U.S. inflation accelerates; Bitcoin retreats on modest selling.

The year-over-year rise in U.S. core consumer prices, excluding energy and food, in August slowed from 4.7% to 4.3%, which was higher than market expectations. Bitcoin retreated to around $26,000, erasing the day’s gains.

On a monthly basis, prices rose 0.3% versus 0.2% in July and in line with economists’ expectations.

The overall inflation, including the aforementioned volatile components, rose 3.7% year over year and 0.6% month over month (the largest jump in more than a year). The previous readings were 3.2% and 0.2%, respectively.

Analysts had forecast readings of 3.6% year over year and 0.6% month over month.

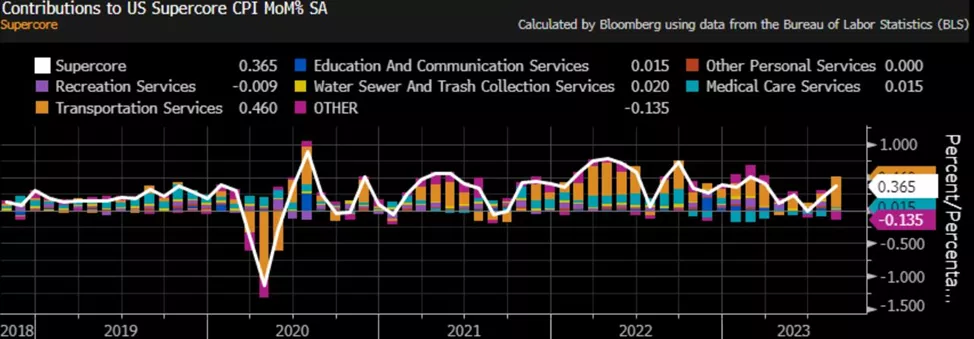

The so-called supercore category of inflation, which tracks the cost of services excluding rent — a key component for the Fed — rose 0.37% month on month, the highest since March. This should bolster hawkish sentiment among the monetary authorities.

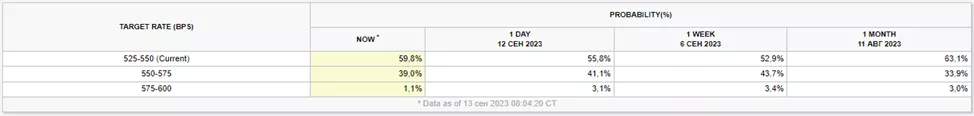

The data released by the U.S. Bureau of Labor Statistics strengthen the case for a rise in the Fed’s policy rate at one of the meetings in November–December.

The latest figures weighed on risk appetite in global markets. S&P 500 futures fell 0.3%. The euro versus the U.S. dollar showed notable volatility but pared losses to 0.1% as markets priced in a higher likelihood of a 14 September rate hike by the ECB. Gold fell 0.2% as the dollar strengthened.

“The Fed will not raise rates next week, but, especially given the strength of the supercore, the decision on the November rate remains ‘open’, — said Ben Jeffery of BMO Capital Markets.

Earlier, BitMEX co-founder Arthur Hayes allowed for a possible brief dip below $20,000 followed by a new bullish impulse. However in September he pointed to positive prospects for Bitcoin despite Fed policy.

As noted, Rick Edelman, founder of Edelman Financial Engines, forecast the price of digital gold to $150,000 by the summer of 2025.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!