Trump’s Victory Fuels Continued Inflows into Crypto Funds

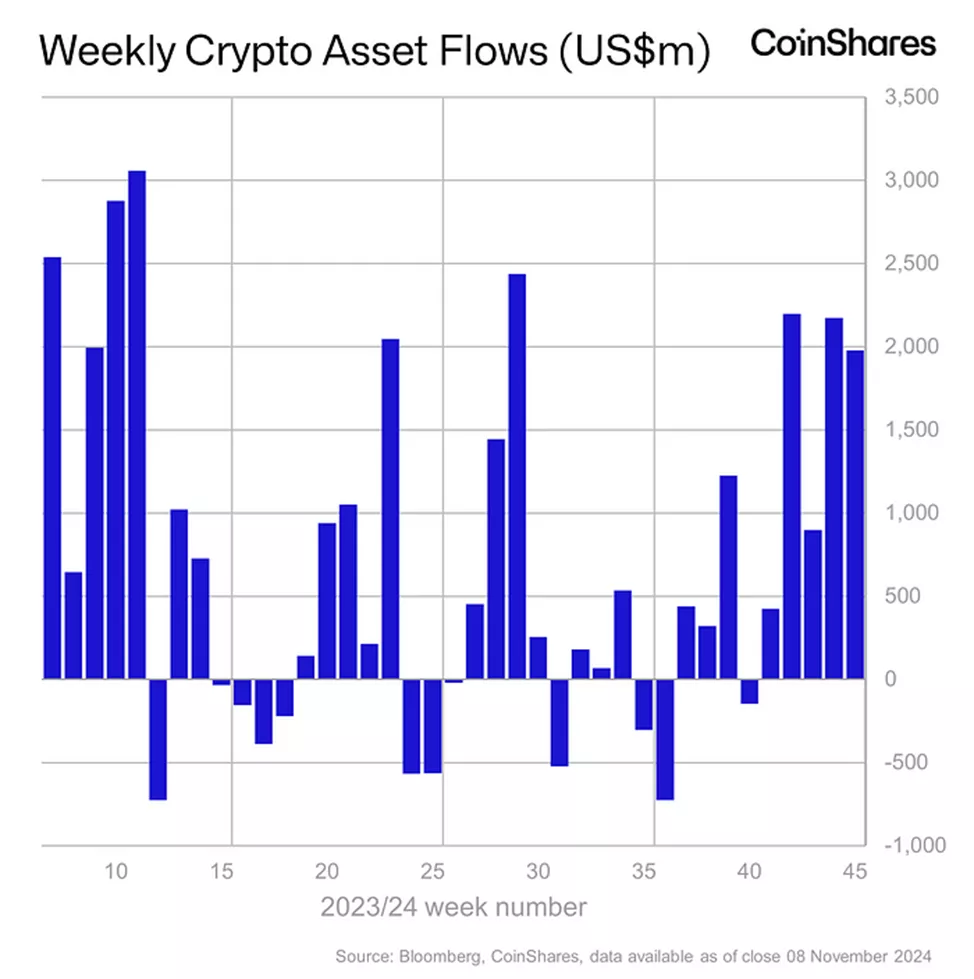

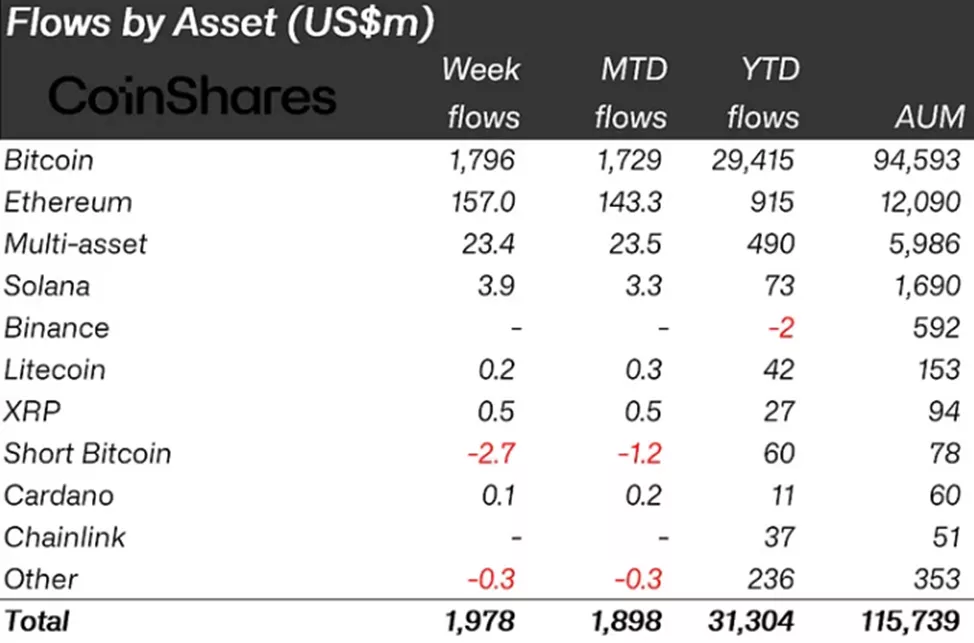

Inflows into cryptocurrency investment funds from November 3 to 9 amounted to $1.98 billion, following $2.18 billion the previous week, according to CoinShares.

The year-to-date inflow increased to a new record of $31.3 billion.

The volume of assets under management also reached a historic high of $115.7 billion.

Product turnover rose to $20 billion, the highest since April.

Bitcoin instruments received $1.8 billion after $2.16 billion the previous week.

“The combination of a favorable macro environment [following the Federal Reserve’s Fed rate cut] and seismic shifts in the U.S. political system likely contributed to such positive investor sentiment,” the report stated.

Clients withdrew $2.7 million from structures allowing short positions on digital gold, after adding $8.9 million in the previous reporting period.

Inflows into Ethereum funds increased from $9.5 million to $157 million, the highest since July.

Among other altcoins, Solana-based instruments stood out with $3.9 million, followed by Uniswap with $1 million and Tron with $0.5 million.

Previously, technical analyst Peter Brandt stated that ETH and SOL are poised for an upward breakout to join Bitcoin. Earlier, the expert saw potential for Solana to grow 27-fold to $4500.

Co-founder of Syncracy Capital, Daniel Chung, predicted the launch of a SOL-ETF in the first quarter of 2025 following Donald Trump’s victory in the U.S. presidential election.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!