U.S. congressman accuses the SEC of ‘unethical conduct’ toward the crypto industry

The U.S. Securities and Exchange Commission (SEC) is obstructing the regulation of the cryptocurrency industry and acting unethically toward its participants, said Representative Tom Emmer.

Under Chair Gensler, the SEC has become a power-hungry regulator, politicizing enforcement, baiting companies to “come in and talk” to the Commission, then hitting them with enforcement actions, discouraging good-faith cooperation.

— Tom Emmer (@RepTomEmmer) July 19, 2022

At a House Financial Services Committee hearing, Emmer accused the Commission of politicising rules. In his view, chairman Gary Gensler has adopted a tactic of intimidation and threats.

“Under Gensler, the SEC has become a power-hungry regulator, politicizing enforcement, baiting companies to “come in and talk” with the Commission, then hitting them with enforcement actions, discouraging good-faith cooperation,” the politician said.

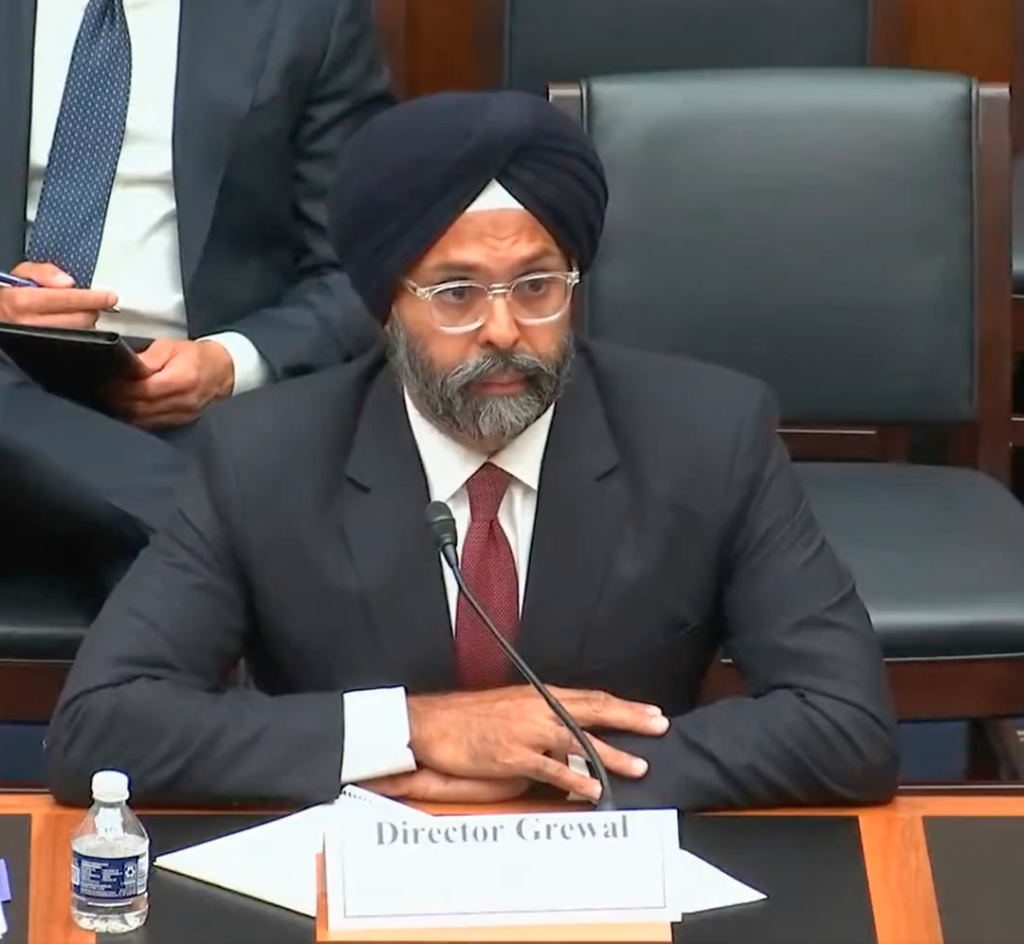

Emmer asked enforcement chief Gurbir Grewal whether such probes fall within the agency’s powers and what consequences await companies that refuse to engage in dialogue.

A spokesperson for the agency acknowledged taking enforcement actions against organizations not under the Commission’s jurisdiction. Emmer called the regulator’s actions “absolutely unacceptable.” In his view, the agency uses unscrupulous methods when it comes to digital assets.

Representative Brad Sherman, who previously called for banning the purchase of cryptocurrency and mining, also criticized the SEC’s approach to industry participants. He reminded that the regulator brought charges against Ripple for selling unregistered securities in the form of XRP, rather than to trading platforms.

Gensler took the helm of the agency in April 2021. In the following months, he urged Congress bring clarity to crypto regulation andwarned of tighter oversight over stablecoins and DeFi.

Later, the head of the Commission urged bitcoin exchanges to engage in dialogue.

In September the SEC warned Coinbase of possible legal action if it launches crypto-savings accounts based on USDC. Subsequently the company abandoned its plans.

During the summer of 2021 BlockFi faced state-level financial regulators’ claims. Later Bloomberg reported that an investigation into the firm was initiated by the SEC.

In February 2022 it emerged that the crypto-lending platform will pay $100 million in fines as part of a settlement.

In the same month the Commission clarified that sanctions would apply to companies that voluntarily come under the agency’s oversight.

As noted, in June Ripple’s Brad Garlinghouse accused the SEC of using an enforcement-first approach rather than working toward clear regulation for the industry.

Read ForkLog’s bitcoin news on our Telegram — news on cryptocurrencies, prices and analytics.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!