges, angles and manipulation

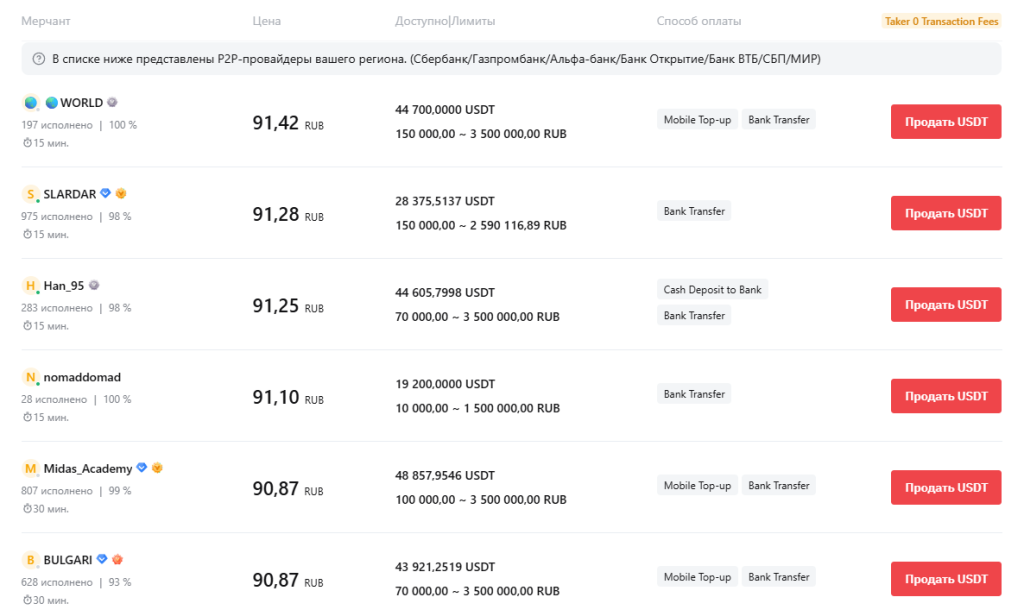

The main examples in this piece are drawn from Bybit, but platforms that support the rouble face similar issues.

In the past, a P2P deal worked like this: two counterparties connected in a local chat, exchanged details (if the UI did not show them in advance), the buyer sent the required fiat amount, and then the seller confirmed the coin transfer. Simple.

It may seem little has changed, but there is a catch. The risk of running into bad actors was always there; now it is less a remote possibility than an almost certain outcome.

Open any P2P page and the numbers jar: the dollar rate is typically a good ten roubles above the official rate when selling—and below it when buying.

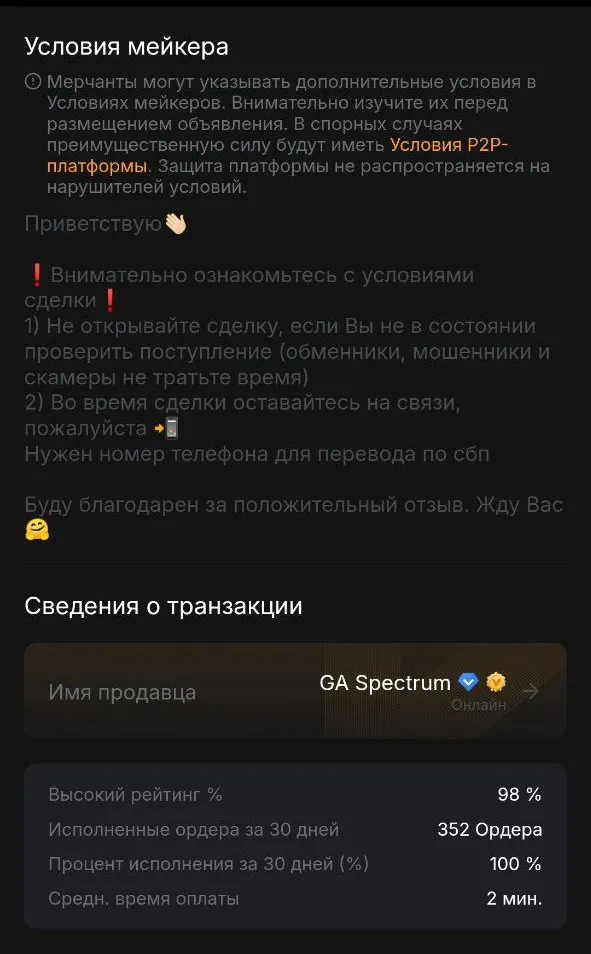

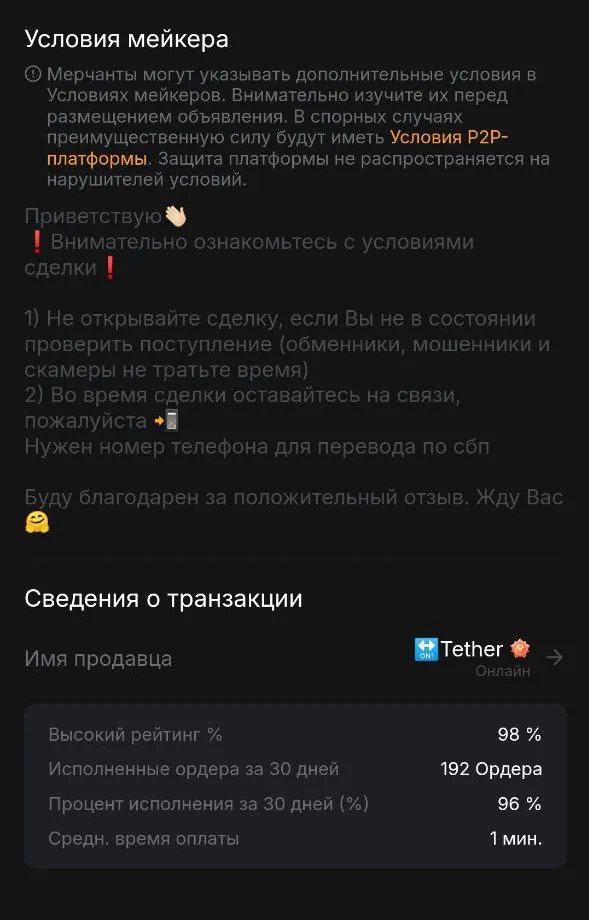

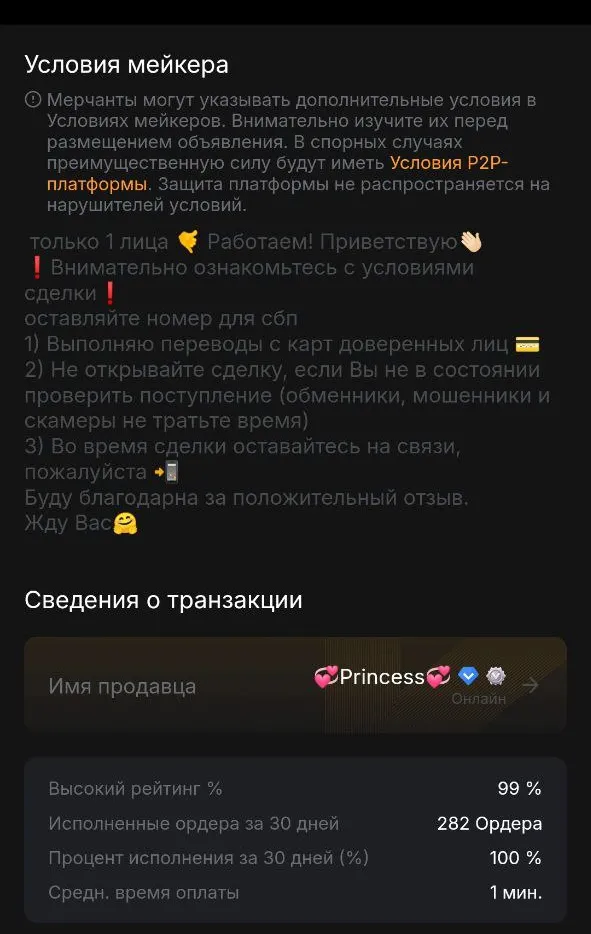

Order descriptions are even more telling: most read as if copied and pasted. Common phrasing includes: “I work with first persons”, “I send from a trusted person’s card”, “Slavs only”, “PDF receipt not provided” — and, most common: “multiple transfers possible”.

The last point is especially troubling, because a large number of transactions creates risks for cardholders.

Yet these users sport high verification levels and many positive reviews (likely padded).

Notably, most platforms’ P2P rules ban using third-party cards, but neither platform administrators nor traders seem bothered.

The fauna of modern peer-to-peer

The broad picture of the P2P segment is clear. But what actually happens when a deal opens? Schemes abound, from brazenly “black” to quasi-legal.

We have grouped various cases and highlighted several types of manipulation you may encounter when buying or selling crypto.

“Triangles”

Arguably the most common scheme. Its essence is simple: a merchant-“triangle” connects two otherwise unrelated sides of a deal.

He finds a seller and a buyer—say, for USDT—and forwards the required payment details. He pockets the spread between the two rates.

Both buyer and seller think they are dealing with the merchant, even though his own bank cards are not involved.

The main risk for ordinary users is that the “triangle” cannot fully control either side’s behaviour. Deals often drag or collapse.

With luck, the merchant is “white”. But there is a serious chance of bumping into “black triangles”, who move money of criminal origin.

For instance, funds scammed from a victim may arrive on your card, leaving the recipient the only suspect. There are numerous cases in which ordinary P2P traders were detained on suspicion of complicity in a crime.

You can spot a bad actor by “tell” words in the order description. They often admit to using “trusted person” cards. Reviews are also revealing: disgruntled counterparties write “slow” or “rude”.

“Triangles” also run large tickets (roughly from 200,000 roubles). The average time shows as five to seven minutes—but only because they press the “paid” button as soon as the deal starts to burnish statistics.

Processing

Processing is the technology that handles and confirms payments. It is usually used by online exchangers, but crafty operators now funnel traffic to it through peer-to-peer.

This is likely the chief reason P2P traders’ cards get blocked, because even relatively small sums are split into many micro transfers. We have seen 20,000 roubles chopped into ten transactions of 2,000.

The core problem is not the number of transfers but the cleanliness of the money. Processors typically have weak AML standards—or none at all.

Processor traffic comes from dubious sources: illegal casinos or darknet marketplaces among them. The recipient risks being showered with “dirty” roubles.

Usually counterparties flag the large number of transfers in the order description; some reveal it only later in chat.

They can be spotted, as usual, via reviews. If you see “card was blocked after the deal”, give the ad a wide berth. Their exchange rate will also be far above the official one.

Scammers

The oldest breed of counterparty; it has always existed.

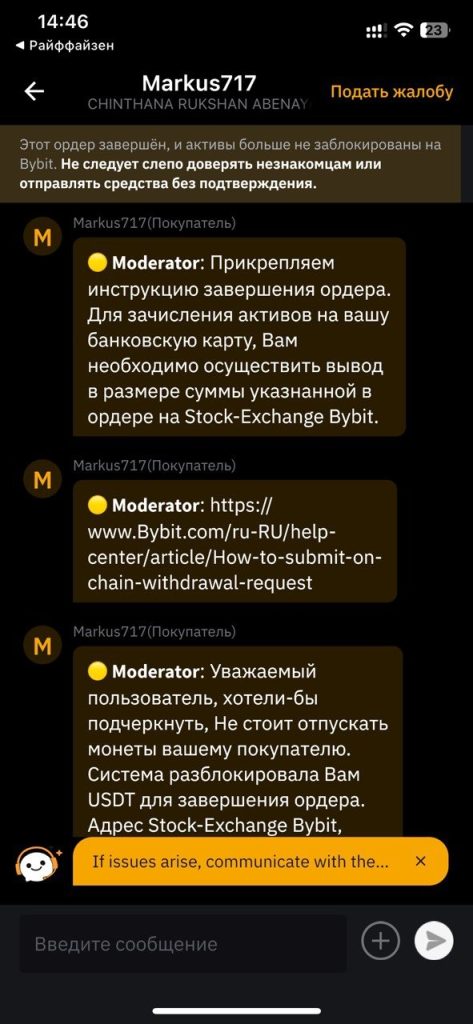

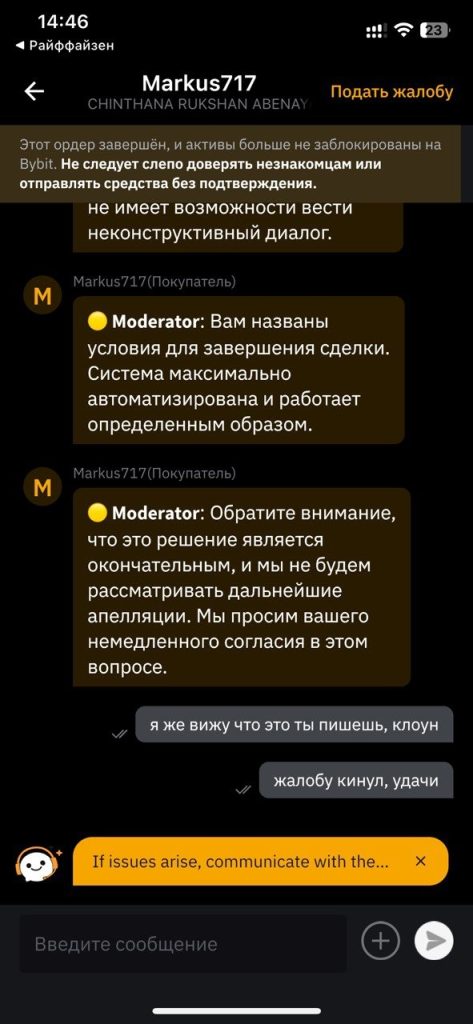

Their scripts differ, but the aim is the same: to make you release coins before the money arrives. There are many ways to do this.

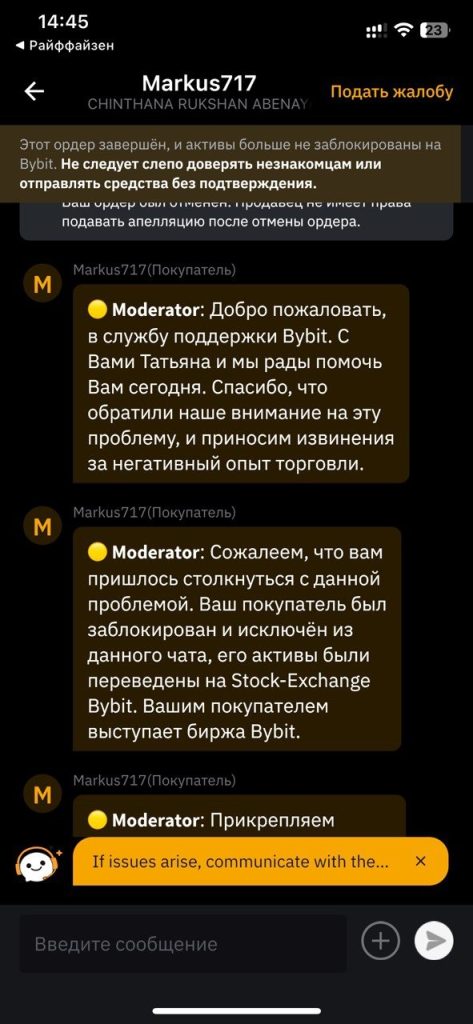

Some pose as platform administrators who have entered the trading chat. In one case, “tech support” suggested sending funds to another address to complete the deal.

Others try to move the conversation to a separate messenger. That makes it easier to pressure a target via social engineering and to deploy tools such as phishing links.

There are cases where a scammer tried to place a video call to “speed things up”. They likely aim to capture passwords or 2FA codes.

There is no universal method to spot such characters. Trust your instincts, do not click suspicious links, do not chat off-platform, and above all do not close a deal before all funds arrive.

Bleak consequences

In today’s set-up it is hard to identify the true sender of funds: P2P participants often use cards registered to “drops”. The main risks fall on recipients.

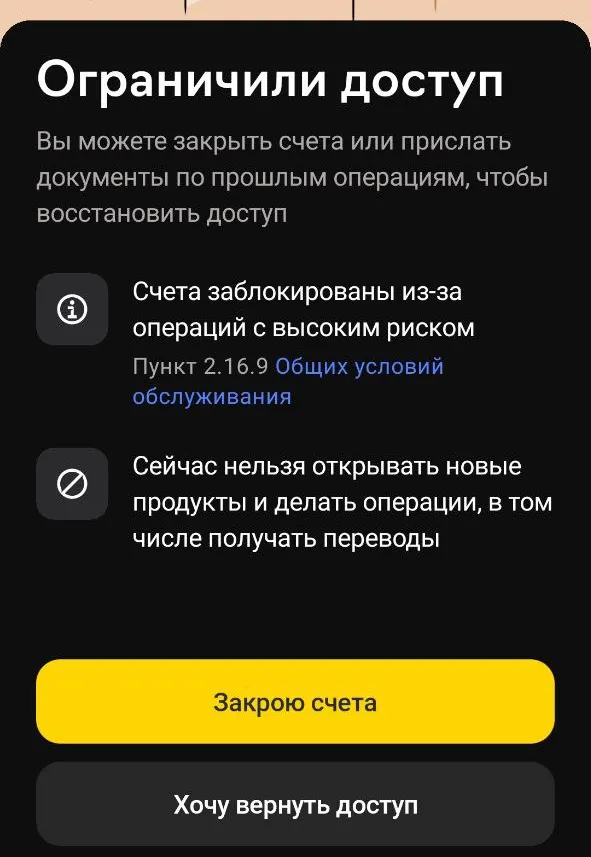

If a bank’s security team detects suspicious activity, the best-case scenario is a card block. In Russia, accounts are closed under 115/161-FZ. Sometimes cases escalate to criminal charges for money laundering.

Unblocking an account is difficult: you must prove your innocence with order screenshots and other information, with no guarantee of success.

Worse outcomes are possible, including detention by police. In October, a Russian trader was arrested for two months: the man, a realtor, was accused of transferring funds to accounts of “one of the organisations banned and recognised as terrorist in the Russian Federation”. He was conducting a buy/sell deal on an unnamed P2P platform with an anonymous counterparty.

Law enforcement shows little appetite to unpack such cases, especially if there is already someone to pin it on. Only experienced lawyers are likely to help.

The end of P2P?

The mess has dragged on for years. Many honest market participants are tired of “triangles” and scammers, and are seeking alternatives.

These might be platforms with stricter KYC or the simple cash-for-crypto trade. But those options bring hassles too: slow processes, unfavourable rates, and so on.

Meanwhile, there is little sign of action from problematic platforms such as Bybit. Perhaps stable trading volumes suit them. Recently, however, the exchange aggregator BestChange restricted rouble operations for 95 services due to grey schemes and complaints about card blocks.

What ultimately happens to P2P in Russia is unclear, but a mass user migration is already visible. Scammers and grey operators will adapt quickly; whether exchanges can adjust to the new reality is an open question.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!