Trader: Bitcoin price could rise above $11,000 in September

A practicing trader and founder of the Crypto Mentors project, Nikita Semov, explains the current market situation.

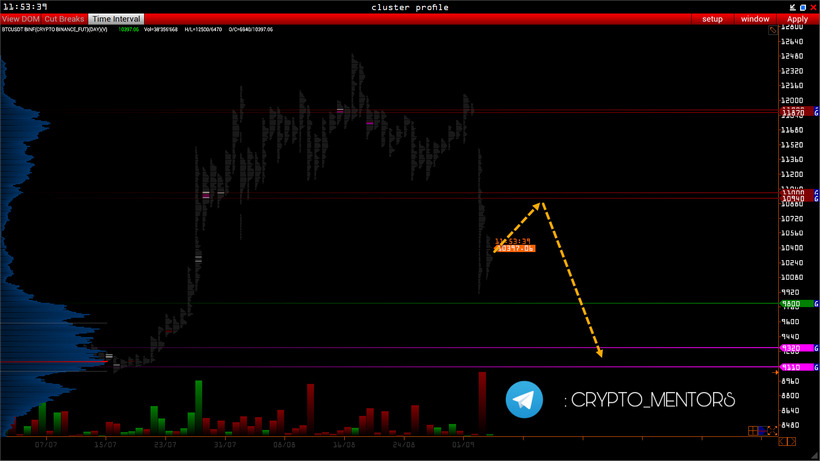

Daily chart

Yesterday there was a substantial dump. The formation is very similar to stop‑loss sweeping with a liquidity grab, as we anticipated earlier. All movement has been driven by the JOC + BTC pattern, with the left‑side buy halting a significant price drop. The overall context remains positive, so we expect in the coming days $11,030 and then a gradual correction toward $10,520.

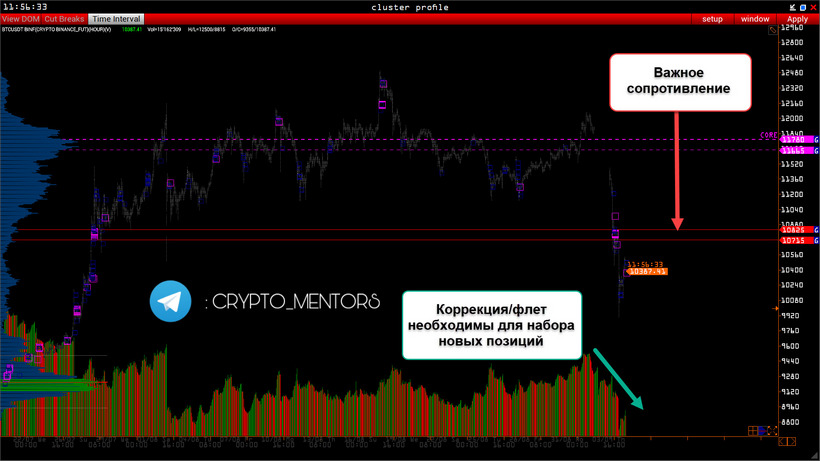

4-hour chart

The main selling range lies between $11,250-$10,669. At these levels there will be some form of selling reaction with a certain angle of attack. The character of this angle will indicate the style of the buying movement. A large volume spike is occurring precisely at the level of purchases from the left side; therefore, we expect bulls to move back into the sideways range.

Analysis of horizontal volumes

We have moved out of the monthly balance. By indicators such as the pace of movement, projection, distribution of volumes, and volume support, one can say with confidence that this is not a false breakout.

Important supports were flooded with additional liquidity and are now acting as resistance. The main zone to test is expected to be $10,940-$11,000.

Target levels for the decline are $9,200-$9,800.

More locally, watch the range $10,715-$10,825. It is these values that should hold, and there you can look for short-entry points.

According to open‑interest data analysis, many market participants have been left on the sidelines. This suggests that a correction or perhaps a small balance is needed to gather momentum for further movement.

Conclusions

There is no reason for total panic at the moment; however, it is unlikely that Bitcoin will top $11,000 in September.

Subscribe to ForkLog news on Telegram: ForkLog Feed — all the news, ForkLog — the most important news and polls.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!