Trader outlines potential impulsive sell-off in Bitcoin price

A practising trader and founder of the project Crypto Mentors, Nikita Semov, explains the current market situation.

Bar-by-bar Analysis

The bar has a very narrow spread that tightens with each new purchase. This behavior signals underlying weakness among bulls, particularly in responses from the demand zone (blue).

Volume is increasing on average, but there is no correlation with the spread. The progress is extremely weak when compared with the left-hand side.

The expectation for the current week is a bearish bar.

According to Japanese candlestick analysis, the pattern ‘tower’ can be identified, which is a reversal pattern for the price. The candle-based expectation is downward. The ‘lower wick’ is merely information about a brief rebound.

Price Action and VSA

The move on the four-hour chart shows local buyer-dominance. From the $10,600 level noted over the weekend, selling activity emerged, proceeding without significant initiative and without a liquidity grab.

The current rise is progressing with a weak attack angle and no volumes — a characteristic sign of wave weakness. Given that the direction is against a large seller from the left, mid-term longs are currently extremely risky; only local positions with tight stops are relevant.

Hence, the previously outlined scenario remains unchanged: the current chop will have a manipulative push up to $10,700–$10,800, and from there a move down with updates to local lows, as highlighted by arrows on the chart.

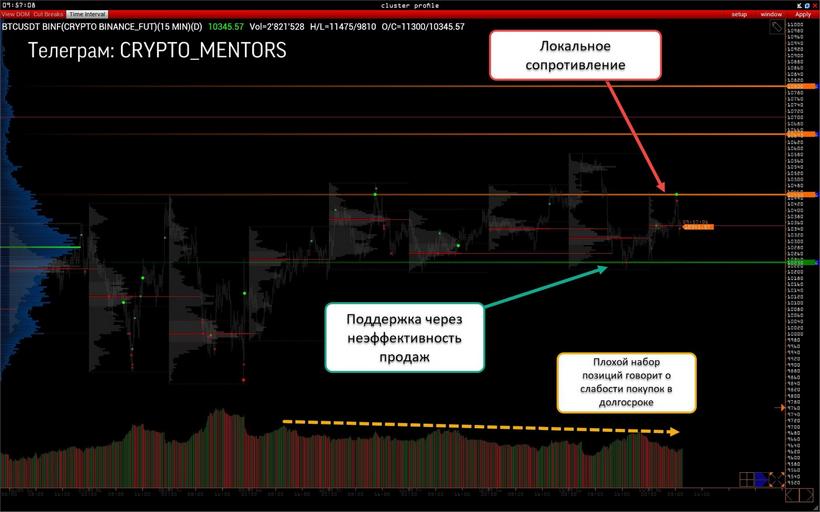

Horizontal Volume and Delta Analysis

On the higher time frame, clear traces of price being held by limit buys in the $10,260 zone are visible, pinning the price within the $10,260–$10,650 band. This contraction in volatility suggests an imminent strong impulse, which could occur this week.

Delta indicates an even balance, yet given that we are mostly trying to rise, buyers are weak, indicating the persistence of the broader downtrend.

Local Situation

Dropping to the hourly chart, one can see that quotes have poured volume at $10,545. This value will now serve as local resistance. On the downside, large volume clusters and POC levels are defended by both liquidity and delta imbalance, indicating buying interest and strength, should the subsequent move materialize.

Quotes are rising, there is no real buying control, and open interest is also falling, which signals the weakness of the move. Below, a very large number of important levels remain defended. One can expect in the first half of the week a move higher toward $10,650–$10,800, followed by a powerful impulsive sell-off. This manoeuvre is necessary to trigger the long stops so that, on that volume, sellers can push through all major support levels.

Subscribe to ForkLog news on Twitter!

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!