Trezor Reports 600% Surge in Demand for Hardware Wallets

Hardware cryptocurrency wallet manufacturer Trezor has recorded a 600% increase in weekly sales amid bitcoin’s ATH approaching $100,000, according to Cointelegraph.

On November 22, the price of digital gold reached record levels above $99,600. On the same day, the company achieved its highest daily sales volume of devices since May 2023.

Trezor’s Chief Commercial Officer, Danny Sanders, attributed the surge in demand to several factors.

One of these was Donald Trump’s victory in the U.S. presidential election. According to the manager, this spurred user interest in self-custody solutions like hardware wallets.

Sanders believes that the change of power in the White House signifies a shift in the regulatory regime for digital assets in the country, moving from a hostile environment to a more favorable one.

“This promises to provide greater regulatory clarity, which will lead to improved conditions for businesses in the industry and increased institutional adoption,” he added.

However, Sanders acknowledged that there were no significant changes in wallet sales in the United States. Nonetheless, political changes in the country have pushed cryptocurrency prices higher, attracting new customers, the manager noted.

He is confident that the bitcoin halving in April had a positive impact on the market.

“From a seasonality and block reward halving perspective, there was already an expectation of price increases within the four-year cycle, approximately six months after the halving,” Sanders stated.

In his view, demand for cryptocurrency and the influx of investors were also supported by increased liquidity due to interest rate cuts by central banks in the U.S. and Europe.

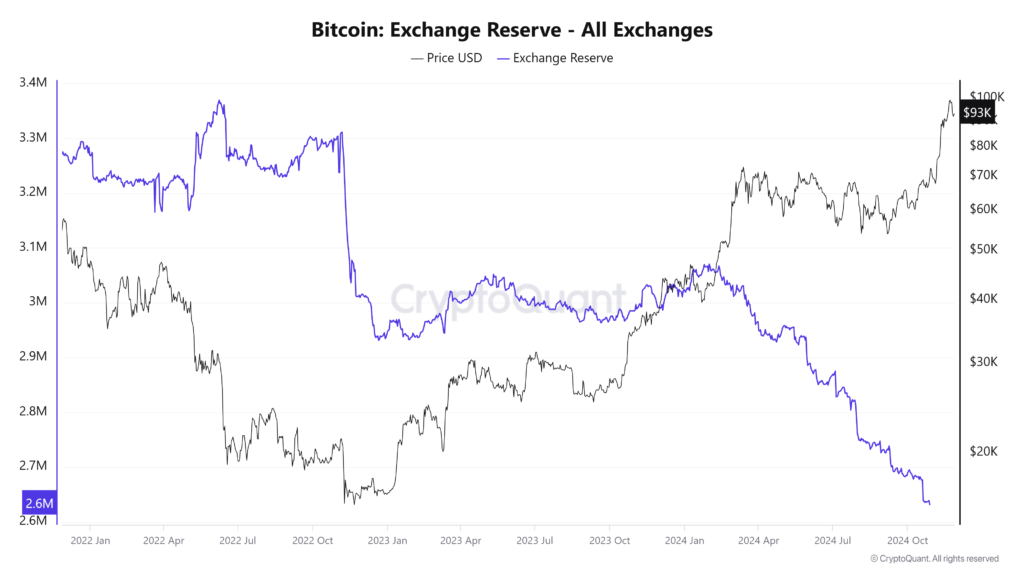

According to CryptoQuant, bitcoin reserves on major platforms like Binance and Coinbase have fallen to their lowest levels in six years. In 2024 alone, users withdrew approximately 427,000 BTC, worth around ~$40 billion.

This also indicates the growing popularity of self-custody, suggested the Trezor manager.

“The mantra ‘not your keys, not your coins’ remains highly relevant as the market gradually realizes the risk of trusting assets to centralized exchanges—a hard lesson learned from numerous past collapses,” he emphasized.

In June, the company unveiled its new flagship Trezor Safe 5, including a bitcoin-only wallet version.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!