Uniswap Labs unveils UniswapX liquidity aggregator

Uniswap Labs introduced UniswapX — a liquidity-aggregation protocol for decentralized exchanges with open-source code.

The service has entered beta on Ethereum.

“In the near future” an expansion to other networks and the Uniswap wallet is expected. The timeline for the final version is not specified.

Cross-chain execution of the protocol is expected to follow later, the developers said.

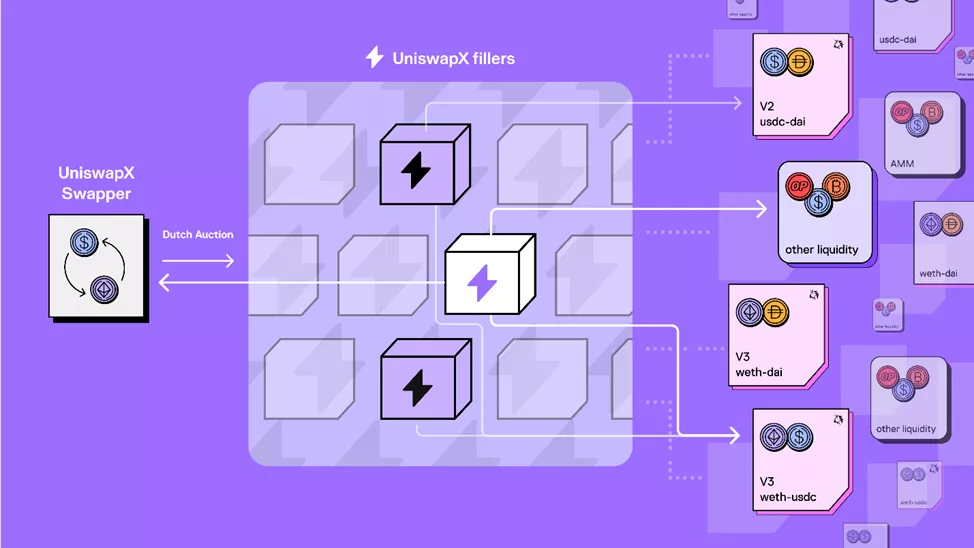

UniswapX aims to become an open network of external entities — “fillers” — tasked with competing with the decentralised exchange itself for trade execution using on-chain liquidity from AMM pools or their own asset reserves.

“Swap-producing traders can use the Uniswap interface without worrying about whether they are getting the best price. Transactions will always be transparently recorded and calculated on the blockchain. All orders are supported by the Uniswap Intelligent Router, which incentivises fillers to compete with Uniswap v1, v2, v3 and with v4 (when it launches),” — Adams explained.

One of the main features of UniswapX is gasless order execution — swappers can authorise off-chain orders, while fillers pay the fees on their behalf. This also implies no fees for unexecuted transactions.

“Since traders do not need to spend on gas, they do not need to own utility-token network (ETH, MATIC) for trading,” — the blog says.

According to Uniswap, fillers include gas in the overall prices of swaps. They also have the ability to reduce transaction costs by bundling multiple orders, thereby creating a competitive environment to achieve the most favorable quote.

The protocol also includes protection against MEV. This functionality should improve swap cost and guard against malicious behaviour such as sandwich attacks. For fillers, incentives have been created to use private-transaction relayers when submitting orders to liquidity pools.

UniswapX also includes a “switch” for protocol usage fees. It will be activated if approved by the Uniswap governance.

According to the blog, Uniswap Labs cannot modify or suspend UniswapX. Users will retain control of their assets throughout the swap process.

Earlier in June, developers posted on GitHub an early implementation of the code for the next version of the protocol named Uniswap v4.

On April 1, Uniswap Labs lost the exclusive commercial rights to the Uniswap v3 code due to the expiration of the BSL license.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!