The Ultimate Swamp Asset: The Economist’s Disillusionment with Cryptocurrencies

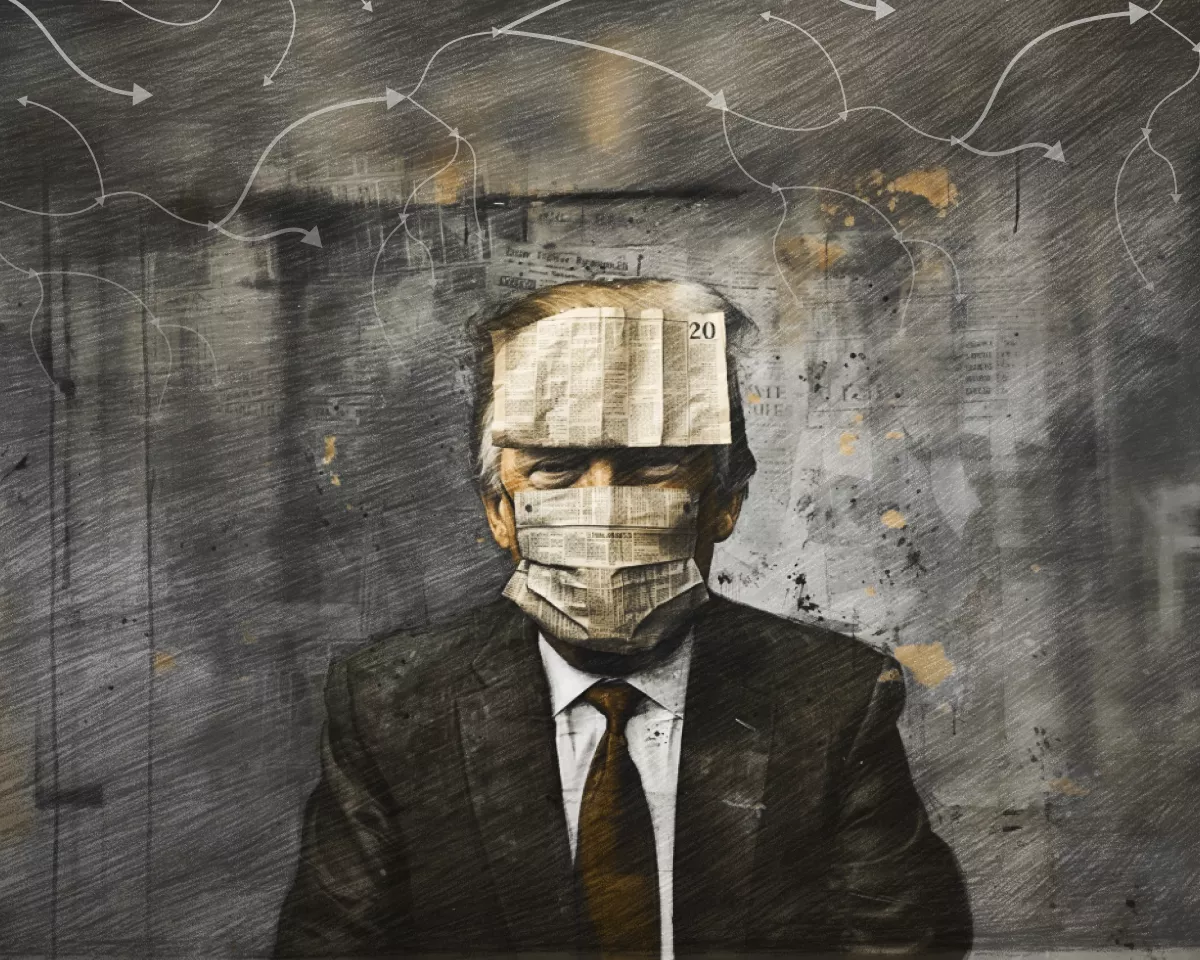

Digital assets, initially conceived as an apolitical tool, have become synonymous with bribery and greed, according to an article in The Economist.

The article was published under the headline “Cryptocurrency has become the ultimate swamp asset.” The authors noted that over the past few years, this new financial direction has firmly entrenched itself in American public life.

“Crypto enthusiasts help run regulatory bodies. Leading industry companies are among the largest donors to election campaigns […]. The sons of President [Donald Trump] promote their cryptocurrency ventures worldwide. The biggest investors in Trump’s meme coins can dine with him. The first family’s assets are now valued in billions, making cryptocurrency perhaps the largest source of their wealth,” the publication highlighted.

Journalists noted the irony in the situation, as Bitcoin was initially conceived as a “revolution in finance.” Its followers had “lofty goals” of protecting people from inflation and empowering retail investors.

“[Bitcoin] was more than an asset: it was a technology of freedom,” stated The Economist.

Now, the original ideas are forgotten, and cryptocurrency facilitates fraud, money laundering, and other crimes. According to the authors, the industry has also developed “murky relationships” with the executive branch of the American government, surpassing the capabilities of Wall Street or any other sector.

Meanwhile, various jurisdictions such as the European Union, Japan, Singapore, Switzerland, and the UAE have managed in recent years to provide digital assets with regulatory clarity without “unchecked conflicts of interest.” Moreover, in some parts of the developing world with high inflation and weak banking sectors, cryptocurrency still plays “something like the role early idealists once hoped for.”

“There is still much speculation. But cryptocurrency is gradually being taken more seriously by major financial firms and tech companies,” the article states.

As a promising direction, journalists pointed to the tokenization of real-world assets, already being pursued by major American players, including BlackRock and Franklin Templeton.

The most common use of digital assets remains payments—many industry firms already use stablecoins in some transactions.

However, the US risks missing opportunities, the publication argues. SEC under Gary Gensler’s leadership has been skeptical of the sector, entangling crypto companies in legal battles and intimidating banks.

“The result is that cryptocurrency in America needs saving from itself. New rules are still necessary to ensure that risks do not spill over into the financial system. If politicians, frightened by the electoral power of the industry, fail to properly regulate cryptocurrency, the long-term consequences will be dire,” journalists warned.

Back in January, the task force on digital asset markets formed by Trump identified the development of a regulatory framework for stablecoins as a priority.

In May, the “stablecoins” bill (GENIUS Act) failed at a key vote in the US Senate.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!