U.S. inflation slowdown stalls; Bitcoin volatility returns

US consumer price inflation in September rose 3.7% year over year, as in the previous month, beating the forecast of 3.6%. Bitcoin showed mixed moves within a 0.4% range around $26,800.

On a monthly basis, prices rose 0.4% — worse than economists’ expectations of 0.3% and down from 0.6% in the prior month.

Core inflation, which excludes food and energy, rose 4.1% year over year and 0.3% month over month. The previous readings were 4.3% and 0.3%, respectively.

Analysts had forecast readings of 4.1% y/y and 0.3% m/m.

An hour later, Bitcoin sellers gained the upper hand. The digital asset’s daily losses widened to 1.4%.

A similar dynamic formed in Ethereum. The second-largest cryptocurrency by market cap fluctuated around $1,550, before retesting local lows.

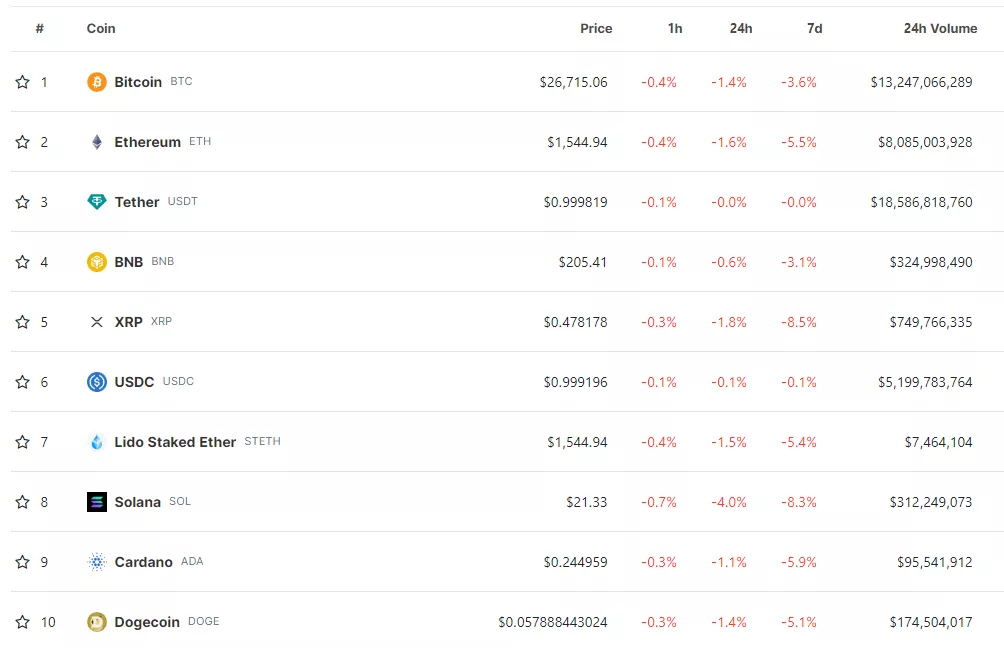

According to CoinGecko, all top-10 cryptocurrencies by market cap (excluding stablecoins) saw their 24-hour declines broaden over the last hour — from 0.6% for BNB to 4% for Solana.

CPI excluding rents and energy rose by thelargest month-over-month gain since the start of the year, 0.6% m/m. The Fed previously indicated that policymakers would be guided by price dynamics in the services sector.

According to the minutes of the September meeting, a majority of officials saw the need for another rate hike this year. The agency suggested that this stance could persist, despite the recent spike in bond yields in the absence of further inflation declines, according to Bloomberg.

“While inflation is gradually easing, a strong labour market means that the threat of renewed price growth cannot be ignored. It keeps the Fed on edge. The question of whether there will be another rate hike remains to be answered,” said Sima Shah, Chief Global Strategist at Principal Asset Management.

She was echoed by Bloomberg economists Anna Wong and Stuart Paul.

“The inflation report will not convince a majority of Fed officials that rates are sufficiently restrictive. Our base case is that the Fed will hold them steady through year-end. But we see risks of another rate hike that the market is likely underpricing,” they explained.

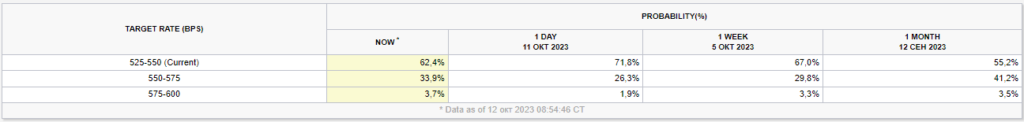

The data slightly raised the odds of the Fed tightening policy at the December 12–13 meeting. According to the CME Fed Watch, the probability of a 25 basis-point increase rose from 26.3% to 33.9%. By the January 2024 meeting, the odds were higher still—40.7% vs 27.1% a day earlier.

Analysts at Cryptoquant highlighted a potential rise in Bitcoin after breaking above $27,900.

Earlier, former BlackRock director Steven Shonfield suggested that the SEC would approve a Bitcoin-ETF within three to six months.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!