Tom Lee forecasts Ethereum at $15,000

Ether, the second-largest cryptocurrency by market value, could hit $4,000 in the short term and $15,000 in the medium term, says Fundstrat researcher and Bitmine Immersion Technologies chairman Tom Lee.

At the time of writing the token trades around $3,800. It is up 3.82% over 24 hours, 25.23% over seven days and more than 50% over the past month, according to CoinMarketCap.

Lee’s forecast draws on a model built by his colleague Sean Farrell that compares Ethereum with established crypto-industry firms such as Circle.

Farrell estimates ether’s potential value at $15,000 using EBITDA multiples. Fundstrat’s researchers argue that layer-1 blockchains like Ethereum underpin entire ecosystems and can therefore command higher valuations. As an analogy, Lee pointed to software companies’ richer multiples compared with mass-market consumer firms.

He also cited the technical work of Fundstrat’s head of technical strategy, Mark Newton, who sees Ethereum reaching $4,000 by the end of July.

Lee called that only an interim target. Given current adoption and valuation, a $10,000–$15,000 range looks achievable by year-end—possibly sooner.

Early this month, in an interview with CNBC, Lee called Ethereum Wall Street’s preferred choice for blockchain infrastructure. He stressed that projects from JPMorgan and Robinhood—the JPMD token and a tokenisation initiative—are centred on this network.

Lee also expects the RWA segment to keep surging, particularly alongside the expansion of stablecoins.

Whale demand

Ethereum’s rapid rise comes amid strengthening capital inflows into US spot ETFs and hype around corporate reserves.

As the screenshot shows, the “strategy flagships”—Bitmine Immersion Tech and SharpLink Gaming—have increased ether holdings by 84% and 59% respectively; together they now approach 600,000 ETH (>$2.2bn). By contrast, Ethereum Foundation’s holdings fell by 7.68%.

SharpLink chairman Joseph Lubin signalled “serious” intensifying competition among ETH-strategy proponents.

Tom and $BMNR and we at $SBET might engage in a cut-throat one-upmanship, incessantly working to out buy each other stacking up the ETH.

Or we might hold hands and collaboratively explain the paradigm shift to decentralization and how it will affect (and supercharge) the…

— Joseph Lubin (@ethereumJoseph) July 19, 2025

“The game has begun,” emphasised the Ethereum co-founder.

Net inflows into spot ETH ETFs topped $2bn last week—a record and the longest positive run for such funds at 11 consecutive days.

Total assets under management in ether-based ETFs have surpassed $18bn. Cumulative inflows since the instruments launched last summer have reached $7.49bn. Large individual players have also stirred: according to on-chain analyst EmberCN, over the weekend one whale bought about $50m of ETH at an average price of $3,714.

Analyst Ali Martinez noted that over the past two weeks whales have acquired more than 500,000 ETH.

Whales have bought over 500,000 Ethereum $ETH in the last two weeks! pic.twitter.com/9Th37pLxqC

— Ali (@ali_charts) July 19, 2025

A large short squeeze

An analyst posting as Crypto Banter warned that if Ethereum reaches $4,000, more than $330m of short positions would be liquidated.

$ETH is the most hated rally right now 👀

$331.17M worth of shorts are set to be liquidated when Ethereum reaches $4000. pic.twitter.com/tl3XbSqs5b

— Crypto Banter (@crypto_banter) July 20, 2025

A cascade of liquidations could amplify the move via a self-reinforcing effect—a short squeeze in which traders with short positions are forced to cover, boosting demand and accelerating the rally.

Is it altseason already?

Some analysts read Ethereum’s outperformance as a sign of changing market sentiment.

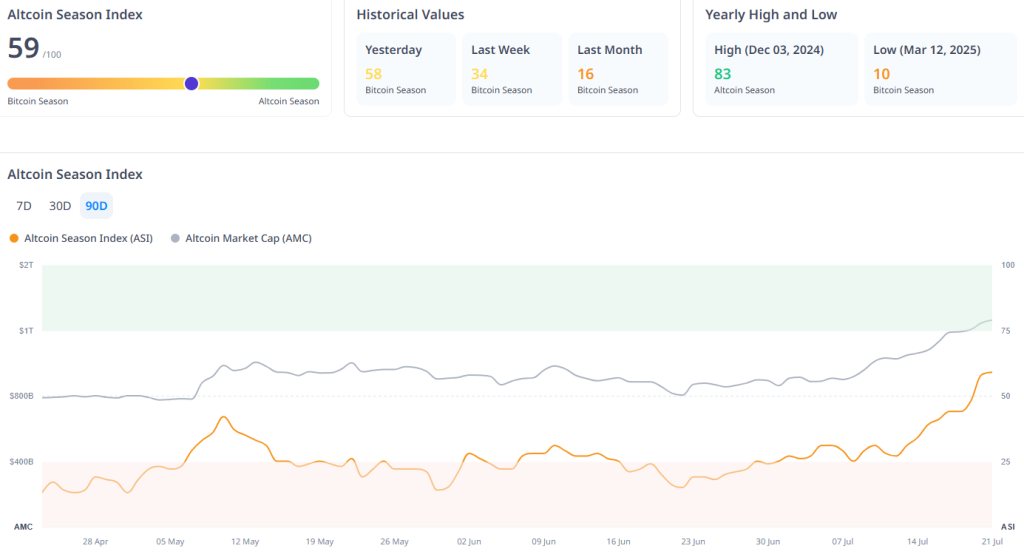

The “altseason index” keeps rising and has crossed the midpoint—reaching 59 out of 100.

On July 20th it stood at 58, a week earlier at 34 and a month ago at 16. The ATH was 83 in early December 2024.

Trader Pentoshi pointed to the largest weekly drop in bitcoin dominance in four years as a sign of capital rotating into ether.

BTC dominance largest drop in a week in 4 years.

Enjoy the next few weeks

So far so good! We are up a lot this month https://t.co/Xw2AzLiWcN pic.twitter.com/r4u9vPecEw

— 🐧 Pentoshi (@Pentosh1) July 20, 2025

In his view, the current explosive rally in ETH is driven mainly by FOMO rather than fundamentals.

Analyst Benjamin Cowen noted that altcoins still lag ether, even though the latter is a lower-risk asset.

#ALTs are down another 2% against #ETH today.

ALT/BTC pairs go up but they are lagging ETH/BTC.

And ETH is lower risk than ALTs.

This is the same view I had about BTC.D for years, just replaced with ETH.D pic.twitter.com/wIkJrLfCQb

— Benjamin Cowen (@intocryptoverse) July 20, 2025

He argues that ether is absorbing a “disproportionately large share of market flows” and resembles bitcoin in previous cycles.

Earlier, noted technical analyst Peter Brandt declared the start of “altcoin season”.

Experts at Santiment made a similar claim earlier.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!