Trader identifies a key resistance level for Bitcoin’s rise to $12,000

A practicing trader and founder of the Crypto Mentors project, Nikita Semov, explains the current market situation.

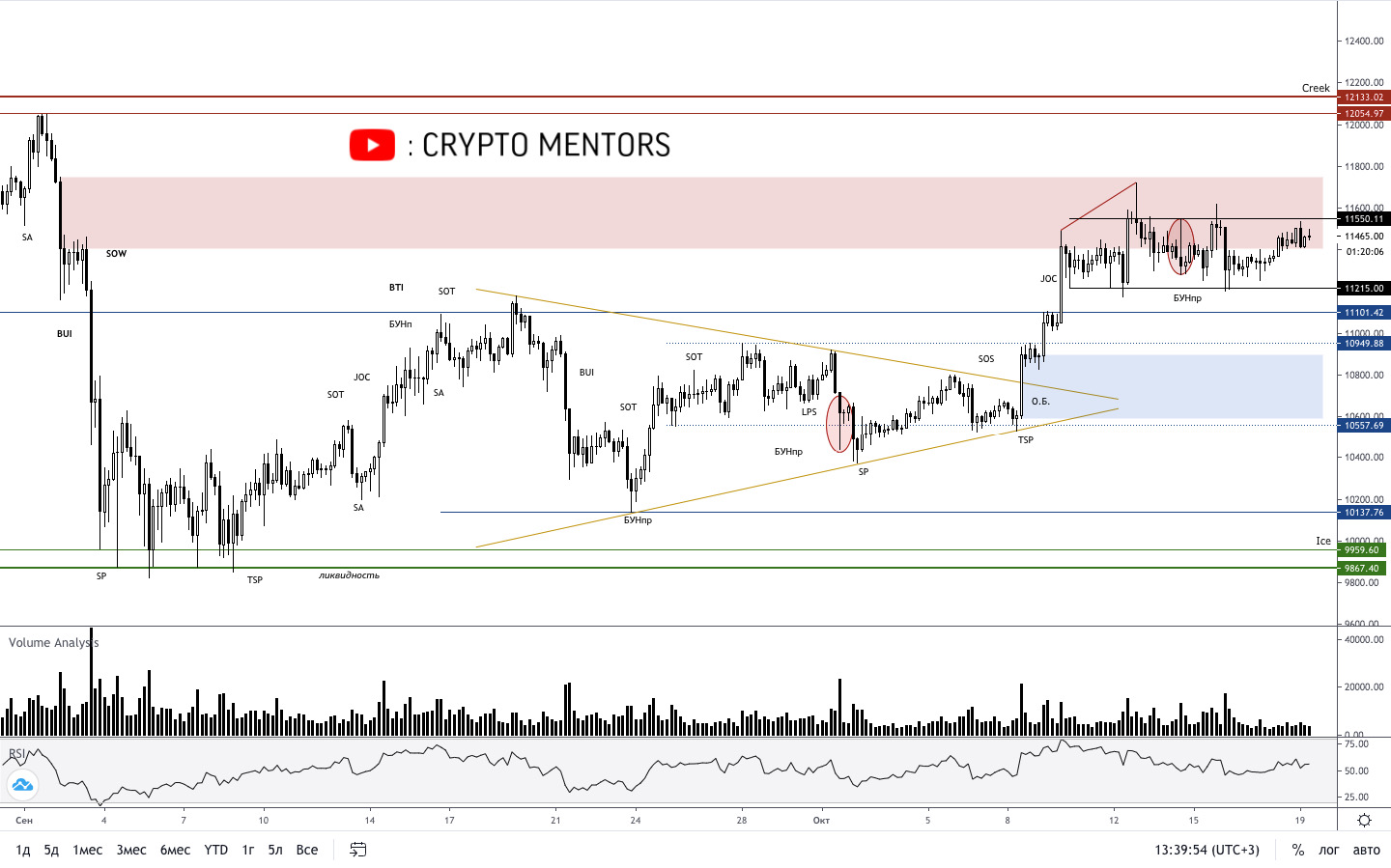

Bar-based analysis

The spread on the current buys is small relative to the previous wave, and the movement is against a large bear from the left side. This behavior was expected, since the price has entered the seller’s zone.

Volume is light (less than on July 13), which clearly argues against buying. Such information from the selling zone points to an upcoming correction, which is unlikely to be significant, as the rebound prior was not initiatory.

Simply, B1 was stronger than B2 — a typical fading of strength. I expect some decline with a likely liquidity grab from the lower level of the previous week. According to the Japanese candlestick analysis we have a "Three Methods" pattern and then a "thinking" formation, which indicates a possible downward candle.

Price Action + VSA

The four-hour retracements from the selling zone did not materialize, so the breakout toward $12,000 is a question of time. The selling wave is weak, and according to the Japanese candlestick analysis, the formation resembles a "halberd blade" — a pause pattern before a rise.

If we are looking specifically at VSA, it points to a weakening of buying in the medium term; locally they may still push the price a bit lower. At the moment, the short-term priority is slightly more to the sells, and we wouldn’t be surprised if they slip lower to collect liquidity. Frequent appearances of BUY signals and the SOS signal according to the VSA method only confirm the hunch of a price move above. If this happens right now, a divergence will appear, pushing the price away from the $12 000 level

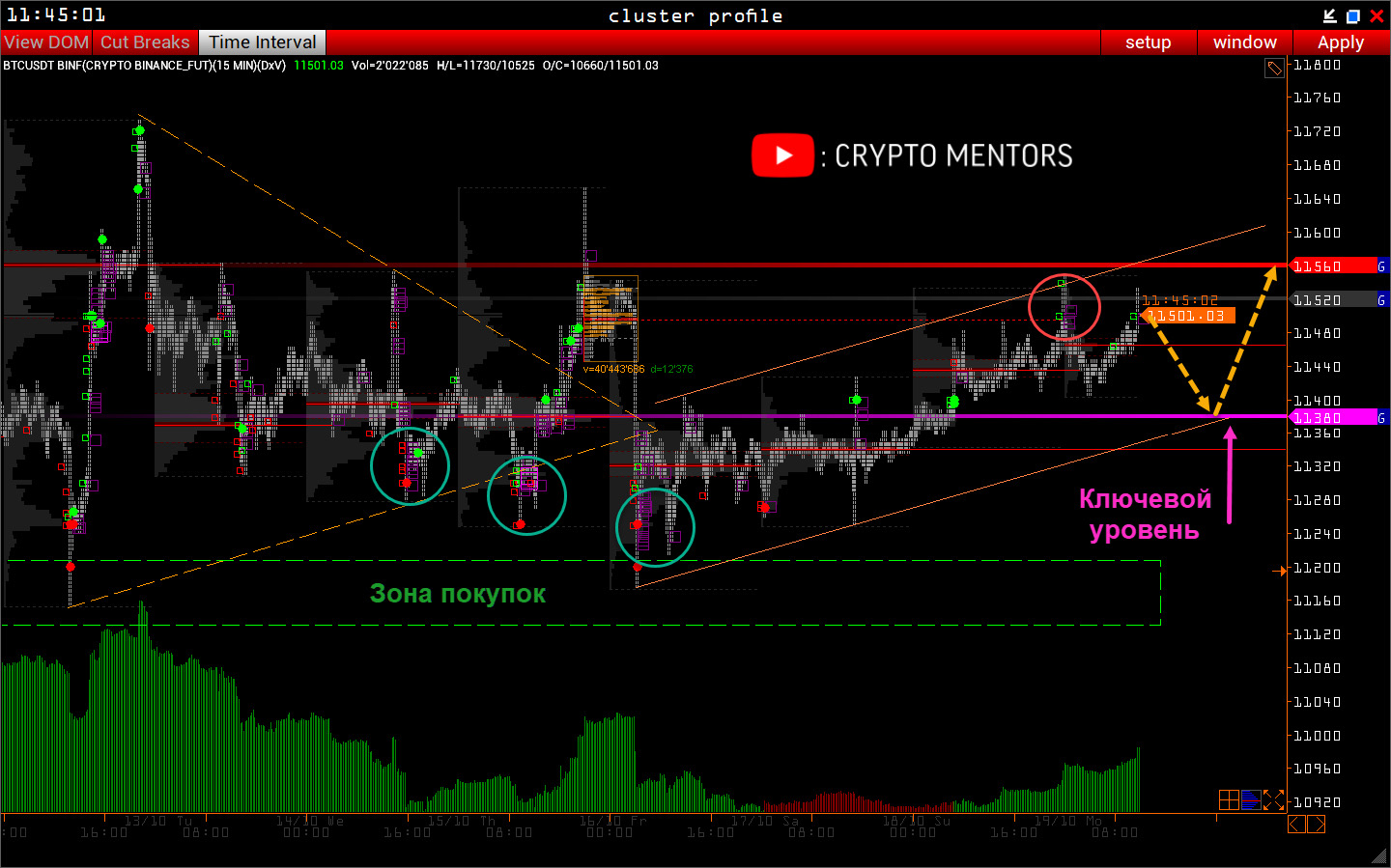

Analysis of horizontal volumes and deltas

In the global auction we obtained initial positioning of volumes, which can now be considered buying, as the quotes have been pushed higher. Moreover, taken together this resembles a squeeze toward the important resistance zone of $11,600-$11,750, indicating a probable breakout of this level.

If we look more closely at the balance we are in, you can notice a very good both volume and delta reaction from the buyers’ demand zone at $11,130-$11,200, while the upper bound of the sideways range does not delight with defensive reactions.

Subscribe to ForkLog news on Telegram: ForkLog Feed — the full news feed, ForkLog — the most important news and polls.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!