Tom Lee Predicts V-Shaped Recovery for Ethereum

Tom Lee expects Ethereum's rapid recovery after corrections.

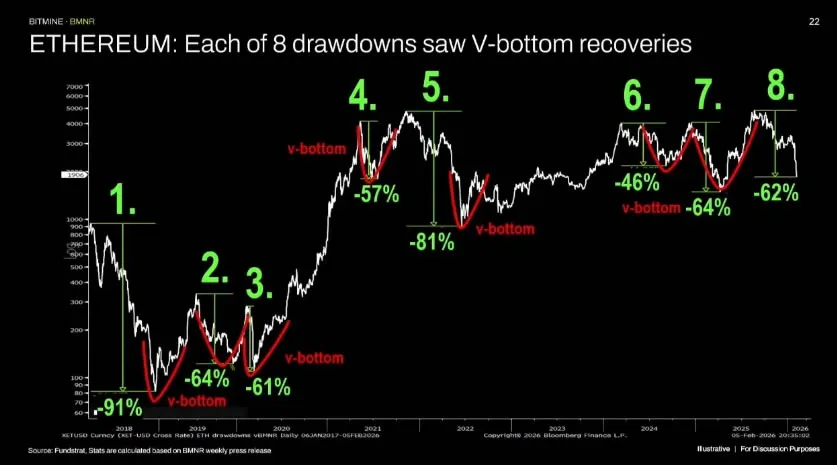

Tom Lee, head of research at Fundstrat, anticipates a swift recovery for Ethereum. According to his observations, since 2018, the second-largest cryptocurrency by market capitalization has shown a robust rebound eight times following significant corrections.

$ETH 100% V-Shape Record 👀

Tom Lee highlights Ethereum’s eight V-shaped recoveries since 2018.

Tom DeMark, whose models are followed by macro legends like Paul Tudor Jones and used across institutional desks, says a final undercut near $1,890 would “perfect” the bottom.

That… pic.twitter.com/j9zWoUOLgP

— SamAlτcoin.eth (@SAMALTCOIN_ETH) February 11, 2026

Speaking at a conference in Hong Kong, the analyst urged investors to remain calm.

He noted that from January to March of the previous year, Ether had depreciated by 64%.

“However, in each of the eight instances [of corrections], the chart showed a V-shaped recovery. The asset rebounded 100% of the time almost as quickly as it fell,” the analyst emphasized.

Lee is convinced that fundamentally the situation has not changed, and Ethereum prices are set for another rapid rebound.

Is the Bottom Near?

BitMine analyst Tom DeMark identified the $1890 level as a probable bottom for Ether prices.

“We believe that Ethereum is indeed close to its lows. The situation resembles autumn 2018, autumn 2022, and April 2025,” Lee stated.

The analyst recommended not focusing on finding the perfect entry point:

“If the decline has already occurred, one should look for entry opportunities rather than sell.”

On February 6, the price of the second cryptocurrency on Binance dropped to $1747. This is only slightly above the 2025 low, recorded just above the $1400 mark.

The asset failed to hold above the psychological mark of $2000. At the time of writing, Ethereum is trading at $1981, having plummeted 36% over the past 30 days.

Demand for Staking

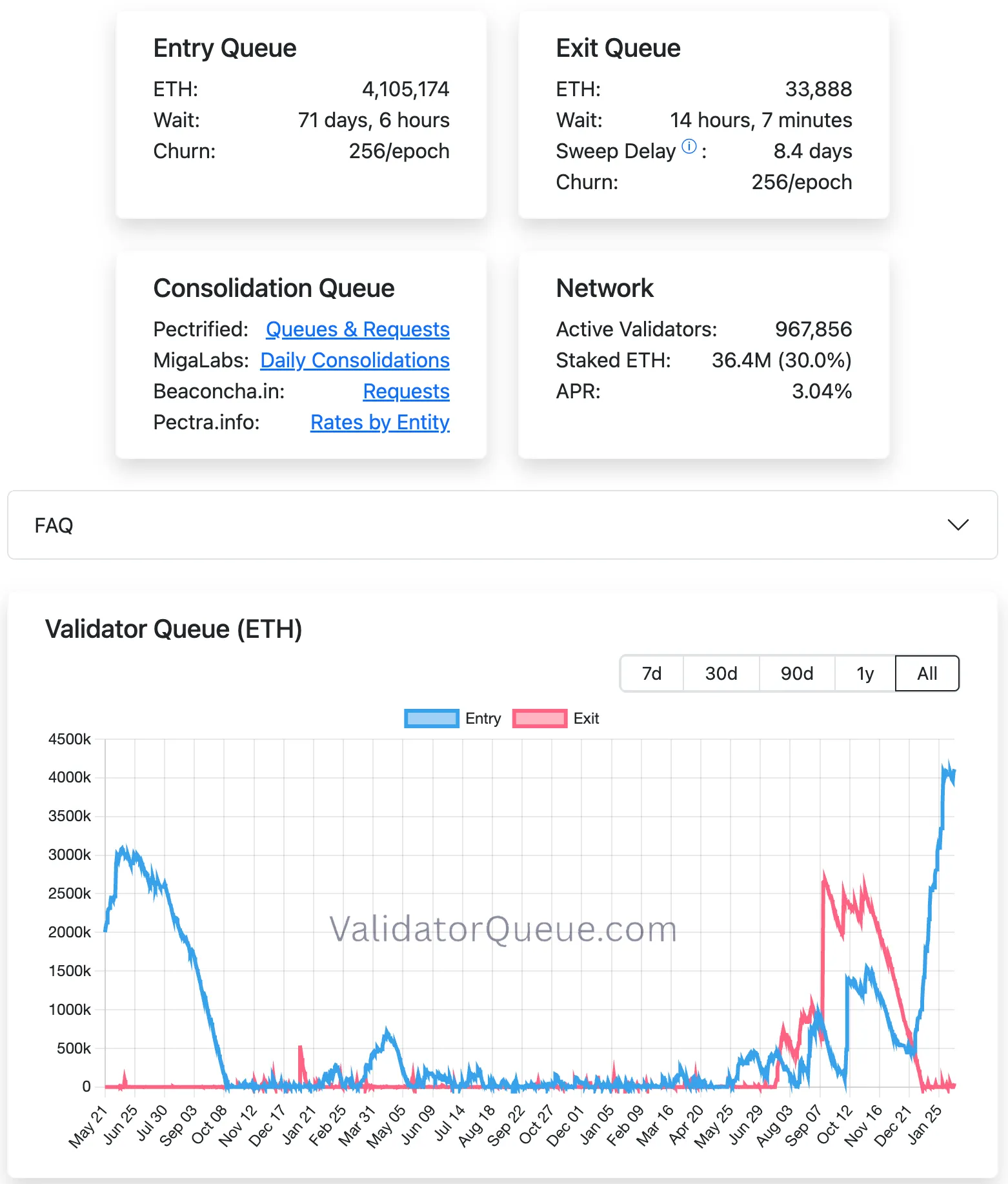

Despite sluggish price dynamics, interest in staking remains high.

According to ValidatorQueue, the queue has reached a historic high of 71 days — a record 4 million ETH are awaiting deposit into the smart contract address.

The share of coins in staking also hit a new high, accounting for 30.3% of the total supply (36.7 million ETH, ~$72.7 billion).

Milk Road analyst described this trend as a “massive supply constraint.”

“A third of all coins have been taken out of circulation and yield a modest 2.83% annually. By crypto market standards, this is not the most attractive yield, yet the queue continues to grow,” the expert noted.

According to him, the locking of coins worth over $70 billion amid falling prices indicates not speculation, but investors’ readiness to play the long game.

As reported, Ethereum’s share on exchanges has been declining for six months in a row due to the frenzied demand for staking.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!