Trump’s Prospects Boost Crypto Fund Inflows to $2.18 Billion

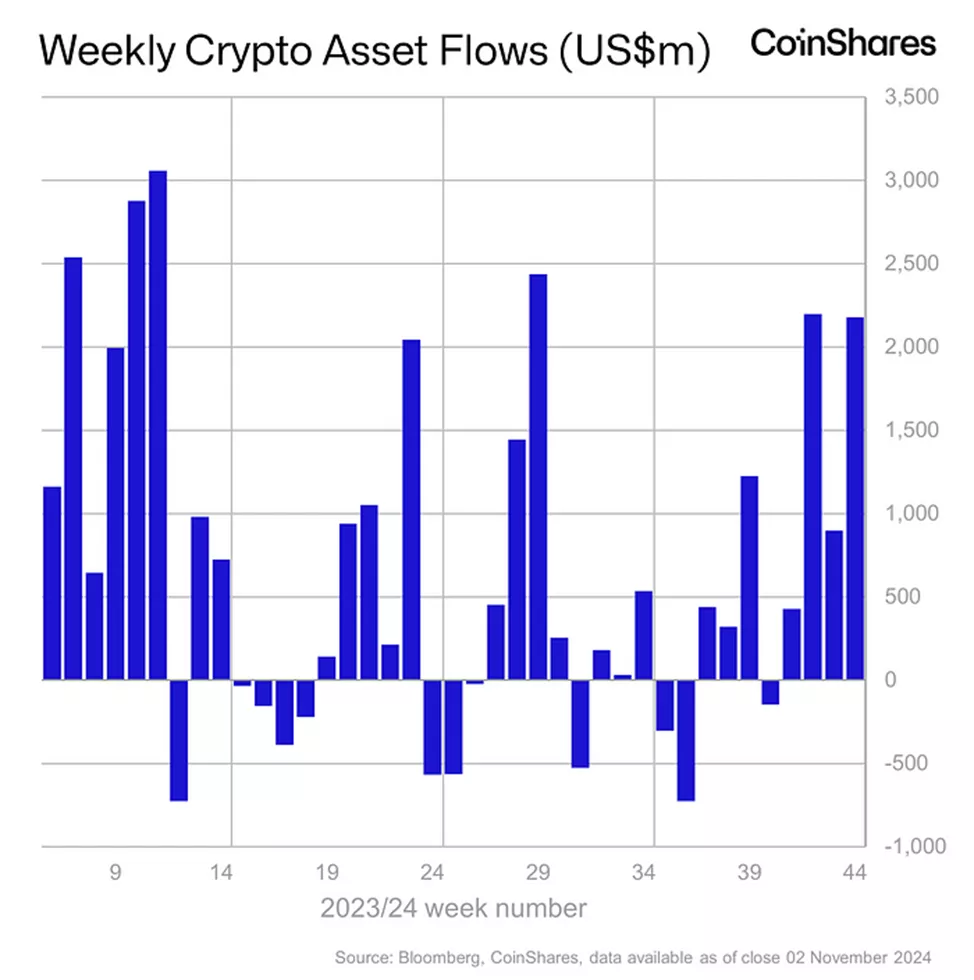

Inflows into cryptocurrency investment funds from October 27 to November 2 reached $2.18 billion, up from $901 million the previous week, according to CoinShares.

This result nearly matched the $2.2 billion observed in the second decade of October, the highest since July.

Year-to-date inflows have risen to a new record of $29.2 billion.

Analysts attributed the continued positive trend for the fourth consecutive week to the euphoria surrounding the potential victory of Republican candidate Donald Trump in the US elections and the strengthening of his party’s positions following a partial review of congressional seats.

On November 1, as the likelihood of this scenario decreased, moderate outflows were recorded, highlighting the asset’s high sensitivity to changes in the presidential race, specialists added.

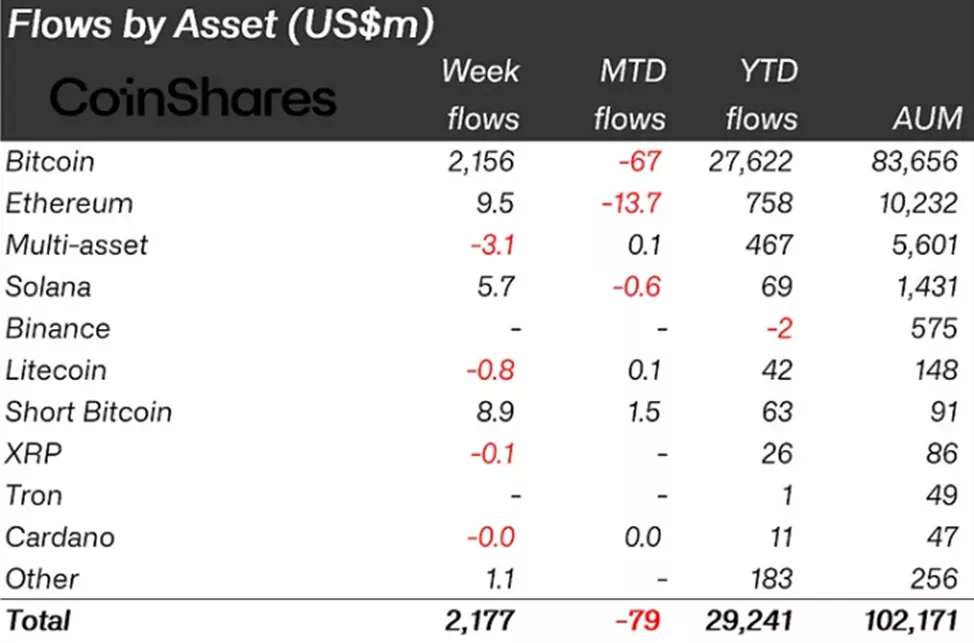

The volume of assets under management in crypto funds increased to $102.2 billion. The twelve-digit threshold was exceeded for the second time in history. The last time such high levels were observed was in June.

Product turnover jumped by 67% to $19.2 billion.

Bitcoin instruments received $2.16 billion after $920 million the previous week.

Investors added $8.9 million to structures allowing short positions on digital gold (compared to $1.3 million withdrawn in the previous reporting period).

Ethereum-based products saw a modest inflow of $9.5 million, in sharp contrast to the bullish sentiment in Solana funds ($5.7 million).

Among other altcoins, Polkadot-based instruments ($0.67 million) and Arbitrum ($0.2 million) stood out.

Previously, experts identified local bottom levels in Bitcoin ahead of the US elections.

Back in earlier reports, ITC Crypto founder Benjamin Cowen predicted a crash in altcoins before their surge.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!